Over the past months, Zetarium has grown from a broad DeFi infrastructure vision into a platform with clear, data-backed user behaviour. As builders, our responsibility is not to chase ideas — it’s to double down on what users are actually using.

After reviewing on-chain activity, product traction, and community engagement, we’ve made a deliberate decision:

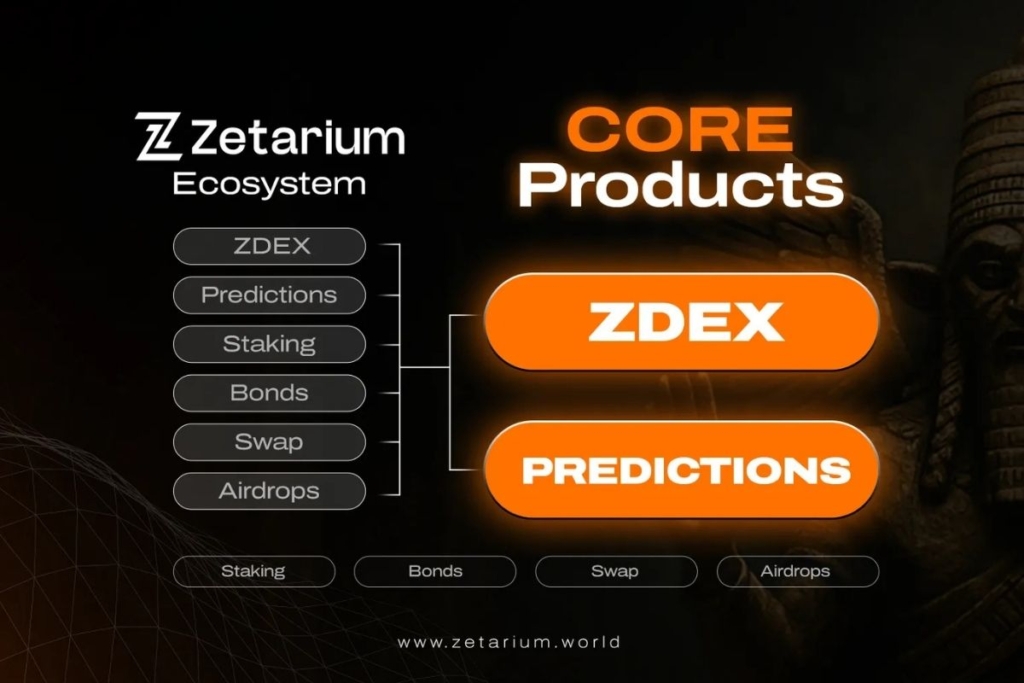

ZDEX (our perpetual DEX) and Zetarium Predictions are now our core products. This article explains why.

Featured News Headlines

Listening to the Data (Not the Noise)

From the outside, it’s easy to assume that more products equal more value. In practice, successful protocols do the opposite: they focus.

Internally, we’ve been tracking:

- User activity flows

- Capital deployment patterns

- Infrastructure load

- Retention and repeat usage

What became clear very quickly is that two products consistently outperform everything else:

- ZDEX — where traders come for execution, liquidity, and performance

- Predictions — where users come for participation, engagement, and fast-growing volume

These aren’t experimental features. They’re the gravity wells of the Zetarium ecosystem.

Why ZDEX Matters

Decentralised derivatives are where DeFi still falls short.

Most on-chain trading platforms either:

- Sacrifice performance for decentralisation, or

- Reintroduce custodial risk to achieve speed

ZDEX exists to close that gap.

By focusing ZDEX as a primary product, we can:

- Optimise execution and latency

- Deepen liquidity where it matters

- Strengthen risk management and liquidation systems

- Deliver a non-custodial trading experience that actually competes.

This requires focus. Perpetual trading is not a “side feature” — it’s a full stack problem.

Why Predictions Are Core (Not a Side Game)

Prediction markets are often underestimated.

In reality, they are:

- One of the most efficient forms of market participation

- Highly capital-efficient

- Extremely engaging for non-professional users

Our data shows that Predictions attract a different class of users than trading — and that’s a strength.

They:

- Increase platform stickiness

- Bring new users into the ecosystem

- Create organic liquidity flow without leverage risk

- Scale naturally with community interest

Predictions are not about speculation alone — they’re about participation at scale.

What About Staking, Bonds, Swaps, and Airdrops?

These modules aren’t disappearing. They are being repositioned correctly.

Instead of presenting everything as a “main product”, we’re now treating:

- Staking

- Bonds

- Swap aggregation

- Airdrops

as supporting infrastructure.

They exist to:

- Reinforce liquidity

- Align incentives

- Support governance

- Improve user onboarding

This makes the ecosystem clearer, simpler, and more honest — both for users and partners.

Focus Is a Feature

Scaling a decentralised protocol is not about doing everything.

It’s about doing the right things exceptionally well.

By focusing on:

- ZDEX as our execution engine

- Predictions as our participation engine

we can:

- Ship faster

- Improve reliability

- Reduce complexity

- Align more closely with regulatory expectations

- Build something sustainable, not inflated

This decision wasn’t made overnight. It was made by watching how real users interact with Zetarium.

What This Means Going Forward

You should expect:

- Faster iteration on ZDEX

- Deeper liquidity and better execution

- More prediction markets, better UX, and higher throughput

- Cleaner messaging and product clarity

- Infrastructure modules that support — not distract

This is not a pivot away from our vision. It’s a maturation of it.

Final Thoughts

Zetarium is evolving in the direction its users are already pointing.

ZDEX and Predictions are where:

- The activity is

- The growth is

- The future is

Everything else exists to make those two products stronger.

And that’s exactly what we’re going to do.

Comments are closed.