Spot Bitcoin ETFs- What History Tells Us About Price Movements

Spot Bitcoin ETFs– Bitcoin continues to dominate headlines, captivating both institutional giants and retail traders. But its wild price swings and sensitivity to global economic moves make it a thrilling yet risky ride.

Bitcoin’s Volatility: Twice the Risk, Twice the Reward?

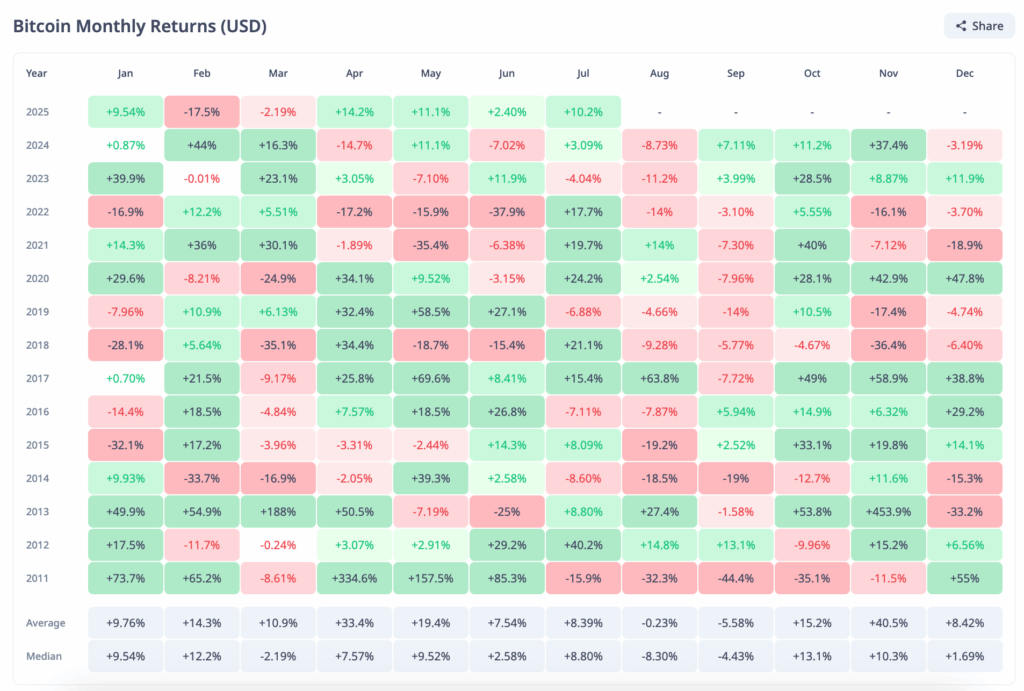

Since 2020, Bitcoin has been nearly four times more volatile than major stock indices. This extreme volatility highlights the risks but also the unique opportunities Bitcoin offers compared to traditional assets.

Despite new U.S. laws like the GENIUS Act aiming to stabilize crypto, Bitcoin remains highly reactive—especially to Federal Reserve policies. When interest rates rise to fight inflation, Bitcoin often stumbles as investors seek safer havens like government bonds. But when rate cuts loom, expect sharp rallies fueled by renewed risk appetite.

Institutional Influx: How Bitcoin ETFs Changed the Game

January 2024 marked a turning point with the launch of spot Bitcoin ETFs. Big players like BlackRock and Fidelity rushed in, making Bitcoin more accessible to traditional investors. This influx sparked a powerful cycle: rising prices attract ETF buyers, which pushes prices even higher.

Institutional involvement has transformed Bitcoin’s ecosystem—building custody services, derivatives platforms, and infrastructure that bolster market confidence. Even skeptics are turning bullish, signaling Bitcoin’s shift from speculative asset to mainstream contender.

August remains a historically challenging month for Bitcoin, often seeing sharp dips. Yet, long-term predictions stay bullish. Analysts like PlanB, creator of the stock-to-flow model, argue Bitcoin is vastly undervalued—potentially worth over $1 million. Others, like Bitwise CIO Matt Hougan, forecast Bitcoin hitting $200,000 by the end of 2025, driven by rising institutional demand.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.