Featured News Headlines

Ethereum Market Structure Turns Bullish — What’s Next?

“Ethereum [ETH] could be undervalued at $3k,” warned Bitmine Immersion’s Tom Lee, although he also acknowledged that mid-size holders in the 1k–10k ETH range continue to sell. At the same time, falling exchange supply hints at accumulation, creating a mixed on-chain picture.

L2 Shift and Market Structure

With the recent Fusaka upgrade, Ethereum is moving toward a model in which everyday transactions migrate to Layer-2 networks while the base layer focuses on settlement. This design aims to improve throughput, increase data capacity, and help reduce overall network congestion.

Despite the cautious market mood, some analysts believe the long-term outlook could strengthen. Still, this is not an indication of future price movement, and traders should remain aware of market volatility.

Weekly Structure: Demand Zone Reaction

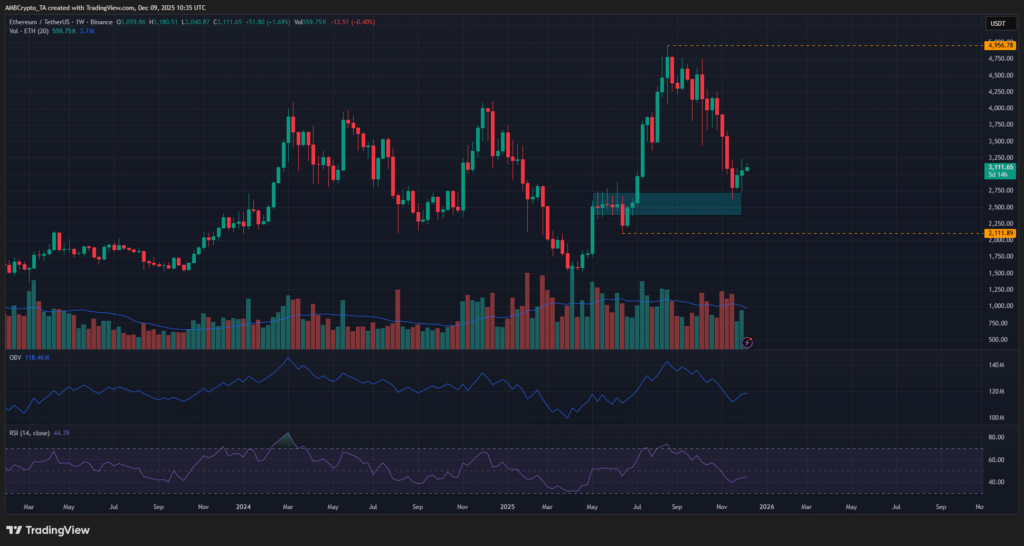

On the weekly chart, the broader swing structure remains bullish. September’s drop below $4.2k signaled short-term weakness, confirmed by a retracement into the $2.7k demand zone, first established in May. From this region, Ethereum has already climbed roughly 18% over the past three weeks.

Momentum indicators, however, tell a more cautious story. The RSI fell below the neutral 50 zone in October, reflecting bearish pressure, while the OBV reversed sharply after months of steady gains. These do not yet indicate strong bullish conviction, but the price has shown early signs of a positive reaction from the $2.5k–$2.7k area.

Short-Term Trend and Key Resistance

On the daily timeframe, ETH has broken above its previous local high at $3.1k, shifting the internal structure toward the bullish side. The next major barrier sits between $3,370 and $3,660, a supply zone that could challenge any upward push.

Yet low volume continues to signal a lack of strong demand. This means the $3.2k local support may still produce rejection if bulls fail to sustain momentum.

Lower Timeframes: Potential Bullish Setup

Shorter charts may offer clearer opportunities. On the one-hour timeframe, the $3,014–$3,086 demand zone has shown the potential to support a move toward $3.4k—though this should not be interpreted as investment advice.

Overall, Ethereum’s path forward remains technically constructive but fragile, shaped by low volume, shifting sentiment, and critical resistance overhead.

Comments are closed.