Featured News Headlines

World Liberty Financial Faces Heavy Selling Pressure

World Liberty Financial (WLFI) has shown signs of stabilization after a sharp decline, bouncing from a local low of $0.19 to reclaim the $0.20 mark. At the time of writing, WLFI was trading at $0.200, posting a modest 0.92% daily gain.

Recent Downtrend Signals Weak Sentiment

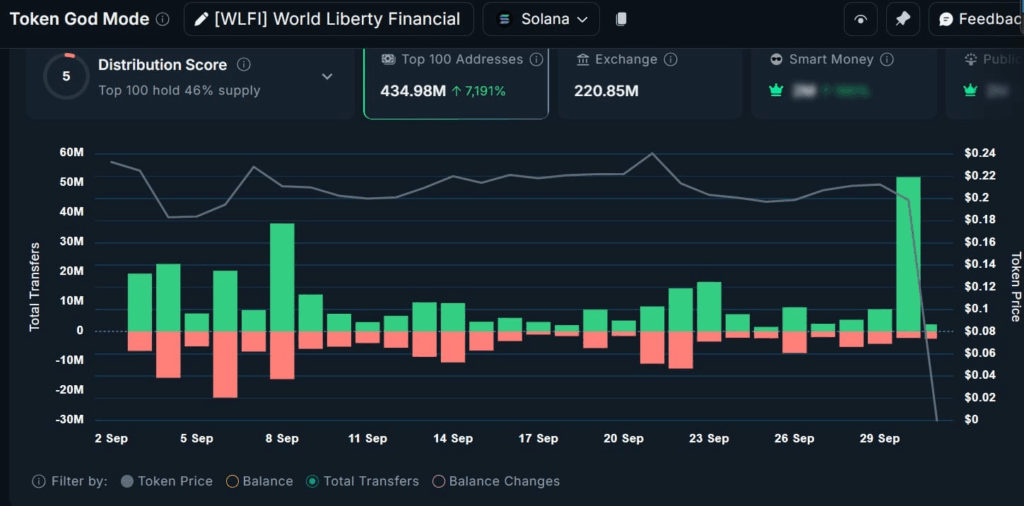

Despite the slight recovery, WLFI remains under bearish pressure. Over the past 30 days, the altcoin has lost nearly 36% of its value. This persistent downtrend has prompted many market participants to retreat, reflecting broader uncertainty.

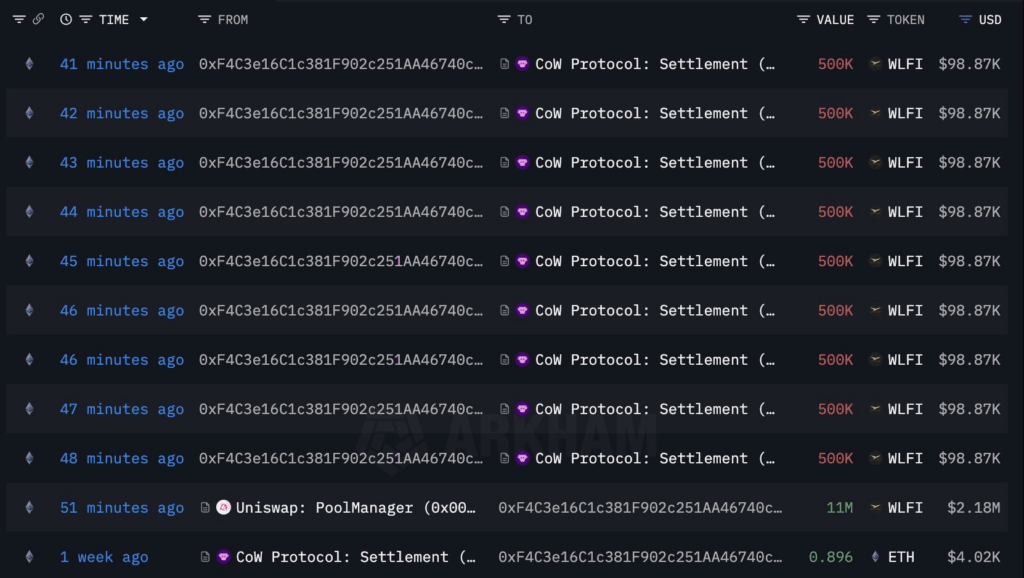

Whale Activity Sends Mixed Signals

On-chain data reveals conflicting signals from major holders. According to Lookonchain, one whale reacted to the dip below $0.20 by removing 11 million WLFI (worth $2.15 million) from a liquidity pool, converting the holdings into 521 ETH. As the platform notes, “this move may indicate a lack of confidence.”

However, data from Nansen suggests otherwise. For three consecutive days, whales have been net buyers, accumulating 61 million WLFI — a sign of potential long-term positioning.

