When one first ventures into the cryptocurrency market, it is easy to assume that the entire ecosystem revolves solely around sending “digital money.” Bitcoin pioneered this concept, certainly. However, can blockchain technology be utilised not merely for currency transfer, but to fundamentally alter the concept of “ownership”? Ravencoin (RVN) was born specifically to answer this question.

In this guide, we shall set aside cold technical jargon to explore precisely what Ravencoin does, why it is frequently hailed as “Bitcoin 3.0,” and why it holds such significance for the future of finance.

Featured News Headlines

- 1 What is Ravencoin (RVN)?

- 2 The Origin Story: An Egalitarian Inception

- 3 The Heart of the Technology: Asset Tokenisation

- 4 Mining and the KAWPOW Algorithm: Equality for All

- 5 Ravencoin Tokenomics: The Figures Behind RVN

- 6 Why Ravencoin? Advantages and Risks

- 7 How to Buy and Store Ravencoin (RVN)?

- 8 The Future of Ravencoin

What is Ravencoin (RVN)?

In its simplest definition, Ravencoin (RVN) is an open-source blockchain project specifically designed to facilitate the transfer of assets from one party to another securely, rapidly, and without intermediaries.

The moniker is inspired by the fictional world of Westeros in Game of Thrones. In that lore, ravens are the messengers that carry the truth. Similarly, Ravencoin aims to be the network that carries the “truth of ownership” across the digital realm.

How Does It Differ from Bitcoin?

Ravencoin is built upon a code fork of Bitcoin. Consequently, it inherits Bitcoin’s robust security and resilience. However, whilst Bitcoin is perfected for the transfer of currency, Ravencoin is bespoke-engineered for the transfer of “any asset.”

To illustrate: You use Bitcoin to purchase a coffee. You use Ravencoin to digitally transfer the title deed to the coffee shop, shares in the company, or loyalty rewards.

The Origin Story: An Egalitarian Inception

In the crypto sphere, the vast majority of projects commence with an ICO (Initial Coin Offering). Founders raise capital, allocate a substantial portion of coins to themselves, and only then launch the project.

Ravencoin took a revolutionary stance against this norm. Launched on January 3rd, 2018 (coinciding with Bitcoin’s 9th anniversary):

- There was absolutely no ICO.

- There was no “pre-mine” (no coins were allocated to developers or founders beforehand).

- There were no Masternode requirements.

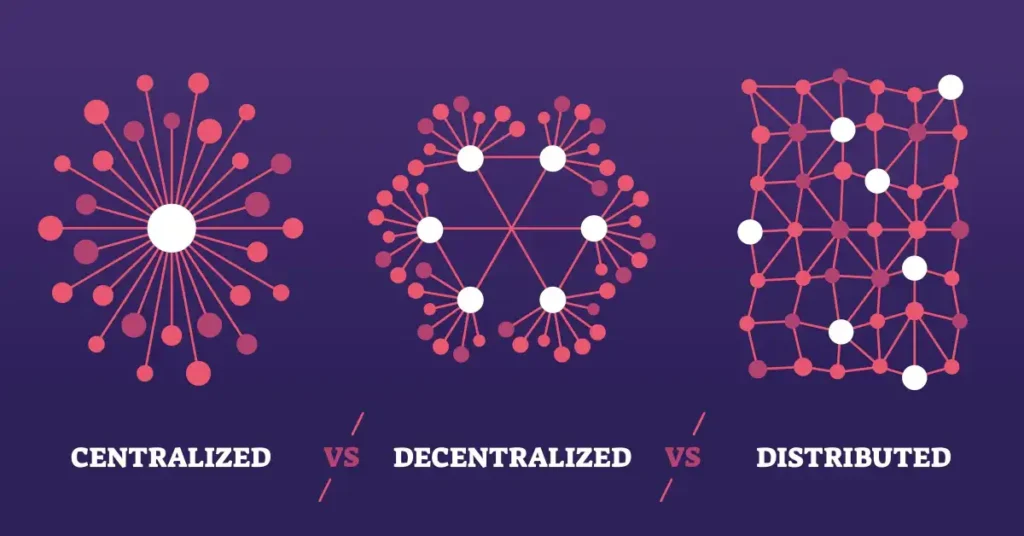

This makes Ravencoin one of the most “fair” and genuinely “decentralised” projects in existence. Everyone started on equal footing.

