Featured News Headlines

Somnia Faces Critical $1.03 Support as Traders Exit

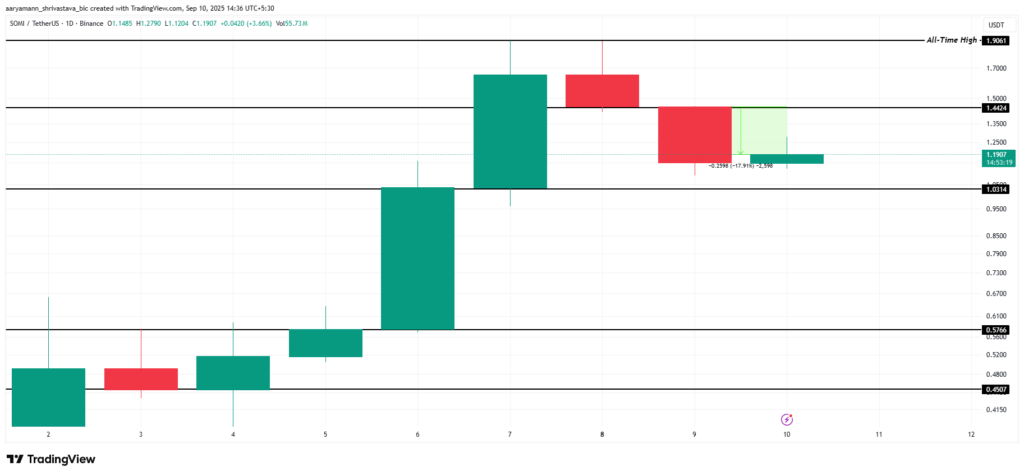

Somnia (SOMI) has seen its bullish momentum wane following a strong rally, as the altcoin experiences a significant price correction from its all-time high. Market participants are now closely watching SOMI, as the token faces potential risks of slipping below key support levels.

Traders Retreat as Open Interest Collapses

The recent downturn in SOMI is closely tied to a sharp collapse in open interest, signaling that traders are stepping back amid concerns over liquidations. Over the past 48 hours, open interest plummeted by 51%, falling from $116 million to $56 million. This steep decline reflects traders reducing risk exposure and suggests that the momentum driving SOMI to its all-time high (ATH) may have been exhausted.

The drop in open interest underscores a broader hesitancy among SOMI participants, highlighting potential vulnerabilities in the short-term price action. While derivative markets show bearish sentiment, technical indicators hint at a more nuanced picture.

RSI Signals Underlying Support

Despite the retreat in open interest, the Relative Strength Index (RSI) remains above the neutral 50.0 line, indicating that SOMI still maintains a degree of underlying support. Analysts suggest that if the RSI sustains its position above this threshold, the token could resist more severe losses.

This metric points to the possibility of SOMI stabilizing even amid bearish conditions in derivatives markets, offering hope that the altcoin may stage a recovery if broader bullish momentum persists.

Price Action and Key Support Levels

At the time of writing, SOMI trades at $1.19, down nearly 18% over the past 24 hours. The token is now testing its immediate support at $1.03, a level critical for maintaining short-term stability.

If SOMI breaks below this support, analysts warn of further downside risks, potentially pushing the token beneath $1.00 and toward $0.57. Such a decline would mark a sharp reversal from recent highs and reinforce bearish dominance in the market.

Potential Recovery Scenarios

On the flip side, if SOMI regains momentum, a rebound toward $1.44 could re-establish bullish sentiment. Flipping this level into a support zone would open the path for a climb back toward its ATH of $1.90, signaling renewed investor confidence and potentially invalidating the current bearish outlook.

The altcoin’s near-term trajectory will likely depend on a combination of market-wide momentum, trader sentiment, and technical support levels. While the risk of further losses exists, strategic buyers could see opportunities if SOMI stabilizes above critical thresholds.

What Traders Should Watch

Investors and traders are advised to monitor:

- Open Interest: Rapid changes can indicate shifts in trader confidence and potential volatility.

- RSI Levels: Sustained readings above 50.0 suggest market support and possible recovery.

- Support and Resistance: Key levels at $1.03, $1.00, $1.44, and $1.90 will determine short-term price movement.

As SOMI navigates this critical juncture, the altcoin’s path could either reinforce bearish trends or pave the way for a resilient recovery in the coming days.

Comments are closed.