Featured News Headlines

Will Kevin Hassett Bring a Pro-Crypto Shift to the Federal Reserve?

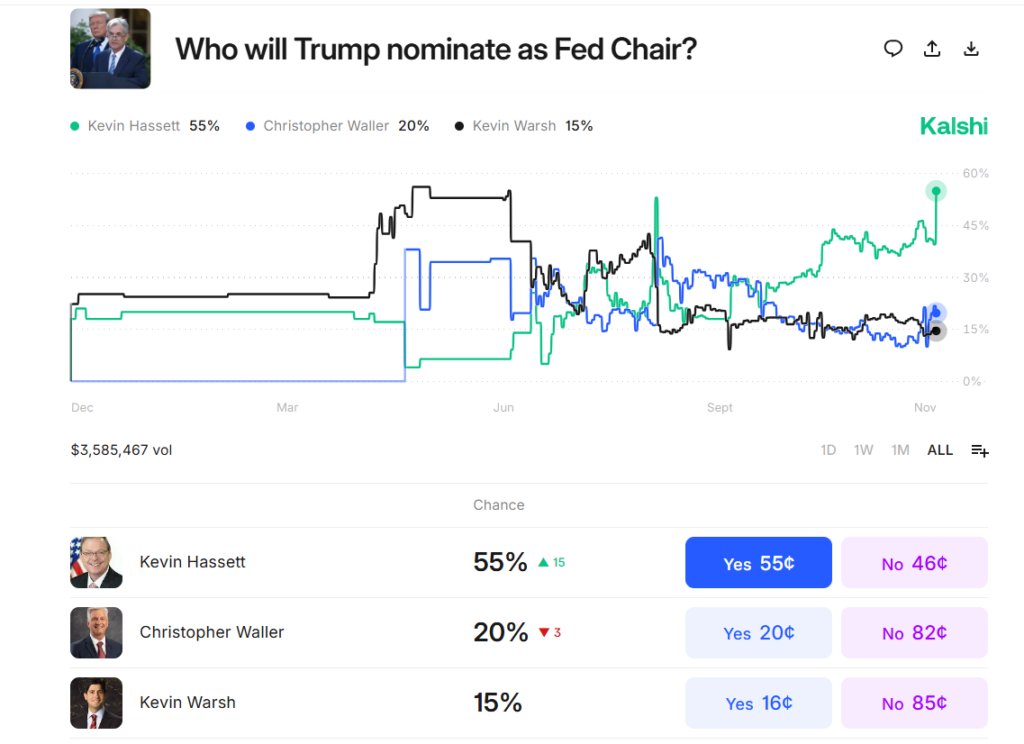

Will Kevin Hassett Beat Trump’s Favorite to Become Fed Chair? Former Coinbase advisor Kevin Hassett, who holds over $1 million in COIN stock, has surged to the top of the Federal Reserve Chair race, with prediction markets giving him a 56% probability of nomination. Kalshi data shows a 15% increase in his odds over the past 24 hours, far ahead of rivals Christopher Waller (20%) and Kevin Warsh (15%). Final interviews, led by Treasury Secretary Scott Bessent, are underway, as President Donald Trump continues to criticize current Fed Chair Jerome Powell.

Dovish Policy and Crypto Expertise

Hassett, former chair of the Council of Economic Advisers and Distinguished Visiting Fellow at the Hoover Institution, is known for advocating rate cuts and a more accommodative monetary policy. His direct involvement with the crypto industry, including a role on Coinbase’s Global Advisory Council, positions him uniquely among candidates. Analysts note that his approach could signal a pro-crypto shift at the Fed, with potential implications for digital asset regulation, central bank digital currencies (CBDCs), and crypto integration into traditional finance (TradFi).

Market and Policy Implications

If appointed, Hassett’s candidacy could foster institutional adoption of cryptocurrencies and increase regulatory transparency. Crypto strategist Juan Leon emphasized that Hassett’s dovish stance and digital asset experience could be strongly bullish for the market. However, critics highlight possible conflicts of interest due to his COIN holdings, especially given the Fed’s influence over cryptocurrency exchanges and stablecoin issuers.

A Choice Between Stability and Innovation

The contrast with Christopher Waller presents two diverging paths: Waller’s caution versus Hassett’s support for innovation. As the expected announcement approaches in December 2025, both financial and crypto markets are closely monitoring potential shifts in U.S. monetary policy and the Fed’s stance on emerging technologies.

Comments are closed.