Featured News Headlines

XRP Fundamentals Strong, But Price Lags Behind

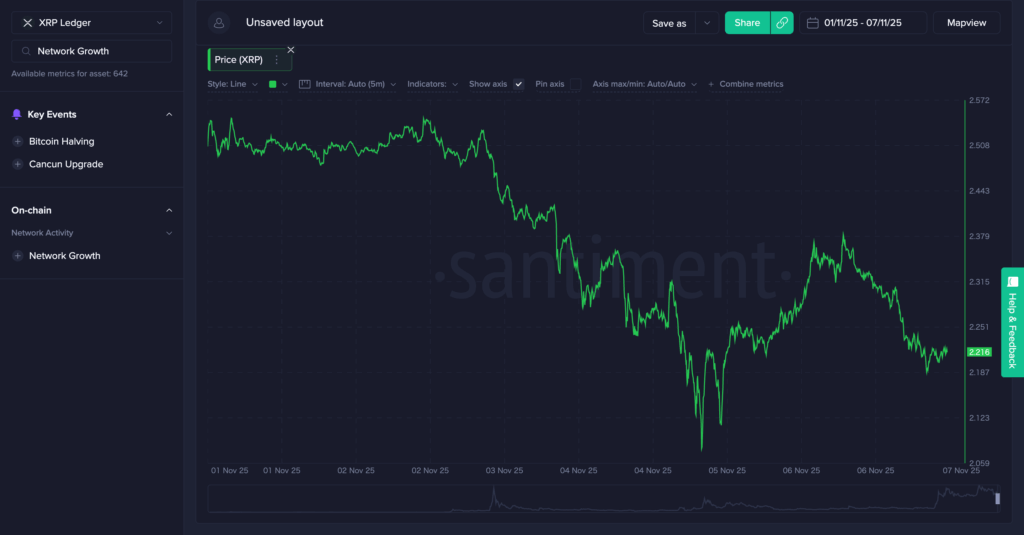

Despite strong fundamental signals, including a 12% price gain and record new wallet creation, XRP’s market value has continued to struggle. This divergence highlights the gap between the rapid institutional adoption of the XRPL infrastructure and XRP’s price action. The key question remains: are macroeconomic pressures overshadowing technical and institutional progress?

Mastercard Boosts XRPL Institutional Validation

Institutional adoption received a significant boost as Mastercard joined Ripple and Gemini to begin testing the RLUSD (Ripple USD) stablecoin directly on the XRPL. The announcement immediately translated into measurable on-chain activity, with new XRP wallets hitting a record high, reflecting rising engagement and interest within the ecosystem.

In addition, XRP experienced a 12% price surge between November 5 and 6, signaling the market’s short-term optimism toward this news. Such rapid adoption demonstrates XRPL’s success in attracting regulated, real-world financial entities. However, the subsequent price decline emphasizes a clear tension between fundamental adoption and market sentiment. Even high-profile adoption events appear challenged by broader market dynamics, including risk-off investor behavior and profit-taking.

Rebranding XRPL and Tokenomic Considerations

Ripple’s CEO has emphasized that the XRPL must evolve beyond its initial focus on cross-border payments. The platform is actively working to redefine its brand, aiming to serve as a foundation for decentralized finance (DeFi) and regulated asset tokenization. This shift positions XRPL as a competitor to networks like Solana and Ethereum.

This strategic pivot has intensified discussions around XRP’s tokenomics. Analysts are increasingly exploring XRP’s long-term value potential, particularly if XRPL implements a fee-burning mechanism similar to Ethereum’s EIP-1559. Such a development could transform XRP into a potentially deflationary asset, altering both perception and valuation over time.

For example, some projections suggest that XRP’s price trajectory by 2035 could be significantly impacted if fee burning is implemented. The combination of technical evolution and institutional adoption is crucial for maximizing the long-term value embedded in the XRPL ecosystem.

Price vs Fundamentals: Regulatory Uncertainty Remains

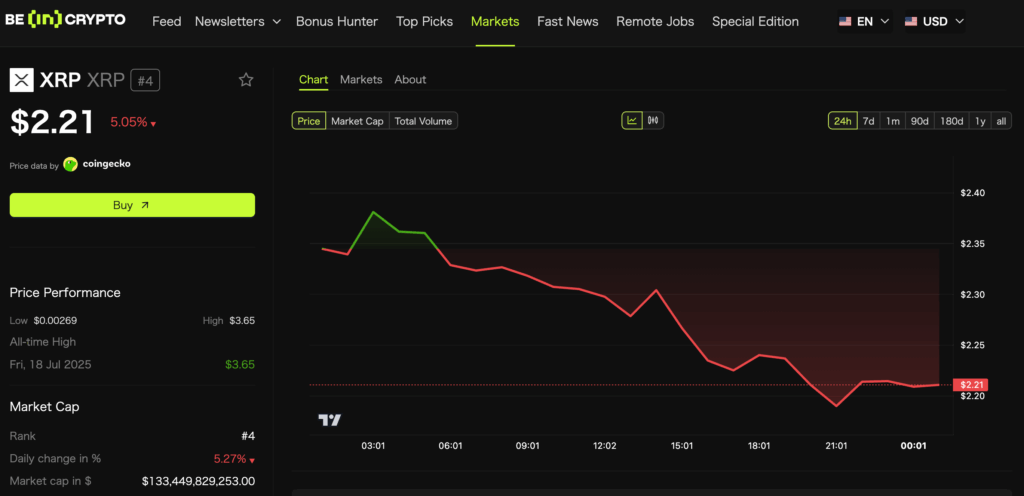

Despite these strong fundamental developments—including record wallet growth, stablecoin adoption, and potential tokenomic improvements—XRP’s market price remains in a downtrend. This disconnect indicates that external uncertainties continue to influence market behavior.

At the time of writing, XRP trades at $2.21, reflecting a 5.05% decline over 24 hours. While XRP has achieved clarification regarding its non-security status for programmatic sales, lingering legal uncertainty from SEC litigation continues to weigh on investor sentiment. Additionally, macroeconomic headwinds and broad risk aversion in the crypto market contribute to the muted price response despite strong fundamentals.

Comments are closed.