Featured News Headlines

Bitcoin Hits $117K After Powell’s Jackson Hole Speech

The cryptocurrency market experienced a dramatic shift on Friday as Bitcoin reached new heights, climbing above $117,000 following Federal Reserve Chair Jerome Powell’s comments at the Jackson Hole Economic Symposium. The digital asset’s performance sent shockwaves through the trading community, resulting in massive liquidations and renewed optimism among market participants.

Market Response to Fed Chair’s Remarks

Bitcoin’s price trajectory changed dramatically after Powell hinted at potential interest rate adjustments in September during his Jackson Hole address. The cryptocurrency surged more than 4% to an intraday peak of $117,300 on Bitstamp, representing a significant recovery from its six-week low of $111,600 recorded earlier in the week.

The Federal Reserve Chair’s comments appeared to signal a more dovish monetary policy stance, which historically benefits risk assets like cryptocurrencies. Market participants interpreted these remarks as favorable for digital assets, leading to increased buying pressure and substantial short position liquidations.

Massive Liquidation Events Shake Markets

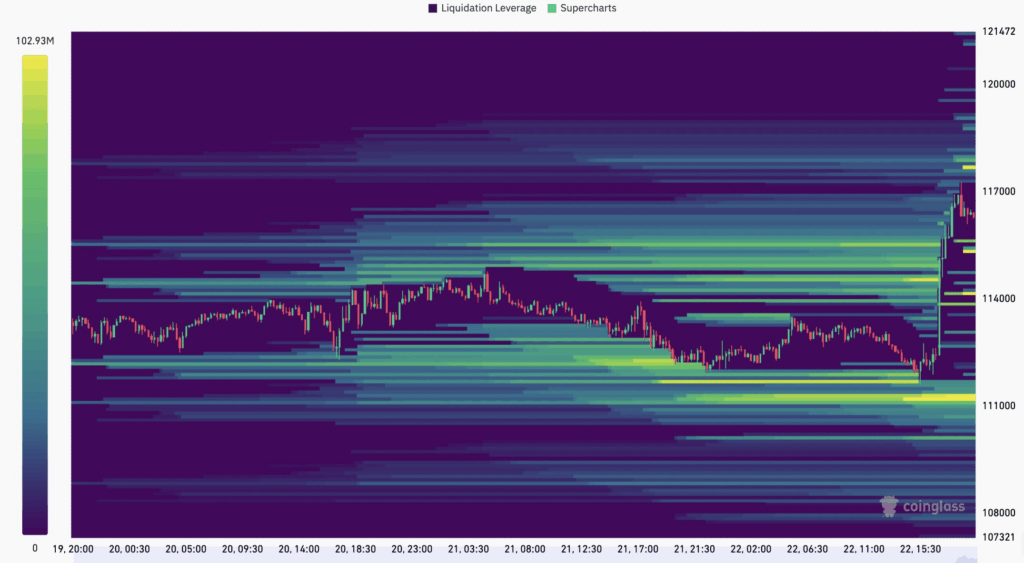

According to data from CoinGlass, the market witnessed extraordinary liquidation activity totaling $629.48 million across both short and long positions. Short positions bore the brunt of the market movement, with $379.88 million in bearish bets being wiped out during the rally.

Ethereum led the liquidation figures with $193 million in short positions eliminated as the cryptocurrency soared nearly 15% to reach $4,760. Bitcoin followed with $56.4 million in short liquidations, demonstrating the widespread impact of the market reversal.

The sudden shift in market dynamics affected 150,217 traders during this period, catching many participants off guard as investor sentiment rapidly transformed from bearish to bullish. This dramatic change highlighted the volatile nature of cryptocurrency markets and the risks associated with leveraged trading positions.

Technical Analysis Reveals Key Resistance Levels

Bitcoin’s liquidation heatmap provided insights into market structure, showing significant liquidity absorption above the $117,000 level. The data revealed more than $259.5 million in ask orders positioned between $117,000 and $118,000, indicating substantial resistance in this price range.

The cryptocurrency’s ability to clear these liquidity pools suggests strong underlying demand and potential for further upward movement. Market microstructure analysis indicates that breaking through these resistance levels could pave the way for additional price appreciation.

Industry Expert Perspectives

Several prominent analysts have weighed in on Bitcoin’s recent performance and future prospects. Michael van de Poppe, founder of MN Capital, had previously identified the potential for a sweep below the August 3 low of $111,900 as an accumulation opportunity for traders.

“A small sweep took place and an immediate massive move upward on Bitcoin. Uptrend is back,” van de Poppe commented on Friday.

His analysis proved prescient as Bitcoin indeed swept lows below $112,000 before launching into its significant upward move. This technical pattern provided what many considered an attractive entry point for market participants.

Fellow analyst Jelle acknowledged the possibility of a retracement following the recent rally but maintained an optimistic outlook, stating that “the market wants higher.” This sentiment reflects a broader bullish consensus among technical analysts monitoring Bitcoin’s price action.

Long-term Price Projections

The cryptocurrency community has expressed varying degrees of optimism regarding Bitcoin’s future price trajectory. Analyst BitQuant maintains his cycle top target of $145,000 for Bitcoin throughout 2025, suggesting the current rally may be part of a larger upward trend.

More ambitious projections have emerged from institutional players. André Dragosch, head of European research at Bitwise, suggested that regulatory developments could significantly impact Bitcoin’s valuation. During a recent Chain Reaction daily show, he indicated that President Trump’s initiative to allow cryptocurrency investments in 401(k) retirement plans could potentially drive Bitcoin to $200,000 by year-end.

These forecasts, while speculative, reflect the growing institutional interest in cryptocurrency and the potential impact of regulatory clarity on market dynamics.

Comments are closed.