The Heart of the Technology: Asset Tokenisation

What sets Ravencoin apart is its native ability to create assets. Whilst one can generate tokens on networks like Ethereum (such as ERC-20), the process often involves complex smart contracts and can suffer from transfer friction. Ravencoin, conversely, is coded solely to perform this function.

What Can Be Digitised with Ravencoin?

Virtually anything of value can be converted into a “token” on the RVN network:

- Physical Assets: Gold bullion, silver, land deeds, energy credits.

- Securities: Company shares, dividend payments, partnership equity.

- Virtual Goods: In-game items, rare collectibles, event tickets.

- Credits and Points: Gift cards, airline miles.

When a user wishes to create an asset on the Ravencoin network, they must “burn” a specific amount of RVN coins (removing them from circulation forever). This mechanism creates a deflationary pressure, reducing the RVN supply over time.

Mining and the KAWPOW Algorithm: Equality for All

Bitcoin mining today requires colossal industrial facilities and prohibitively expensive ASIC hardware. Mining Bitcoin with a domestic computer is now an impossibility. Ravencoin opposes this centralisation.

Ravencoin utilises a specific mining algorithm known as KAWPOW.

- ASIC Resistant: This algorithm prevents the network from being dominated by massive machines manufactured solely for mining.

- GPU Friendly: One can mine Ravencoin using the graphics card (Nvidia or AMD) found in a standard gaming PC.

This feature ensures that the network’s security is maintained not by a handful of corporate entities, but by thousands of individual users scattered across the globe. This is decentralisation in its truest form.

Ravencoin Tokenomics: The Figures Behind RVN

For investors and enthusiasts, the mathematical infrastructure of the project is crucial. Here is Ravencoin’s identity:

- Total Supply: 21 Billion RVN (1,000 times that of Bitcoin). This higher figure is designed to make micro-transactions and asset transfers more calculable.

- Block Time: 1 Minute (compared to Bitcoin’s 10 minutes). This results in significantly faster transaction confirmations.

- Halving: Much like Bitcoin, mining rewards are halved every 2,100,000 blocks (approximately every 4 years). The first halving event occurred in January 2022.

Why Ravencoin? Advantages and Risks

As with any financial instrument, RVN possesses both strengths and weaknesses. Let us take an objective view.

The Advantages

- Specialised Architecture: Because it focuses solely on asset transfer, it performs this task more efficiently than general-purpose blockchains.

- Security: It utilises Bitcoin’s proven consensus model.

- Regulatory Compliance: Ravencoin includes features that allow security tokens to be digitised in accordance with the law (such as voting rights, dividend distribution, and messaging).

- Community Strength: There is no CEO or central company; it is entirely community-governed.

Risks and Challenges

- Competition: Giants like Ethereum, Solana, and Avalanche are also engaging in asset tokenisation. Ravencoin must compete with these massive ecosystems.

- Marketing Limitations: As there is no central entity, there is no marketing budget. Growth relies entirely on organic, “word-of-mouth” expansion.

How to Buy and Store Ravencoin (RVN)?

RVN is a well-established project listed on the world’s major exchanges.

- Exchanges: You can easily purchase RVN via major platforms such as Binance, Paribu, OKX, or Kraken using USDT, BTC, or fiat currency pairs.

- Wallets (Storage):

- Desktop: Ravencoin Core (For those wishing to run a full node).

- Mobile: Trust Wallet, Exodus, or the official Ravencoin Mobile Wallet.

- Hardware: Cold wallets like Ledger or Trezor support RVN and remain the most secure option.

The Future of Ravencoin

Ravencoin is not a “get-rich-quick” scheme; it is a serious piece of technology poised to alter the infrastructure of the financial system. In a future where trillions of dollars in assets—from real estate to stock markets—move onto the blockchain (the Real World Assets or RWA trend), Ravencoin has the potential to be a key player.

If you believe in decentralisation, equal opportunity in mining, and the digitisation of real-world assets, Ravencoin is a project that certainly deserves a place on your radar.

Comments are closed.