Featured News Headlines

Solana Meme Coin Market Faces Liquidity and Scam Risks

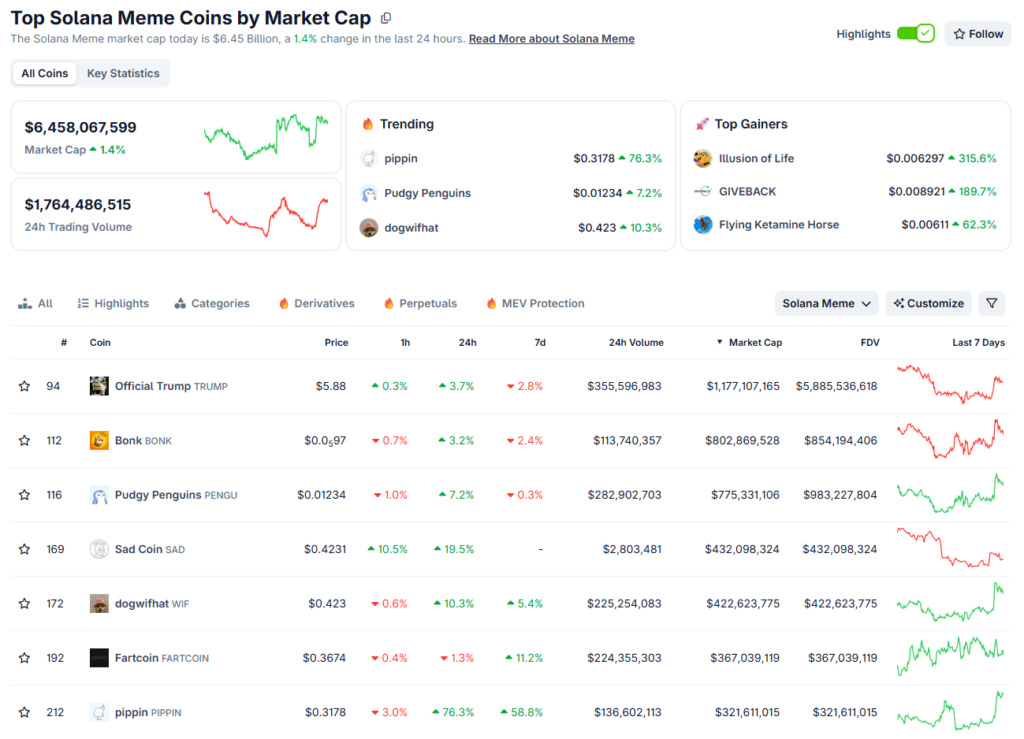

According to CoinGecko, the total market capitalization of Solana meme coins stands at approximately $6.45 billion, with daily trading volume exceeding $1.7 billion. However, the top seven meme coins — TRUMP, BONK, PENGU, WIF, FARTCOIN, and PIPPIN — account for nearly 70% of the total market cap. Their combined daily trading volume represents 75% of the sector’s liquidity.

This concentration leaves smaller meme coins with limited trading activity, reducing their ability to recover from market fluctuations.

Unlock Schedules and Sector Pressure

Stalkchain reports that major ecosystem tokens such as PUMP, MELANIA, PENGU, SOL, and TRUMP have unlock schedules in December. These dilution events often cause large-cap tokens to lose value, dragging the broader meme coin sector downward.

The situation is exacerbated by scams. Thesis.io analyzed 109 newly issued Solana tokens last week, finding that 68.8% quickly became scams, while only 18.3% showed “potential.” Even within the potential group, 39.1% of holders fell victim to scams within seven days.

Holder Behavior and Market Dynamics

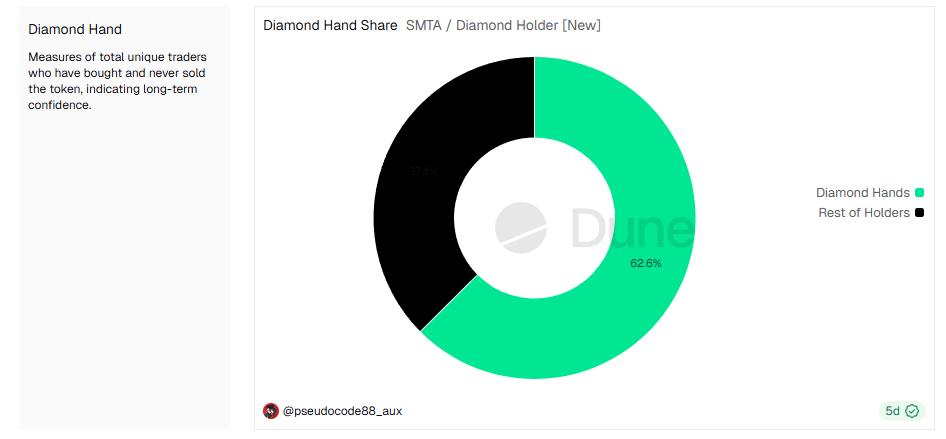

Dune data indicates that more than 62% of Solana meme coin holders qualify as “diamond hands,” meaning they have bought tokens and never sold any. Whether accidental or deliberate, this holding behavior further limits the chances of breaking even in a volatile market.

Signs of Possible Recovery

Despite challenges, there are early signs of recovery in the meme coin market, although momentum remains weak. Stalkchain notes:

“PUMP, TRUMP, BONK, WIF, PENGU, FARTCOIN and USELESS hold most of the memecoin liquidity on Solana. So when money moves out of them, it has to go somewhere, and that’s when small caps and new tokens start pumping.”

This suggests that capital rotation from large-cap to smaller or newer tokens could temporarily lift parts of the market.

Overall, the Solana meme coin ecosystem remains highly volatile. Liquidity concentration, token unlock events, and scam prevalence make this sector particularly susceptible to rapid price swings, highlighting the challenges for holders seeking market stability.

Comments are closed.