Featured News Headlines

Price Breakout Signals Major Rally Ahead

Stellar (XLM) ended its bearish trend with a strong 15.25% surge in 24 hours, reaching $0.4610. The rally brought massive trading interest, with volume jumping 292% compared to the previous day.

Technical analysis shows XLM breaking out of a bullish flag pattern and closing above local resistance. This breakout removes immediate price barriers and opens the path for further gains.

Technical Indicators Support Continued Growth

The Supertrend indicator shows a bullish signal, confirming strong buying pressure. Meanwhile, the RSI sits at 63, staying below overbought levels and suggesting room for additional upside momentum.

Based on the current pattern, XLM could see a 30% rally toward $0.60. The flag pole formation suggests even larger potential gains, with a possible 50% surge targeting $0.70.

Market Predictions Range from $0.90 to $1.59

Social media buzz has generated bold price predictions. Some traders expect XLM to reach $0.90, while others target $1.00. The most optimistic forecasts suggest $1.59 is possible.

These predictions reflect growing interest among crypto enthusiasts, though actual price movements will depend on sustained momentum and market conditions.

Trading Data Shows Strong Bull Dominance

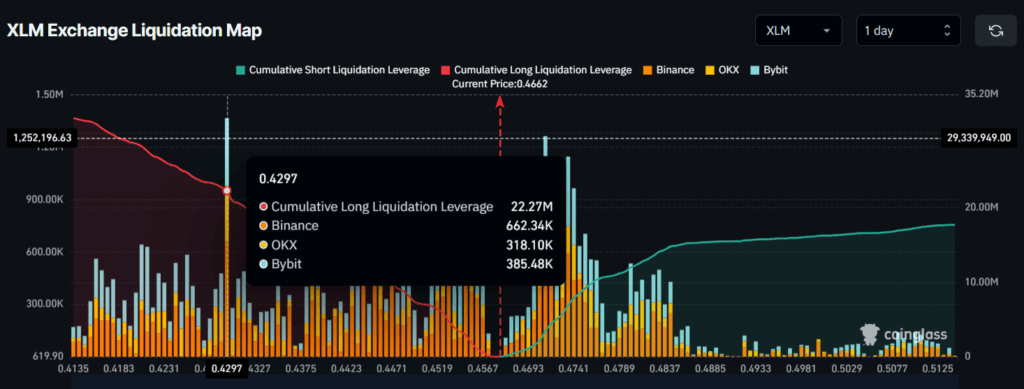

On-chain data reveals investors are accumulating XLM tokens. Current liquidation levels sit at $0.4297 and $0.4711, acting as key support and resistance zones.

Long positions total $22.27 million compared to just $3.46 million in short positions. This 6:1 ratio shows bulls clearly dominate the market.

The heavy long positioning suggests traders expect continued upward movement. If momentum continues, the $3.46 million in short positions could face liquidation, potentially fueling additional price gains.

Support holds at $0.4297, while resistance appears at $0.4711. Breaking above resistance could trigger the next leg higher toward $0.60-$0.70 targets.

The combination of technical breakout, strong volume, and bullish positioning creates favorable conditions for XLM’s continued rally.

Comments are closed.