Featured News Headlines

Aster Price Dips Below Key Support After $26M Whale Dump – Is a Recovery Possible?

Aster [ASTER] is facing turbulent market conditions, with the altcoin plunging 11.04% in the past 24 hours to trade at $1.80, following a sharp rejection at the $2.2 resistance level. This recent decline marks three consecutive days of losses, with Aster hitting a low of $1.76 — all amidst heightened whale activity and a surge in selling pressure.

Whale Moves Trigger Panic Selling

The latest drop in Aster’s price appears to be fueled by a significant whale sell-off, with on-chain data revealing that one large holder recently deposited 6.1 million ASTER (worth $12.07 million) to Binance. In total, this whale has offloaded 12.9 million tokens valued at $26.2 million, though still retains a hefty 51.574 million ASTER, worth $98.51 million.

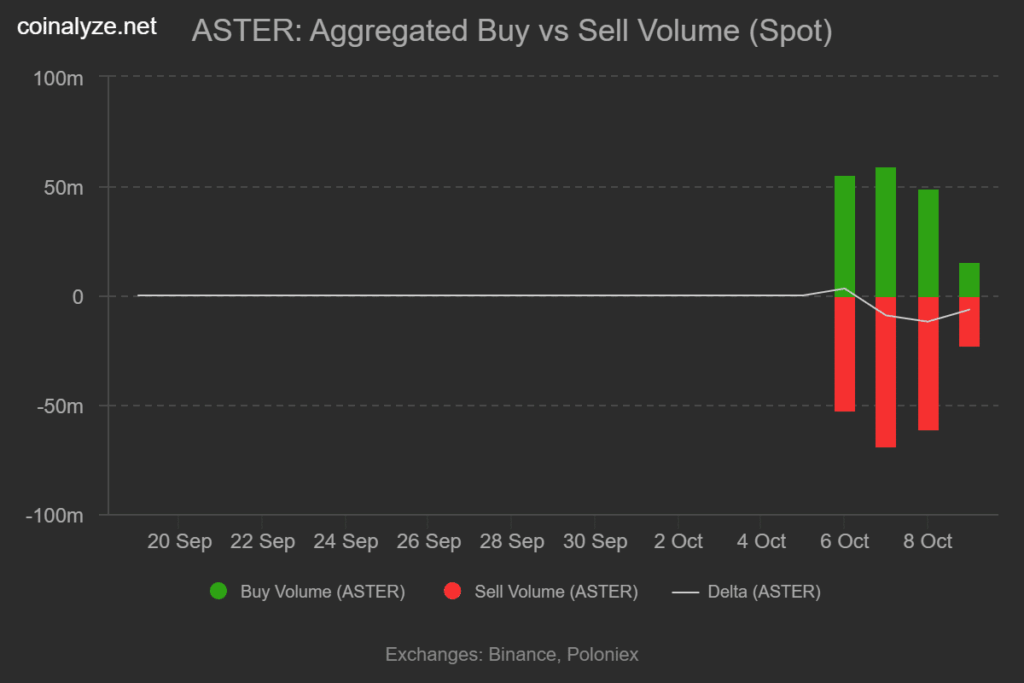

With whales exiting, the Spot market has seen a sharp spike in selling pressure, recording a negative delta of 28.3 million tokens over the past three days — as 152.3 million tokens were sold against 124 million bought. The breach of a key support level has only added to the bearish momentum.

Retail Traders Buy the Dip

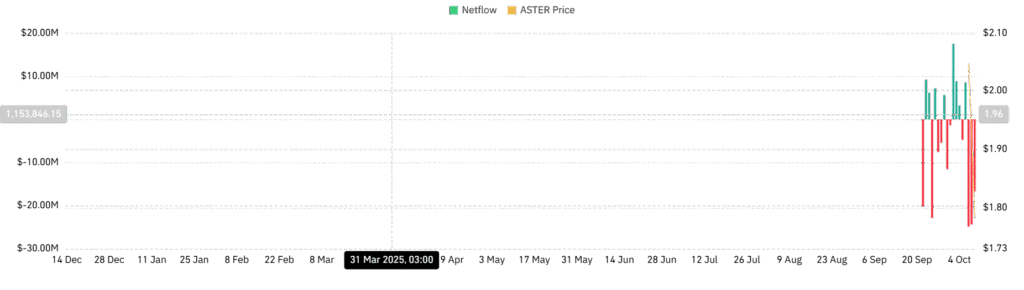

In contrast, retail investors are stepping in. Aster’s Netflow has remained negative for three straight days, signaling increased accumulation. At press time, Netflow stood at -$16.74 million, a modest recovery from the previous day’s -$24.41 million, indicating that small-scale traders may be positioning for a rebound.

Futures Market Shows Bullish Divergence

Despite spot market weakness, Futures traders remain optimistic. Data from Nansen reveals a strong long bias on Hyperliquid, with 64 new long accounts and a drop of 36 short accounts. Contract buys have consistently outpaced sells over the past three days — a bullish signal indicating expectations of a price recovery.

What’s Next for Aster?

Aster’s technical indicators paint a mixed picture. Its Stochastic RSI has plunged into oversold territory at 14.7, while the Relative Strength Index dipped from 65 to 59, highlighting fading bullish strength. If whale sell pressure persists, Aster could fall further to $1.6. However, if retail traders maintain buying momentum, the asset could defend the $2 support and eye a return to $2.26.

Comments are closed.