Featured News Headlines

BNB Price and Activity Trends: What the Data Shows

Binance Coin (BNB) recently ranked among the market’s top gainers as capital flowed into the broader Binance ecosystem. This year, the BNB Chain repeatedly reached new all-time highs, reflecting strong investor interest.

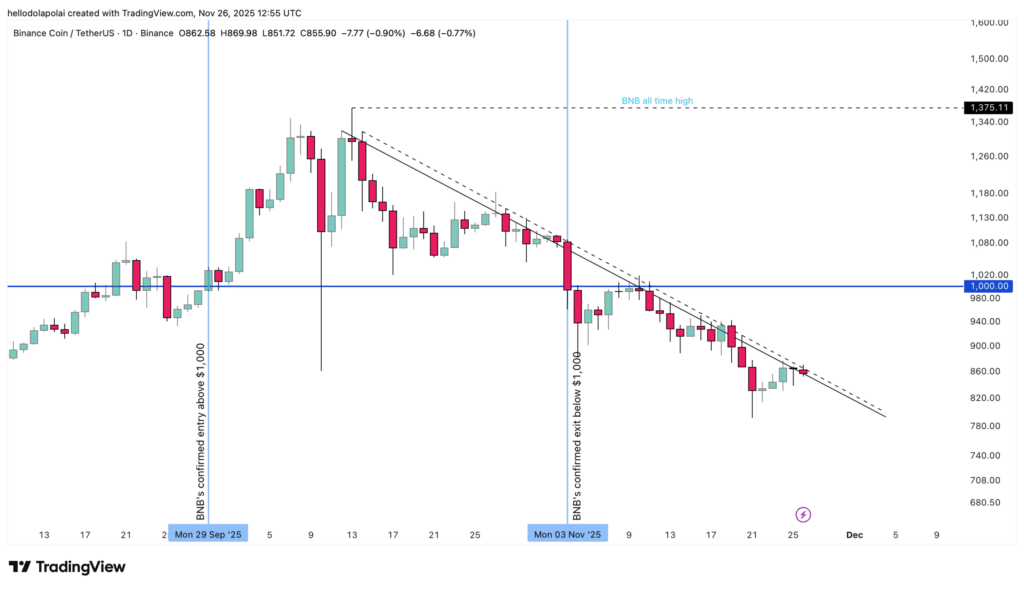

In a notable milestone, BNB crossed the $1,000 mark, staying above it for over thirty-five days—from September 29 to November 3—after hitting an all-time high of around $1,375.

However, a recent pullback suggests underlying weaknesses are emerging in the ecosystem.

On-Chain Activity Shows Signs of Exhaustion

BNB’s decline to around $857, a roughly 25% drop, largely stems from a slowdown in on-chain demand. Rather than a sudden collapse, data points to a gradual decrease in network usage, which has historically supported the token’s value.

