Featured News Headlines

Trump’s China Tariff Sparks Crypto Panic: Sentiment Index Plummets

Trump Tariffs Trigger Crypto Fear – A surprise move by U.S. President Donald Trump has sent shockwaves through the crypto markets, pushing investor sentiment to its lowest level in nearly six months, while triggering nearly $20 billion in liquidations.

Fear Takes Hold Across Crypto Markets

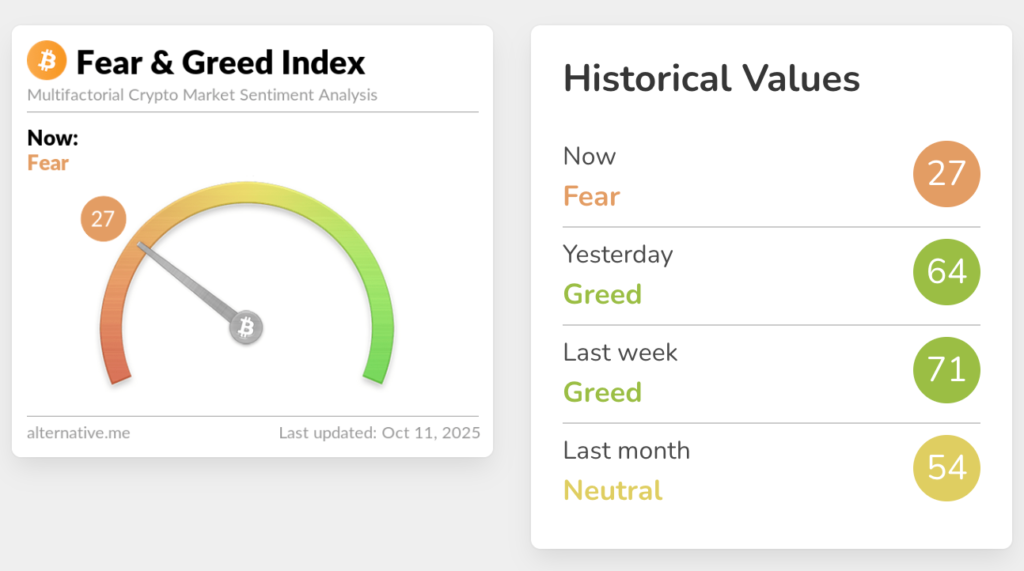

The Crypto Fear & Greed Index plummeted from a “Greed” reading of 64 on Friday to a stark “Fear” level of 27 on Saturday, marking a 37-point decline — one of the sharpest single-day sentiment drops in recent memory.

The sudden shift came after Trump announced a 100% tariff on China, fueling broader risk-off sentiment across financial markets. In the aftermath, Bitcoin briefly dipped to $102,000 on Binance’s perpetual futures pair, despite trading at $125,100 just days earlier.

$19 Billion in Positions Liquidated

According to CoinGlass, over the past 24 hours, approximately $19.27 billion worth of long and short positions were liquidated across the crypto market, underscoring the intensity of the reaction.

Yet, not everyone is bearish.

Analyst Flags ‘Strong Contrarian Buy Signal’

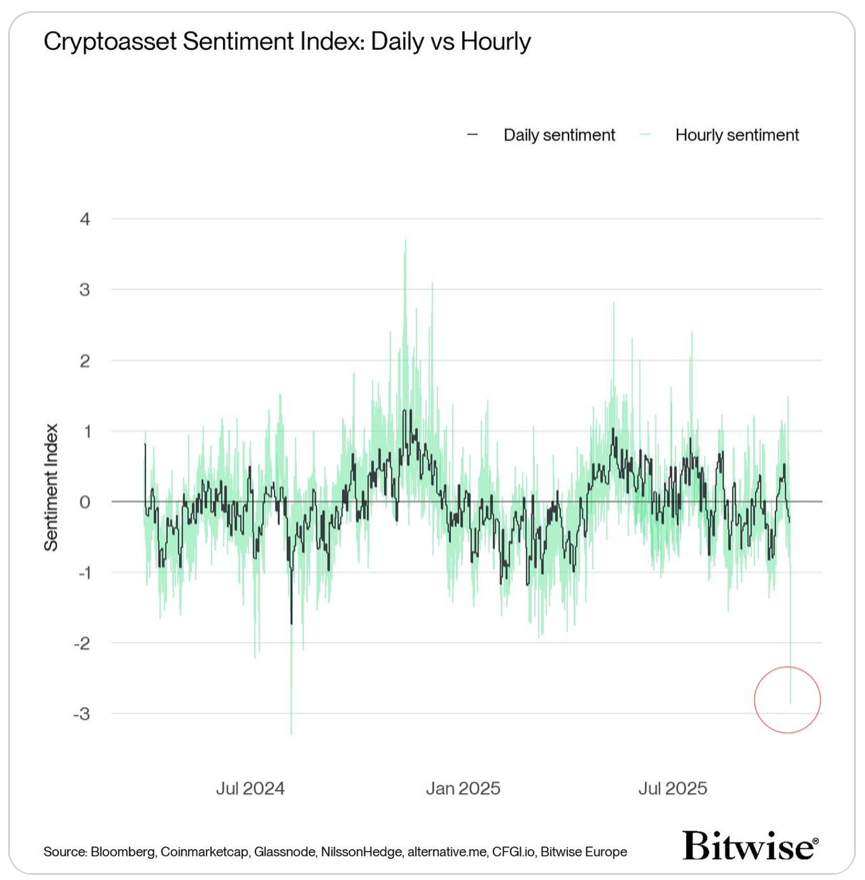

Andre Dragosch, head of research at Bitwise Europe, noted in a post on X that their intraday sentiment index has hit its lowest point since the “Yen Carry Trade Unwind” of summer 2024, reaching -2.8 standard deviations — a level he describes as a “strong contrarian buying signal.”

Muted Response to Bitcoin’s All-Time Highs

Interestingly, despite Bitcoin hitting fresh all-time highs earlier this week, sentiment didn’t follow. Santiment analyst Brian Quinlivan observed a lackluster reaction across social media, noting that “it was like a modest, run-of-the-mill reaction” after Bitcoin’s rally to $125,100. “It’s not nearly as euphoric as some of these previous ones,” he added during an interview on the Thinking Crypto podcast.

Comments are closed.