Stablecoin Market Surges: The Treasury Forced to Purchase Billions of Dollars in T-Bills

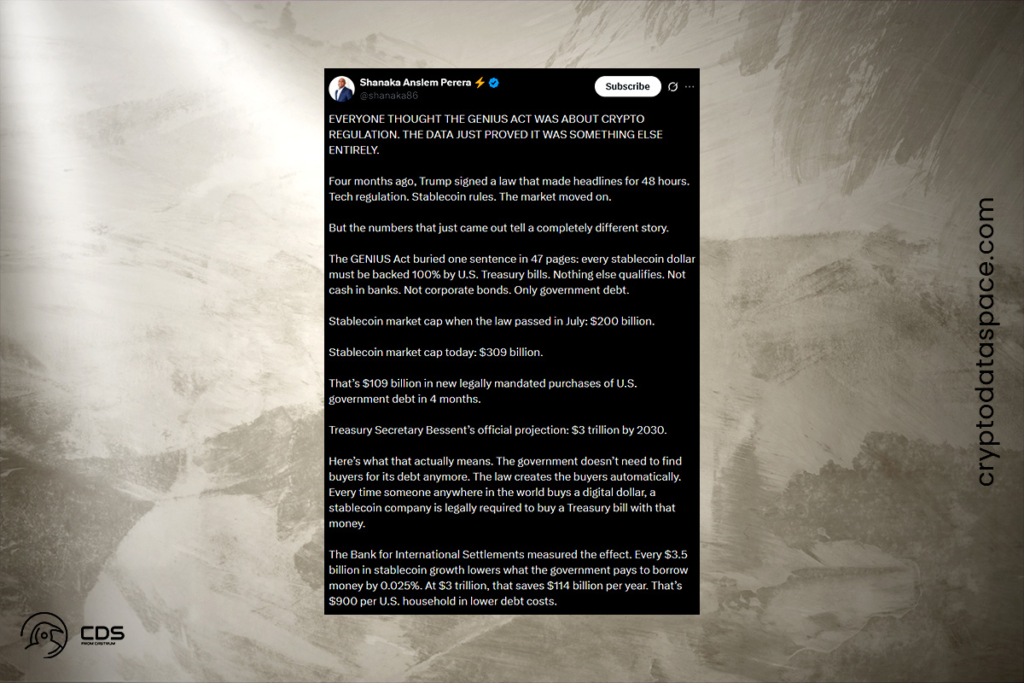

Between July and November of 2025, the market capitalization of stablecoins increased from $200 billion to $309 billion. Thus, issuers had to buy $109 billion worth of US Treasury bills in order to fulfill a legal requirement included in the GENIUS Act. The way the US government finances its operations has undergone a tremendous change as a result of this expansion. The Treasury Department now has regulatory control of stablecoins instead of the Federal Reserve. A new digital dollar policy is used to achieve this transition.

Stablecoin Market Growth Fuels Continuous Treasury Security Buying

The GENIUS Act was signed into law by President Donald Trump on July 18, 2025. The first federal regulations for stablecoin payments were established by this statute. According to the regulation, tokens must be fully backed by US dollars or short-term Treasury bills for all stablecoin issuers. It does not include bank deposits or corporate bonds. Stablecoins become engines for buying government debt because of this important clause. The company must concurrently buy Treasury securities of the same value each time a stablecoin is created. As a result, outside of conventional bond auctions, there is an automated, continuous demand for federal debt.

This obligation is hidden within 47 pages of the technical rule, according to analyst Shanaka Anslem Perera’s thorough research of the ramifications. The global stablecoin market exceeded $280 billion, according to a November 2025 analysis from the European Central Bank. With a market value of $184 billion, Tether dominated the market, followed by USD Coin with $75 billion.

GENIUS Act Turns Stablecoins into Automatic Treasury Buyers

The purpose of the law is revealed by the connection between stablecoin growth and borrowing costs. A $3.5 billion increase in stablecoin market capitalization lowers government borrowing costs, according to research from the Bank for International Settlements. The percentage reduction is 0.025%. These results are cited in the analysis. This may save the US $114 billion annually, or $900 per household, at the estimated $3 trillion figure.

The government doesn’t need to find buyers for its debt anymore. The law creates the buyers automatically. Every time someone anywhere in the world buys a digital dollar, a stablecoin company is legally required to buy a Treasury bill with that money.

The analysis

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.