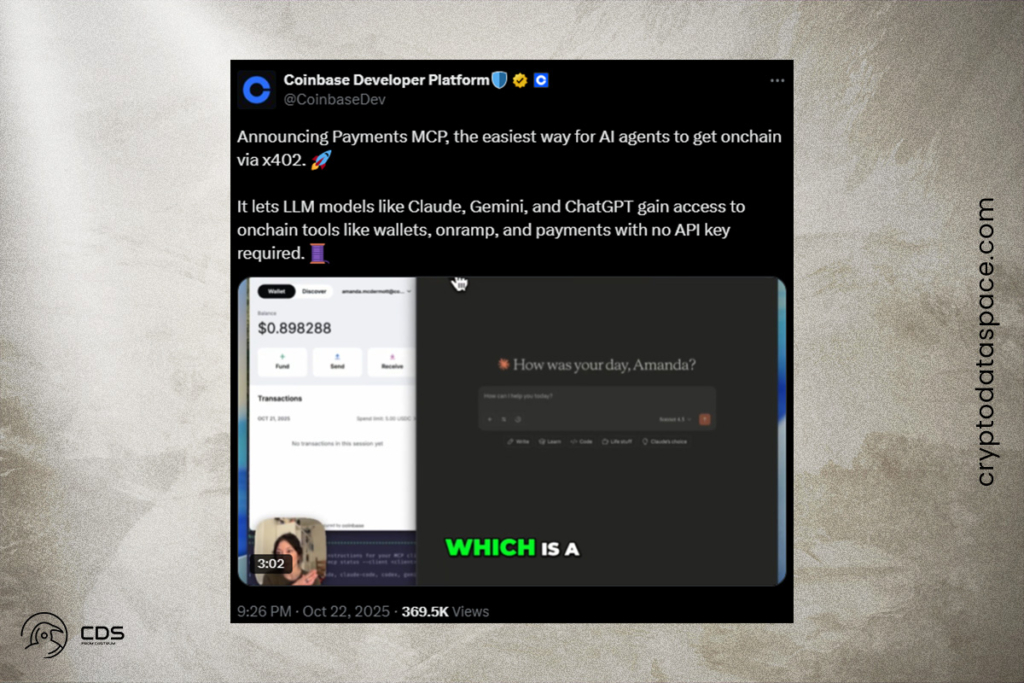

AI Agents Can Now Trade and Pay Like Humans, Thanks to Coinbase’s MCP

In the future, agentic AI is probably going to change how people utilize their cryptocurrency wallets, especially when it comes to trading and payments. In this regard, the cryptocurrency exchange Coinbase revealed Payments MCP last week, a new tool that gives AI machines access to the same on-chain financial tools that humans use. The technology allows the models to communicate with cryptocurrency wallets on their own when it is integrated with an LLM such as Claude, Gemini, or Codex. The Coinbase Developer Platform claims that this integration enables them to pay independently as well.

It marks a new phase of agentic commerce where AI agents can act in the global economy,

the Coinbase Development platform

x402 Protocol Enables Autonomous AI Wallet Management on Coinbase

The Coinbase Developer Platform claims that Payments MCP-powered AI bots are capable of carrying out a variety of financial operations using the x402 protocol. Instant stablecoin transactions are made possible by this protocol, which is an open, web-native payment system. Among these tasks are:

- Covering the cost of services and calculations

- Getting paywalled information

- Giving creators a tip

- Overseeing specific business processes

Though blockchain and AI executives point out that it can be secure, there will be additional hazards.

Using AI for Crypto Management Can Increase Vulnerabilities

According to Aaron Ratcliff, the attributions lead at blockchain intelligence company Merkle Science, granting an AI agent access to your wallet creates additional security vulnerabilities. It basically makes a system that was once intended to be trustless more trustworthy. Although Ratcliff contends that the user of the crypto ultimately bears responsibility for safety, it can be safe if the system is constructed properly.

Safe use depends on users who understand how to prompt and on the AI pulling blockchain data without hallucinating. It also depends on the trading credentials staying secure; if trading credentials leak, the damage writes itself.

Ratcliff

Ratcliff stated that if AI is incorporated into one’s portfolio, there are certain security vulnerabilities that malicious actors could exploit. Injection of prompts or instructions could enable system takeover.

The AI might also interact with scam tokens, miss honeypots or rug-pulls, or handle slippage so poorly it burns users’ funds. I’d want proof that the AI can catch front-running, apply slippage limits, spot scam tokens, and audit contracts in real time before it makes a trade. It should also sandbox prompts, prevent injection, and block man-in-the-middle access.

Ratcliff

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.