Featured News Headlines

WLD Drops Sharply Amid Broader Market Weakness

Worldcoin (WLD) saw a steep 14% decline in the past 24 hours, diverging even from the broader crypto market’s roughly 9% pullback. The token has been locked in a multi-month sideways pattern since its early surge from $0.60, but recent events have intensified the downward momentum.

Market sentiment has clearly played a role, yet a combination of regulatory actions, token unlocks, and an ongoing bearish structure has amplified Worldcoin’s decline.

Regulatory Crackdowns Accelerate Pressure on WLD

WLD’s latest drop is closely linked to rising global regulatory scrutiny. Colombia became the newest country to halt the project’s operations, ordering the immediate deletion of biometric data collected from its citizens.

This comes after the Philippines and Thailand issued cease-and-desist orders, forcing Worldcoin to suspend local activities—an especially damaging setback for users who had relied on the project’s airdrop incentives aimed at boosting adoption.

These regulatory decisions created uncertainty around the project’s data practices, adding pressure to an already shaky market environment.

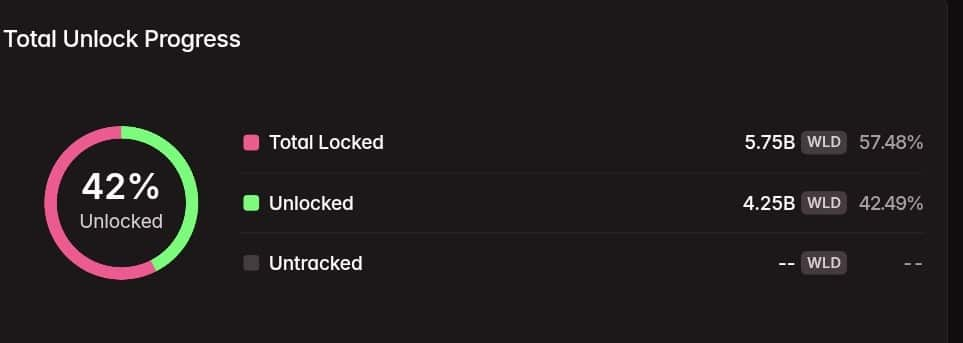

Token Unlocks Increase Selling Activity

Adding fuel to the decline, more than 37 million WLD tokens, valued at just over $25 million, were recently unlocked. Unlock events typically introduce excess supply into the market, and in WLD’s case, the fresh tokens significantly increased selling pressure during a period when most cryptocurrencies were already retracing.

Bitcoin’s drop toward the $80,000 zone further contributed to risk-off sentiment across the altcoin sector, including Worldcoin.

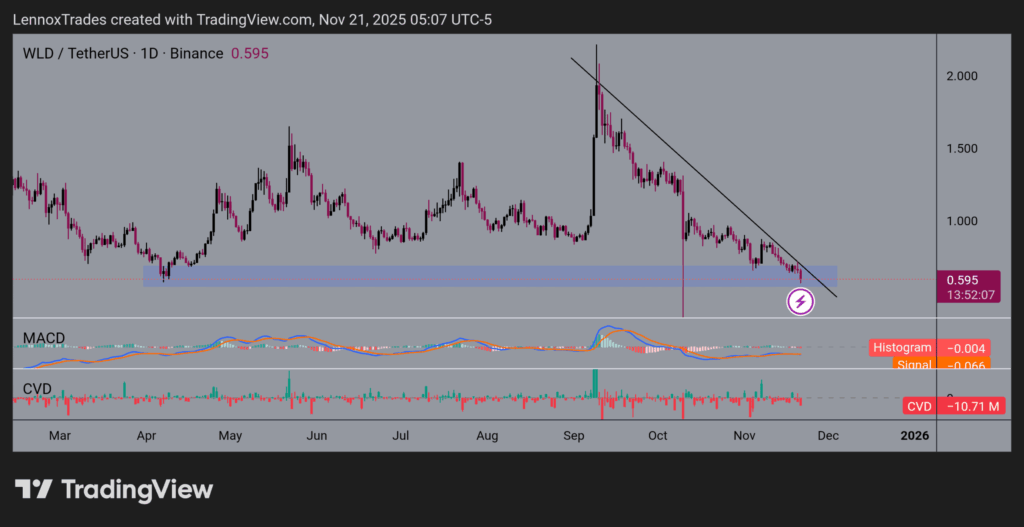

Technical Indicators Show Bearish Momentum—But a Shift May Be Near

On the charts, WLD has been trending below a downward-sloping trendline for the past three months, reinforcing the bearish outlook. Before entering this downtrend, the token had traded within a wide range between April and September.

Momentum indicators reflect sellers’ dominance. The MACD continues to show bearish strength, though not enough to push the price below the long-standing $0.60 support. Meanwhile, the Cumulative Volume Delta (CVD) stands at –$10.71 million, suggesting selling volume has largely come from short-side traders.

However, the price appears to be approaching the apex of its consolidation pattern, often a precursor to a volatility expansion. The direction remains uncertain, but analysts note liquidity signals worth watching.

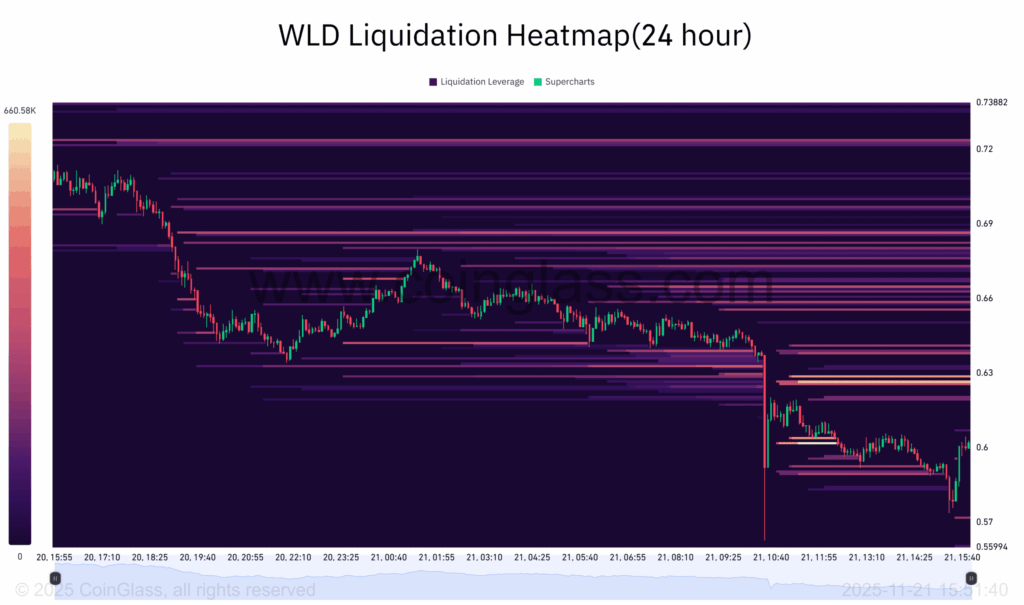

The liquidation heatmap shows more than $1.5 million in liquidity concentrated around $0.63. Lower liquidity pockets have already been cleared, indicating the price may gravitate toward the remaining liquidity above.

Signs of a Possible Reversal

With WLD trading above a key short-term support zone and positioned near the wedge apex, analysts note that a reversal may be forming. While bears have controlled recent price action, the current structure suggests the token may not continue its decline, with buyers expected to re-enter if upward liquidity draws hold.

Comments are closed.