Featured News Headlines

Wisconsin Introduces Strict Crypto ATM Regulations to Combat Rising Fraud Cases

Wisconsin Crypto ATM Operators – Democratic lawmakers in Wisconsin are pushing forward comprehensive regulations to combat rising fraud cases linked to cryptocurrency ATMs across the state.

Dual Legislative Approach Gains Momentum

Senator Kelda Roys and six Democratic colleagues introduced Senate Bill 386 this Monday, working alongside Assembly Bill 384 filed by Representative Ryan Spaude on July 31. This strategic dual-chamber approach significantly increases the legislation’s chances of becoming law while accelerating the review process.

The proposed bills target crypto ATM operators with strict licensing requirements, mandating they obtain money transmitting licenses before conducting business in Wisconsin. These measures represent one of the most comprehensive state-level responses to crypto ATM fraud in recent months.

Strict Identity Verification and Transaction Limits

Under the new framework, crypto ATM operators must collect extensive customer information including names, birth dates, addresses, and email contacts. Every transaction will require government-issued identification verification, with operators mandated to photograph customers during each interaction.

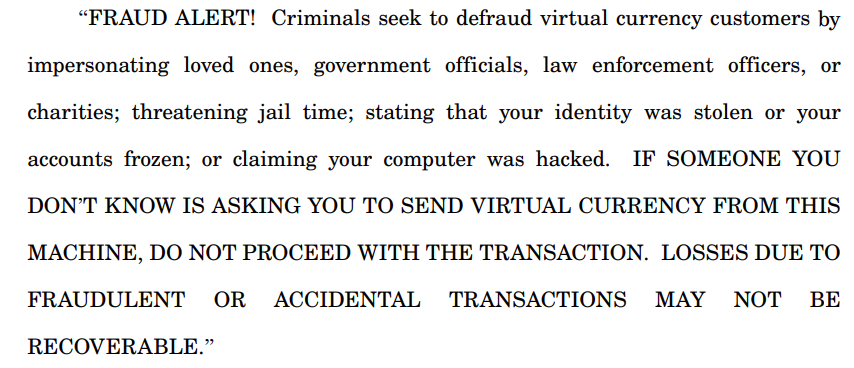

The legislation caps daily transactions at $1,000 per user while requiring prominent fraud warning labels within customers’ direct sight lines on machine fronts. These protective measures specifically target vulnerable populations who have become prime targets for cryptocurrency-related scams.

Fee Caps and Fraud Protection Measures

The bills propose significant fee restructuring, limiting charges to either $5 flat fees or 3% of transaction values – whichever proves higher. This addresses concerns about crypto ATMs charging substantially more than traditional online exchanges.

Perhaps most notably, operators face full reimbursement obligations for fraudulent transactions when law enforcement confirms suspicious activity within 30 days. This provision shifts financial responsibility directly onto ATM operators rather than victims.

Federal Support and Global Trends

The Wisconsin initiative aligns with federal concerns raised by FinCEN Director Andrea Gacki, who recently highlighted how criminals exploit cryptocurrency kiosks for fraud, cybercrime, and drug trafficking operations.

Internationally, New Zealand banned crypto ATMs entirely in July, while UK authorities seized seven machines and made arrests in southwest London. Even Grosse Pointe Farms, Michigan proactively regulated crypto ATMs despite having none locally, demonstrating widespread regulatory momentum against these payment systems.

Comments are closed.