Featured News Headlines

Uniswap Price- Bulls Eye $8 Amid Mixed Signals

Uniswap Price– Uniswap’s native token, UNI, has had a volatile journey in 2025. From a high of $19.47 in December 2024, it plunged by 74% to a low of $4.55 in April. Since mid-May, however, the token has been on a gradual recovery path, supported by the 50-day moving average acting as a reliable floor.

On-Chain Activity Shows Growing Demand

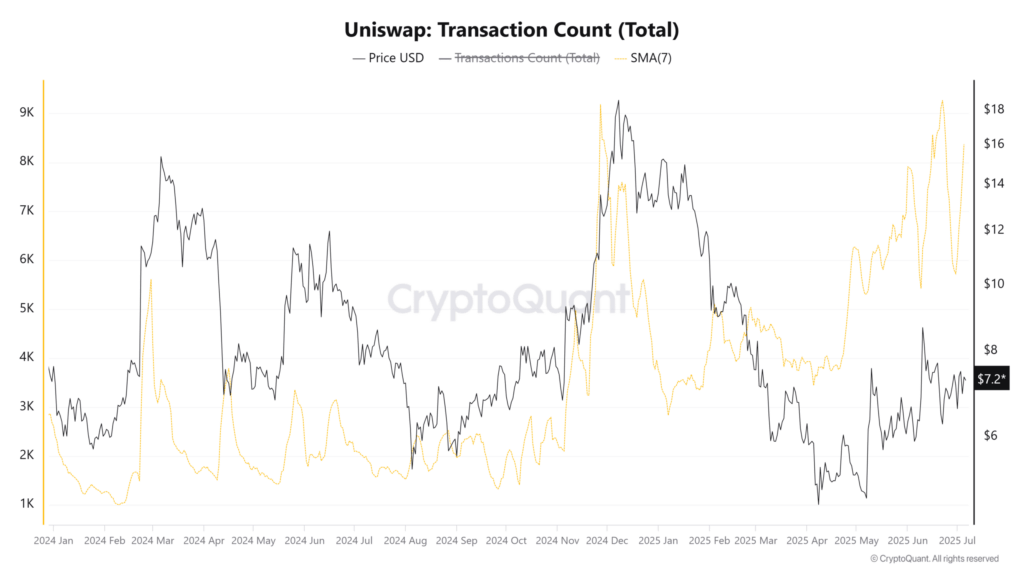

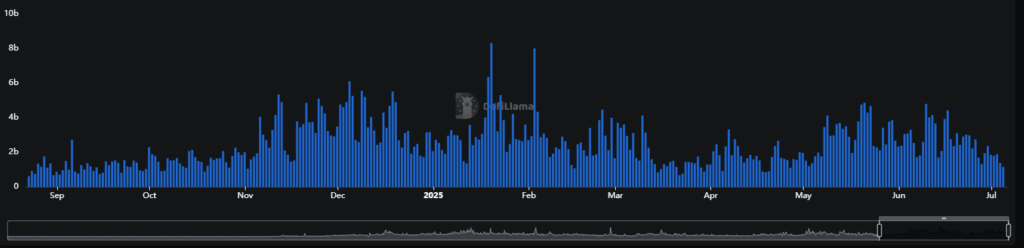

Recent on-chain data highlights an increase in transaction count since mid-April, indicating renewed user interest. This rising trend, tracked by the 7-day moving average, points to stronger engagement and suggests greater demand for UNI. The decentralized exchange (DEX) itself experienced higher trading volumes in May and June, though these figures began to decline toward late June and early July — a development that could hint at weakening momentum.

Mixed Signals From Futures and Spot Markets

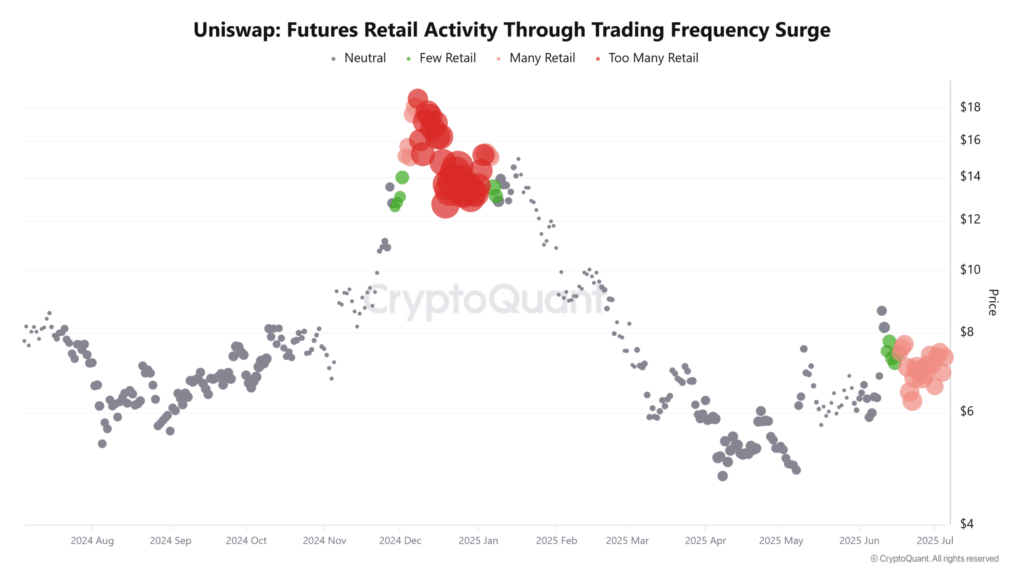

According to CryptoQuant, retail activity in UNI Futures markets has surged in recent weeks, mirroring levels seen in late 2024 and early 2025 — a pattern often associated with overextended markets. In contrast, spot market data tells a different story. The 90-day cumulative volume delta (CVD) for spot trades has remained positive and is steadily rising since mid-May, reflecting a phase dominated by taker buy orders.

This divergence between Futures and spot activity adds uncertainty to UNI’s short-term price direction.

Technical Indicators Highlight Key Resistance

On the daily chart, UNI displays bullish momentum. The RSI is above 50, and the price remains above both the 20- and 50-day moving averages. Yet, the Chaikin Money Flow (CMF) stands at -0.1, signaling capital outflows and casting doubt on sustained upward movement.

Market observers should watch the $8 resistance closely. As noted in the analysis, “it may be likely that the $8 resistance zone would see greater volatility.” A confirmed breakout could open up long opportunities, but caution is warranted amid conflicting market signals.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.