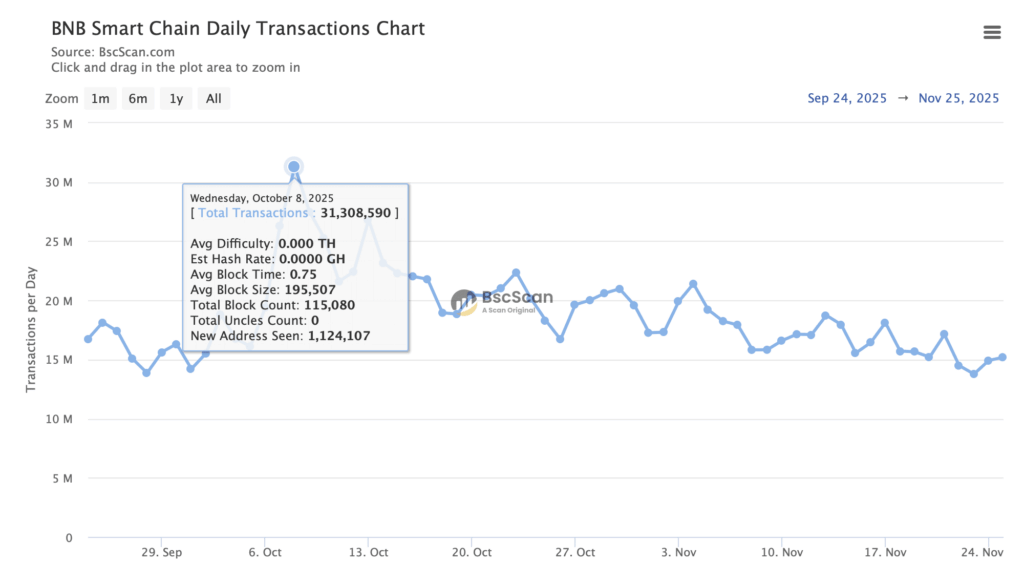

According to BscScan, daily active transactions peaked at 31.3 million on October 8, when BNB traded near $1,334. By November 4, as BNB fell back below $1,000, daily transactions had decreased by nearly 10 million to 21.4 million. At the time of reporting, total daily transactions had dropped further to approximately 15.1 million—a nearly 50% decline.

Network utilization mirrored this trend, falling from 51% to 19%, indicating weakening demand among users and developers alike.

Decline in Trading Volume

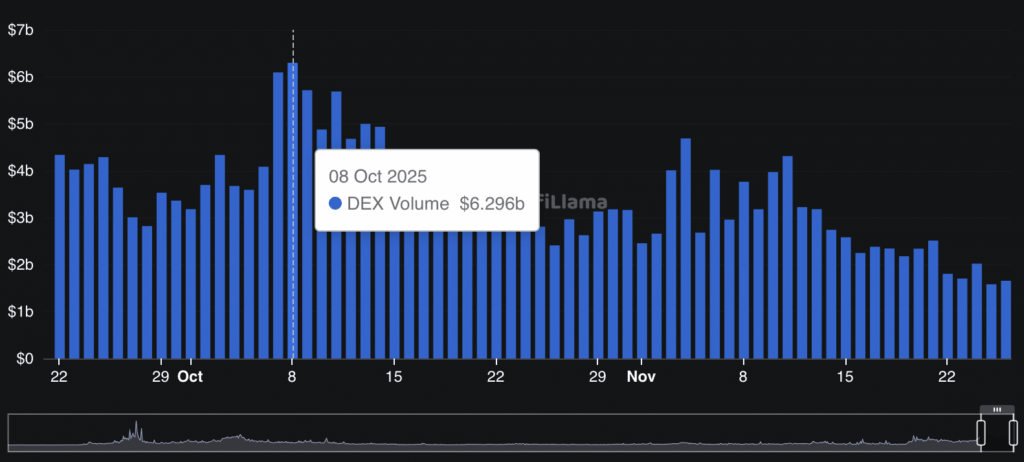

The slowdown in activity is most visible in on-chain trading volume. On October 8, decentralized exchange (DEX) volume on the BNB Chain reached $6.31 billion. By press time, this figure had dropped to around $1.29 billion, marking a dramatic $5.02 billion decrease in just weeks.

This sharp decline highlights a rotation of capital away from the BNB ecosystem. While the BNB Smart Chain remains the third-largest chain by market relevance, the fall in stablecoin activity reinforces the trend.

Typically, higher stablecoin balances indicate users are waiting for opportunities. In this case, however, stablecoin supply on the chain has fallen alongside BNB’s price. Current data shows $13.27 billion in stablecoins, down roughly $98 million from the November 18 peak, suggesting a shift of assets to other chains.

BNB at a Technical Crossroads

BNB is currently trading along a descending diagonal resistance line, which has repeatedly suppressed price in previous attempts.

“If momentum fails to break above this resistance, BNB could face another sharp leg downward,” analysts note. Conversely, a breakout above the trendline could signal renewed bullish momentum and potential recovery from recent lows.

Comments are closed.