Featured News Headlines

- 1 Twenty One Capital Public Listing Highlights Hybrid Bitcoin Treasury and Revenue Model

- 2 Shares Open Low, Close Below SPAC Benchmark

- 3 Massive Bitcoin Treasury Backing

- 4 SPAC Deal and Capital Injection

- 5 Mallers’ Vision: Beyond a Bitcoin Treasury

- 6 Market Reception and Future Outlook

- 7 Positioning in the Bitcoin Corporate Landscape

Twenty One Capital Public Listing Highlights Hybrid Bitcoin Treasury and Revenue Model

Twenty One Capital, the Tether-backed Bitcoin treasury venture led by Strike founder Jack Mallers, made its public debut on Tuesday, but the listing faced a bumpy start even as Bitcoin climbed roughly 3% on the day. The firm, trading under ticker XXI, represents one of the newest attempts to bring Bitcoin-focused corporate structures to public markets.

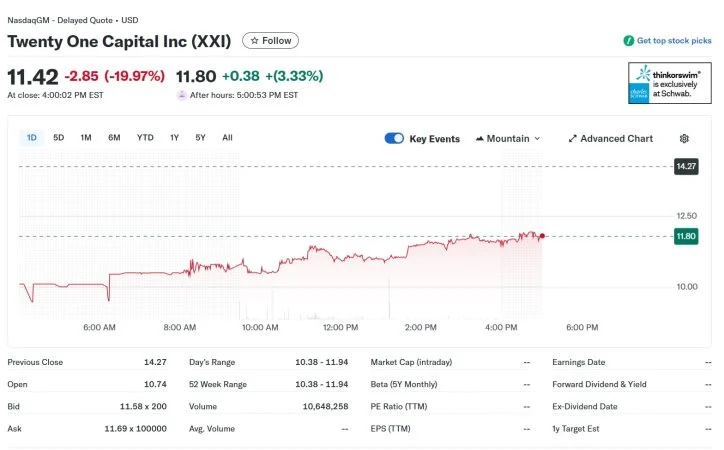

The newly listed company’s shares opened at $10.74 and closed at $11.42, roughly 20% below the $14.27 closing price of the Cantor Equity Partners SPAC it merged with. Post-market trading saw a slight uptick to $11.80, but the day highlighted investor caution toward the novel Bitcoin treasury corporate structure.

The IPO represents the culmination of a months-long effort to take Twenty One public through a Cantor Fitzgerald–backed SPAC, with Tether and SoftBank contributing Bitcoin as part of the deal, reinforcing the firm’s deep ties to major crypto institutions.

Massive Bitcoin Treasury Backing

At launch, Twenty One Capital enters the market holding 43,514 BTC, valued at over $4.05 billion, making it the third-largest public corporate Bitcoin holder, according to The Block. This positions the firm behind giants such as MicroStrategy, led by Michael Saylor, but firmly in the top tier of Bitcoin treasury corporate structures.

Despite comparisons to MicroStrategy’s Bitcoin treasury play, Mallers emphasized that Twenty One is pursuing a broader business model beyond simple accumulation. On CNBC, he stressed that while the company will continue to acquire Bitcoin, its mission includes building revenue-generating Bitcoin businesses across brokerage, credit, and lending sectors.

“We look at a Coinbase and don’t think they’re a Bitcoin business. They’re a crypto business. We look at Strategy that’s focused on Bitcoin but doesn’t have products or cash flow in the industry,” Mallers said. “We want to live in the intersection of that.”

SPAC Deal and Capital Injection

The SPAC transaction brought in approximately $850 million through a combination of convertible notes and equity sales, forming part of a broader capital package. Early Bitcoin contributions from Tether, SoftBank, and Bitfinex added several billion dollars’ worth of BTC when the company was formed in spring, providing substantial backing for the treasury-focused venture.

This combination of capital and cryptocurrency positions Twenty One as a hybrid model—part Bitcoin treasury, part Bitcoin-centric financial services provider—potentially bridging the gap between pure treasury plays like MicroStrategy and broader crypto-focused enterprises.

Mallers’ Vision: Beyond a Bitcoin Treasury

Jack Mallers is keen to differentiate Twenty One Capital from other public Bitcoin holdings, arguing that a pure treasury approach lacks operational cash flow and industry-specific revenue streams. By integrating financial services tailored exclusively to Bitcoin, the company seeks to establish a sustainable Bitcoin-first business model, one that blends accumulation with commercial activity.

The company’s approach may appeal to investors looking for exposure to Bitcoin’s upside while still supporting revenue-generating operations within the crypto ecosystem—a departure from firms whose balance sheets are heavily concentrated in BTC but whose operations remain largely speculative.

Market Reception and Future Outlook

Despite the robust treasury and backing from major players like Tether and SoftBank, Twenty One’s stock performance reflects the uncertainties surrounding newly minted Bitcoin-focused public companies. Investors appear cautious in the early stages, as evidenced by the 20% drop from SPAC closing price, even amidst a general upward trend in Bitcoin itself.

Mallers’ strategic messaging—emphasizing both Bitcoin accumulation and operational revenue generation—may be aimed at reassuring stakeholders that the firm is not merely a treasury play but a Bitcoin-driven business ecosystem. Over time, the market will likely assess whether this hybrid approach can deliver consistent revenue growth while maintaining substantial BTC reserves.

Positioning in the Bitcoin Corporate Landscape

With its initial holdings of over 43,000 BTC, Twenty One Capital now sits in the upper echelon of publicly listed Bitcoin holders, trailing only the likes of MicroStrategy and other institutional giants. The company’s novel business model, combining treasury management with Bitcoin-based financial products, positions it uniquely within the emerging Bitcoin corporate sector.

If Twenty One succeeds in building brokerage, credit, and lending operations around its BTC treasury, it could set a new standard for public companies aiming to integrate cryptocurrency into operational revenue streams, moving beyond the paradigm of simple asset accumulation.

Twenty One Capital’s public debut signals both the growing institutionalization of Bitcoin and the market’s cautious approach to hybrid crypto corporate structures. With a substantial Bitcoin treasury, strategic backing from major industry players, and a focus on revenue-generating Bitcoin businesses, the firm is positioning itself at the intersection of Bitcoin accumulation and operational utility.

While its stock faced a rocky start, Jack Mallers’ vision could carve a new niche in the Bitcoin corporate ecosystem, bridging the gap between pure treasury plays and active, revenue-focused Bitcoin enterprises.

Comments are closed.