Featured News Headlines

ETH Price- Is Ethereum Headed to $4,900? Key Metrics Say Yes

ETH Price– Ethereum (ETH) is quietly setting up for a potential 40% breakout, and the signals are getting hard to ignore. With the price hovering around $3,753, a rare combination of institutional buying and long-term holder confidence could send ETH soaring in the weeks ahead.

Dormant ETH HODLers Aren’t Selling — And That’s Bullish

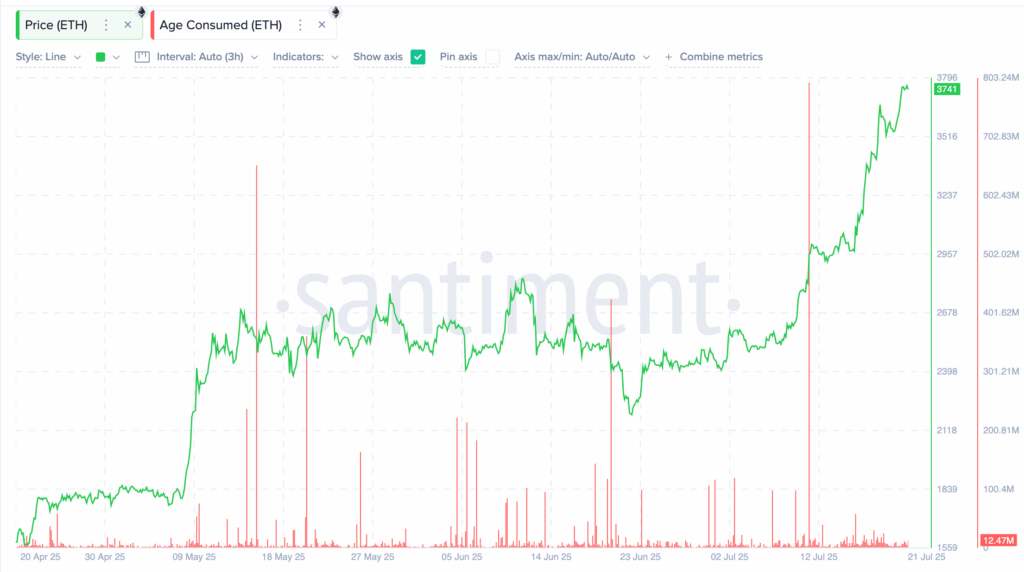

Over the past two weeks, Ethereum’s Age Consumed metric — which measures movement from long-inactive wallets — has plummeted from 795 million to just 12.47 million. That’s a staggering 98% drop, meaning long-term holders are not selling, even as prices climb.

When the oldest wallets go silent during a rally, it’s a powerful signal: conviction is strong, and we’re likely nowhere near the top.

Institutions Are Quietly Loading Up ETH

At the same time, big money is stepping in. SharpLink Gaming just scooped up 19,084 ETH in a single transaction — worth over $67.5 million. The company now holds 345,158 ETH, valued above $1.2 billion.

This kind of accumulation, combined with dormant coins staying put, paints a clear picture: smart money believes in Ethereum’s upside.

ETH/BTC Ratio Mirrors the 2021 All-Time High Pattern

The ETH/BTC ratio has surged 50% since June, rising from 0.021 to 0.031 — the same setup seen before ETH hit its all-time high in 2021. Back then, a 30% ratio jump pushed Ethereum from $3,800 to $4,878 in just five weeks.

If history repeats, a similar 28% price move now could drive ETH to $4,800–$4,900, right in line with its previous ATH.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.