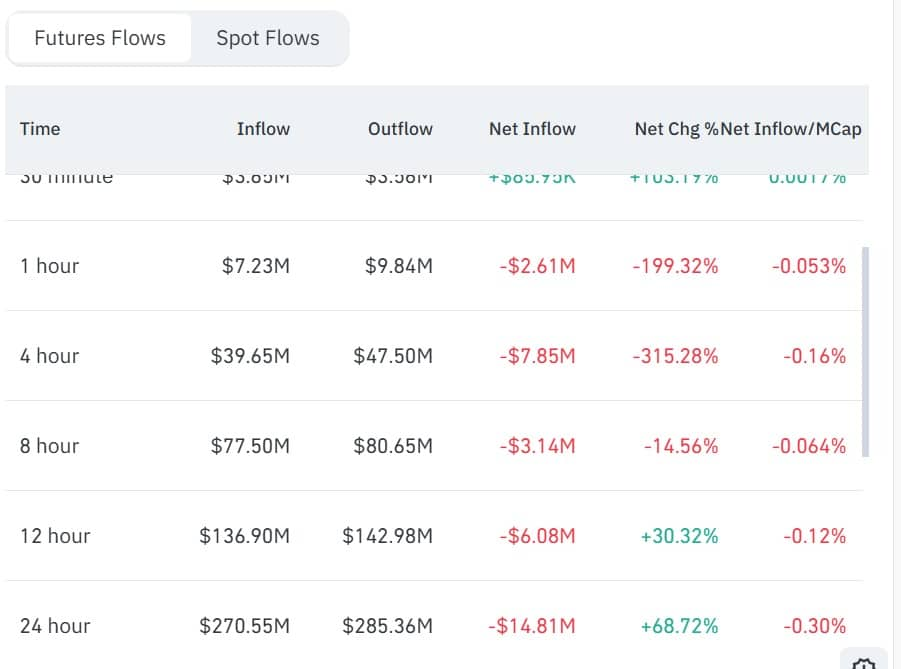

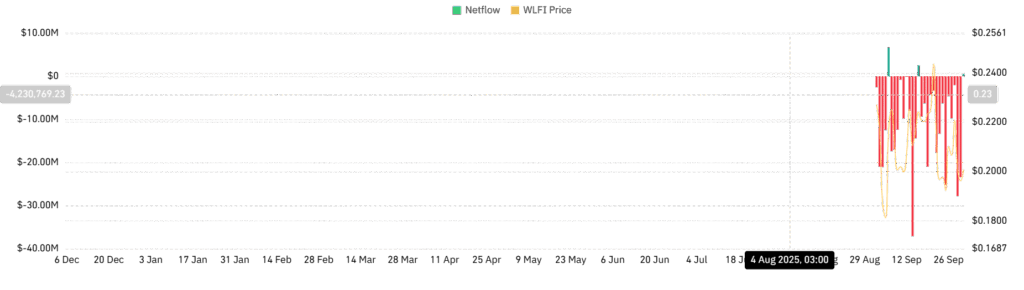

Derivatives and Spot Markets Reflect Bearish Tone

Futures data paints a cautious picture. CoinGlass reports that Futures Netflow dropped to -14.81 million, a 68% decrease, driven by outflows exceeding inflows. This suggests traders are closing positions amid rising uncertainty.

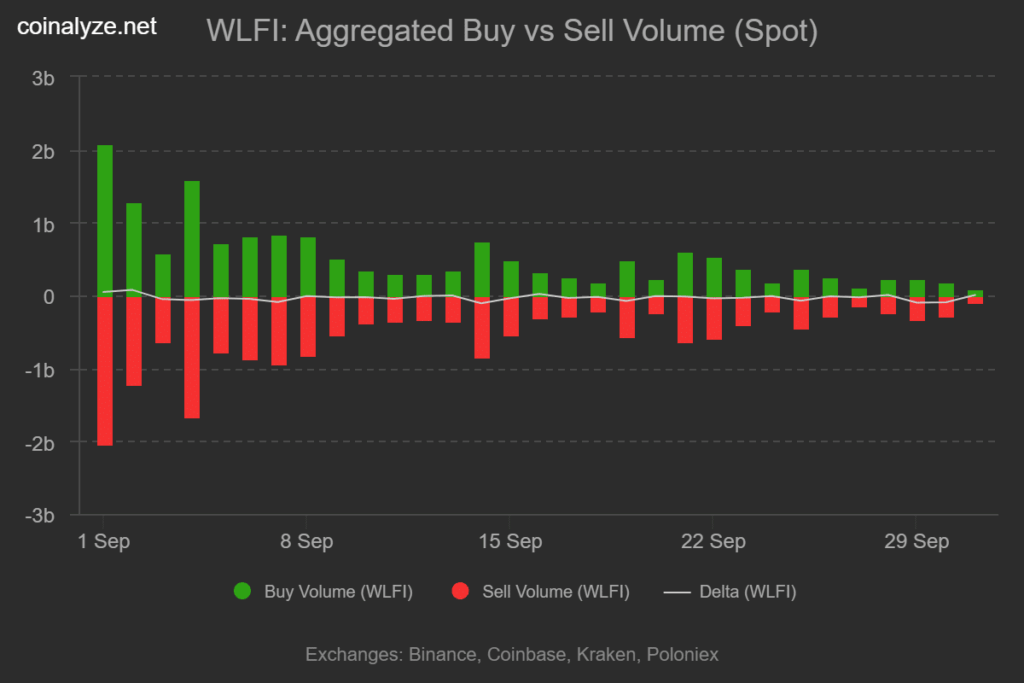

Meanwhile, retail selling has surged. Coinalyze data shows a negative Delta of -192.44 million over three days, confirming strong sell-side pressure. CoinGlass also notes a positive Spot Netflow of $507k, typically a sign of increased exchange inflows and retail selling.

Technical Indicators Point to Weak Momentum

WLFI’s Stochastic RSI has slipped to 28, placing it in oversold territory, while the Relative Strength Index (RSI) sits at 44, indicating sustained bearish momentum. If selling pressure persists, WLFI could test the $0.186 support level. On the flip side, renewed buying could push the token toward $0.224.

Comments are closed.