Featured News Headlines

GENIUS Act’s Stablecoin Yield Loophole Raises Alarm Among US Banking Leaders

Several major US banking groups, led by the Bank Policy Institute (BPI), have raised concerns over a potential loophole in new stablecoin regulations under the GENIUS Act. They warn that this gap might allow stablecoin issuers and their affiliates to indirectly offer interest or yields on stablecoins, sidestepping legal restrictions.

Potential Impact on Banking System and Credit Flow

The GENIUS Act prohibits stablecoin issuers from paying interest or yields directly to token holders. However, the law does not clearly ban exchanges or affiliated businesses from doing so. This could let issuers offer yields through partners like Coinbase or Kraken, undermining the law’s intent.

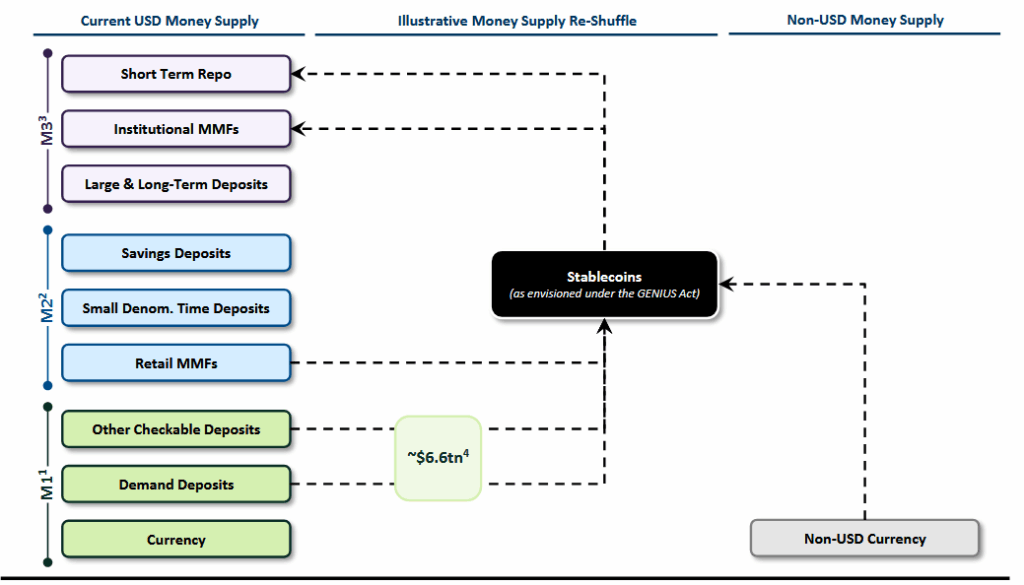

Banking groups argue that stablecoins paying yields pose a risk to the traditional banking system. Deposits are crucial for banks to fund loans, often attracted through interest-bearing savings products. If stablecoins offer similar yields, deposit outflows could surge, potentially reaching $6.6 trillion according to a US Treasury report.

Why Stablecoins Differ from Bank Deposits

The letter, signed by multiple banking associations, highlights that stablecoins are fundamentally different from bank deposits or money market funds. Unlike banks, stablecoins do not fund loans or invest in securities to generate yield. This distinction is why payment stablecoins should not pay interest or yield like traditional banks or funds.

Stablecoin Market Growth and Future Outlook

Currently, stablecoins like Tether (USDT) and USD Coin (USDC) dominate the market with values around $165 billion and $66 billion respectively. The GENIUS Act, signed into law in July, aims to support the US dollar’s dominance by promoting dollar-pegged stablecoins.

The US Treasury projects the stablecoin market could grow to $2 trillion by 2028, making these regulatory decisions critical for both crypto innovation and banking stability.

Comments are closed.