Featured News Headlines

SOL Price Update: Key Whale Activity and Futures Data Explained

Solana (SOL) recently bounced back from a low of $175, climbing to a local high near $190 before settling around $187at the time of writing. This followed a sharp weekly decline of over 9%, during which SOL faced selling pressure.

Whale Activity Signals Renewed Interest

After the pullback from $191 to $175, buying interest returned, led notably by a large buyer—or whale—who purchased 60,000 SOL, worth approximately $11.23 million. This move was tracked by Onchain Lens and reflects a strong belief that current prices offer value.

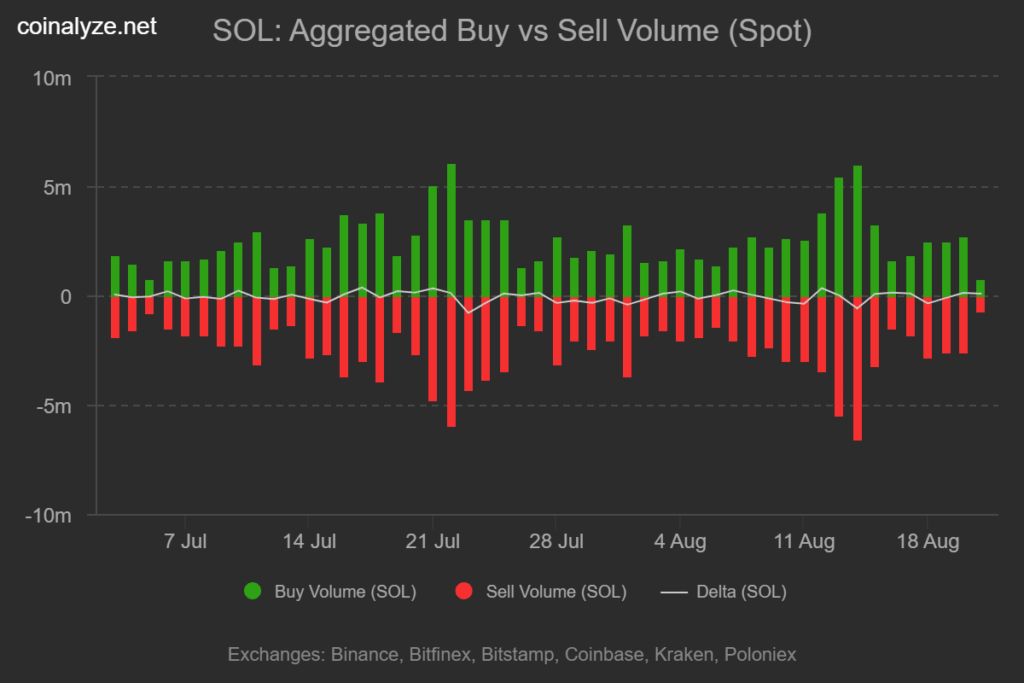

Data from Coinalyze shows Solana’s buy volume slightly outpaced sell volume, with $3.4 million in buys versus $3.2 million in sells, indicating renewed demand.

Futures Market Shows Bullish Signs

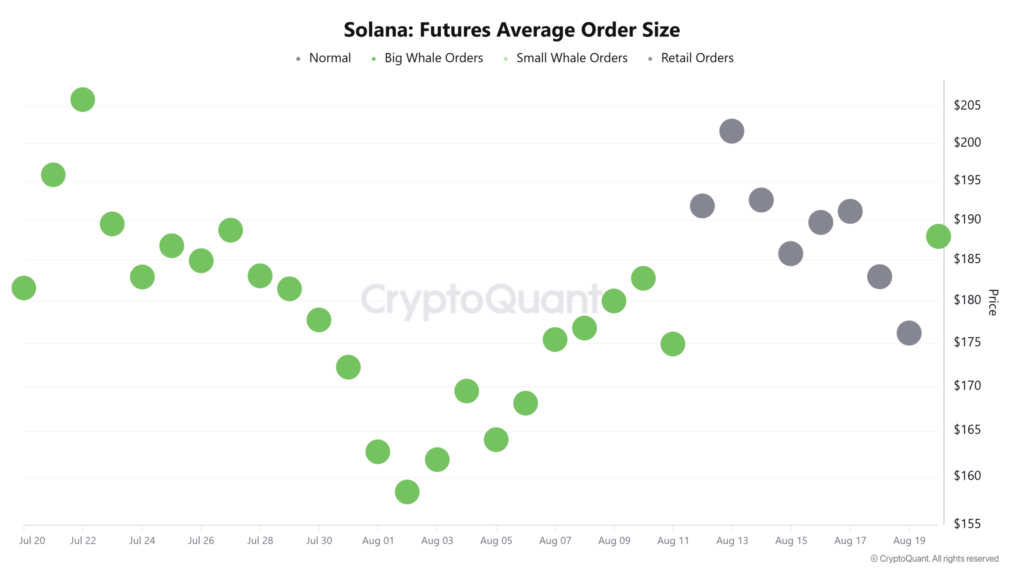

On the futures side, analysis from CryptoQuant reveals the first large whale order in seven days, suggesting strategic positioning. Solana’s Long-Short Ratio also rose to 3.38, with longs making up over 77% of futures contracts. This dominance of long positions typically indicates trader optimism for higher prices ahead.

Profit Taking Could Weigh on Momentum

Despite this optimism, some traders have taken profits. CoinGlass reports that Solana saw positive net outflows for two straight days, meaning more SOL was sold than bought. This could signal short-term downward pressure on prices.

Key Momentum Indicators at a Crossroad

Technical indicators like the Stochastic RSI and Directional Movement Index (DMI) are at critical levels. Both suggest a possible bullish crossover, which would confirm growing buying strength if realized.

To maintain upward momentum, SOL needs these indicators to confirm the shift. If they do, the path to a sustained price recovery may open.

Comments are closed.