Featured News Headlines

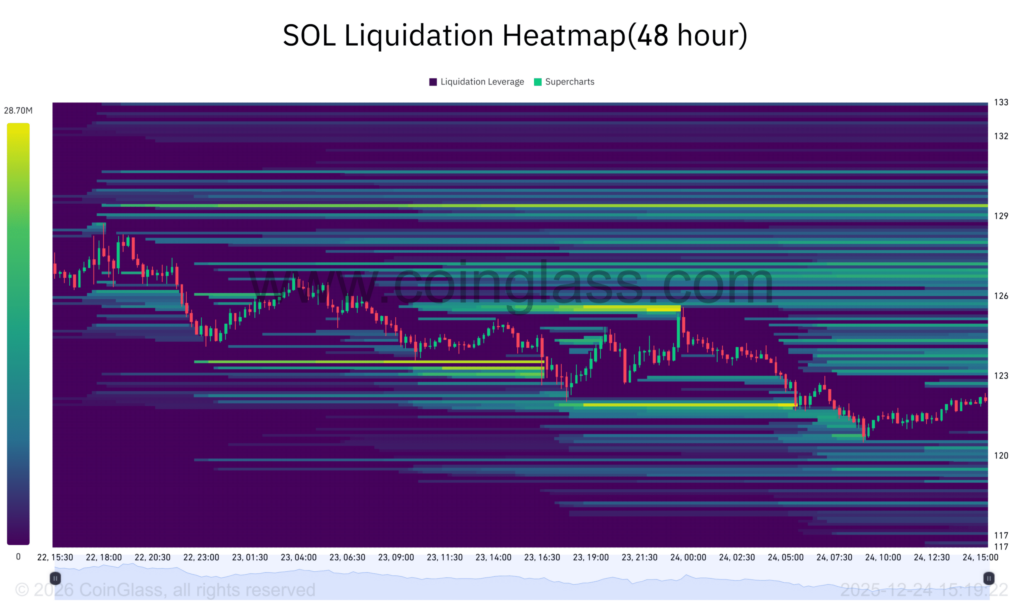

SOL Liquidity Concentrated Between $121 and $133 Levels

Solana (SOL) remained under pressure on December 24, trading below a key short-term support zone. Despite ongoing ecosystem developments, market structure reflected cautious sentiment as liquidity-driven moves largely dictated intraday direction. According to the report, repeated failures to reclaim higher levels “weakened bullish conviction and reinforced short-term downside risk.”

Price Range and Momentum Indicators

Price action over recent sessions remained largely confined within a $122–$145 range. Sellers continued to dominate as upward momentum struggled to generate sustained buying interest. Technical indicators mirrored the subdued market tone: Solana’s RSI hovered around the neutral 40 level, signaling weak momentum, while MACD stayed below the signal line, highlighting persistent bearish pressure without a clear reversal.

Whale Activity Shows Diverging Positions

On-chain data from Onchain Lens revealed a notable divergence between two prominent whale addresses with leveraged SOL positions. Whale “0x0e4” maintained a 20x long SOL position facing losses exceeding $5.78M, with additional leveraged BTC and HYPE positions pushing unrealized losses near $8.5M. In contrast, whale “0x35d” held a profitable 20x SOL short position valued at around $11M, gradually reducing it to manage profits. The same whale also held leveraged BTC and ETH positions with combined profits surpassing $27.7M.

Infrastructure Developments: Coinbase Integration

Coinbase announced support for SOL deposits and withdrawals via its Base network, enabling seamless transfers between Solana and Base without traditional third-party bridges. This allowed SOL to function as an ERC20 token within Base-native decentralized finance applications, reducing transaction friction and improving cross-chain accessibility, though availability remained limited in some jurisdictions.

The 48-hour liquidation heatmap indicated dense downside liquidity between $121 and $122, reflecting leveraged long positions susceptible to forced liquidation. Upside liquidity was concentrated near $128.5–$129.5 and secondary levels at $131.5–$133, representing stacked short positions that could influence momentum shifts. Until then, price reactions remained muted, and corrective bounces lacked strength.

Comments are closed.