Featured News Headlines

Nvidia Stock- A New Giant Emerges in Tech-Driven Philanthropy

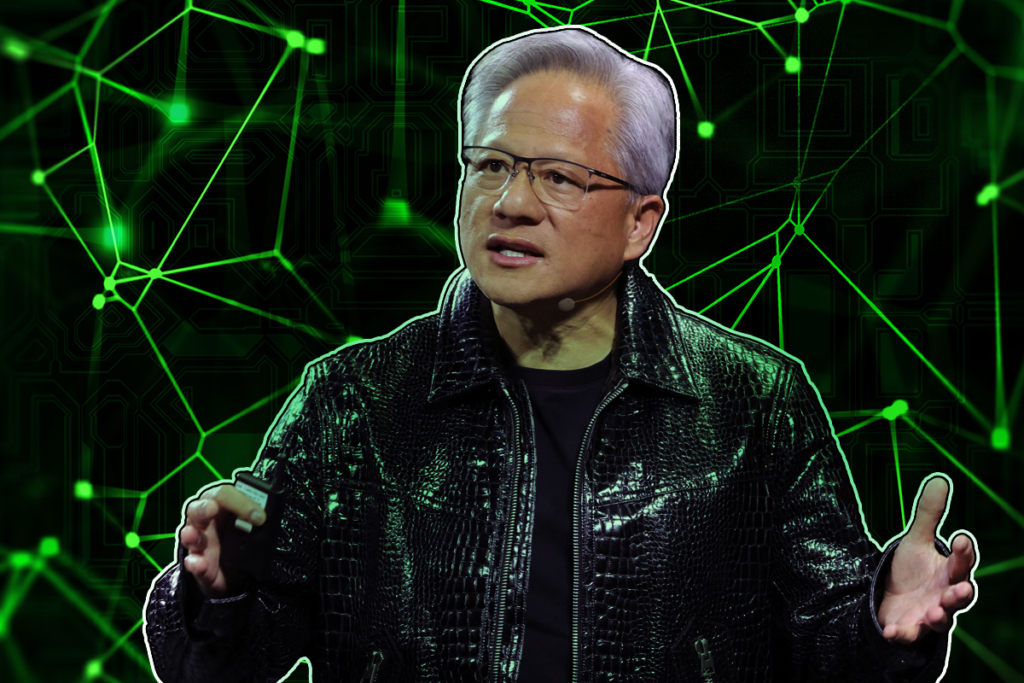

Nvidia Stock– Jensen Huang, CEO of Nvidia, has not only become one of the most prominent figures in the tech world but also a leading force in American philanthropy. The explosive rise of Nvidia’s stock price has dramatically expanded the charitable reach of the Jen-Hsun and Lori Huang Foundation, a nonprofit established by Huang and his wife in 2007.

According to data from FoundationMark, which analyzes private foundations’ financial performance, the foundation’s assets have ballooned from $828 million in 2019 to over $9.1 billion in 2024. This meteoric growth places it among the top 15 private foundations in the U.S., on par with long-standing names like the Rockefeller Foundation.

It’s interesting to see the sort of changing of the guard, Big philanthropy now is tech-driven, like many other things, far more than it used to be.

The Role of Nvidia Stock in the Foundation’s Growth

From $12.6 Million to Billions

The Huang Foundation’s growth story is directly tied to Nvidia’s skyrocketing share price. Initially funded with 370,000 Nvidia shares valued at $12.6 million, the foundation’s portfolio has multiplied more than 16,800%, according to CNBC’s calculations. As of the end of 2023, it held 68.5 million Nvidia shares, contributing significantly to its $9.1 billion valuation.

Recent Contributions Continue Momentum

The Huangs have not slowed their support. An SEC filing from June 2024 reveals that their trust donated 440,000 Nvidia shares worth $60 million to the foundation. An additional 220,000 shares were also transferred to a donor-advised fund (DAF), a popular tool among tech philanthropists for its flexibility.

Legal and Financial Implications of Rapid Growth

Annual Payout Requirements

U.S. tax law requires private foundations to distribute at least 5% of their average annual asset value. Based on 2023 valuations, the Huang Foundation was estimated to disburse $123 million that year. Due to recent asset increases, it may be required to give up to $369 million in 2025.

Disbursement Strategy: Heavy Use of DAFs

Despite the foundation’s growing financial clout, the majority of its charitable outflows have gone to donor-advised funds. For example, $46 million — 77% of 2023’s disbursements — was transferred to a Schwab DAF. These funds allow donors to claim tax benefits immediately, while postponing actual grant-making decisions.

They’re especially popular among younger tech entrepreneurs,who want to start their charitable giving but don’t have time to make grant decisions.

Unlike private foundations, DAFs have no legal obligation to distribute funds within a certain timeframe, nor are they required to publicly disclose recipients.

Lack of Operational Transparency Raises Questions

No Website or Public Disclosures

Despite its size, the Huang Foundation maintains a remarkably low profile. It has no website, and there is limited publicly available information about its structure and governance. CNBC noted that, as of 2023, the foundation reported no paid staff.

A February 2024 press release announcing a $22.5 million gift to California College of the Arts mentioned a chief operating officer, though CNBC was unable to verify his identity or determine his formal role within the organization.

Holdings and Investment Risks

Industry Experts Recommend Diversification

With most of the foundation’s wealth still tied to Nvidia stock, financial advisors have raised concerns about risk concentration.

I don’t think there’s a reason to necessarily hold a very concentrated position in one company in a foundation for a long time, You’re basically going to Vegas and you’re betting on black or red.

While it is not uncommon for tech philanthropists to fund foundations with large equity stakes in their companies, long-term sustainability usually requires diversification to protect against market volatility.

Major Public Gifts Signal Future Focus

Key Contributions to Higher Education

Though most of the foundation’s giving has been directed to DAFs, a few high-profile donations hint at its philanthropic priorities. Notable gifts include:

- $50 million to Oregon State University in 2022, Huang’s alma mater.

- $22.5 million to California College of the Arts in 2024.

These grants suggest a particular interest in education and innovation, though the foundation’s lack of transparency makes its broader mission difficult to define.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.