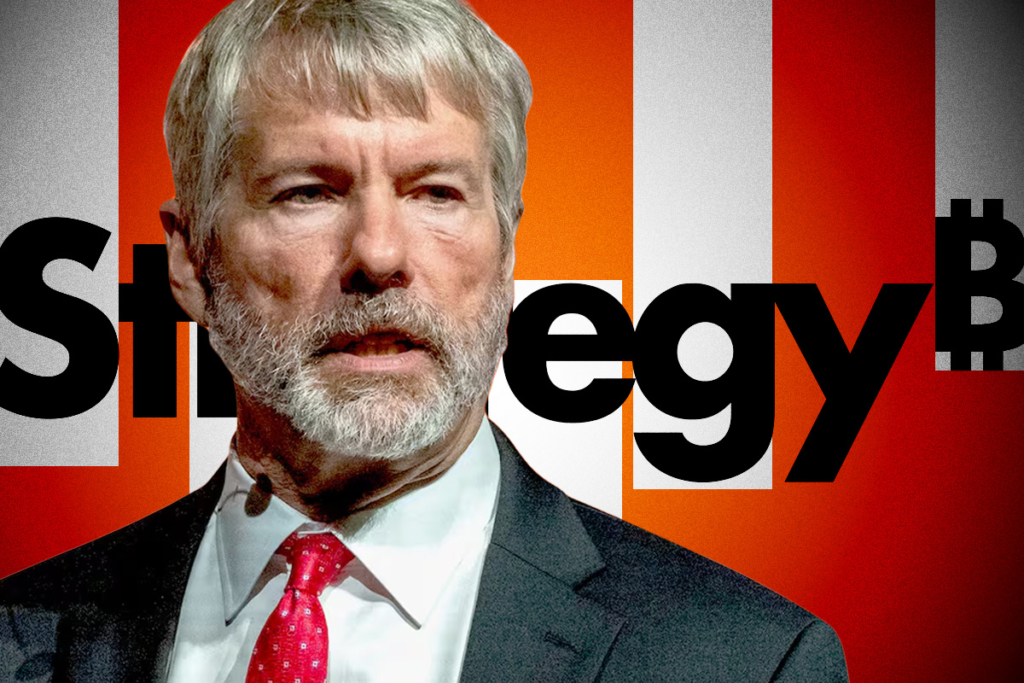

Michael Saylor’s Strategy Hits New BTC Milestone

Michael Saylor – Strategy, formerly known as MicroStrategy, is once again making headlines in the crypto world. Under the bold leadership of Michael Saylor, the Bitcoin-focused firm has surpassed a major financial milestone in 2025 recording $10.3 billion in gains from its BTC yield. The company’s unwavering Bitcoin accumulation strategy has paid off massively, cementing its dominance as the top Bitcoin-holding public company in the world.

Since the start of the year, Strategy has realized returns of 88,062 BTC, equivalent to 19.7% of its Bitcoin yield. These gains come as Bitcoin surged to an all-time high of $117,248, propelling Strategy’s total holdings to an eye-watering 597,325 BTC valued at over $70 billion.

Despite market fluctuations and increasing price volatility, Strategy shows no signs of slowing down. The firm continues to hint at further Bitcoin acquisitions, fueling investor confidence and speculation about what’s next in their aggressive crypto playbook.

Unshaken Commitment to Bitcoin

Michael Saylor’s recent social media updates reaffirm the company’s long-term vision. With $13.1 billion in BTC gains in 2024 and an impressive $10.3 billion already in 2025, Strategy’s performance signals a strong validation of its bold approach to capital allocation.

While the first half of 2025 reflects a 19.7% BTC return, optimism remains high. Many believe Strategy could reach even greater heights by year-end, especially if Bitcoin’s bullish trend continues.

No Profit-Taking Yet Eyes on the Future

Interestingly, despite these historic profits, Strategy has refused to sell, showcasing its commitment to Bitcoin as a long-term store of value rather than a short-term trade.

As the year progresses, all eyes are on Strategy to see if it will continue breaking records and just how far its Bitcoin empire will grow.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.