SHIB Price Breaks Bullish Triangle — Is a Bigger Rally Ahead?

Shiba Inu (SHIB) has broken out of a bullish symmetrical triangle, signaling potential upside. However, conflicting on-chain indicators suggest the price direction remains uncertain — and could swing either way depending on near-term momentum shifts.

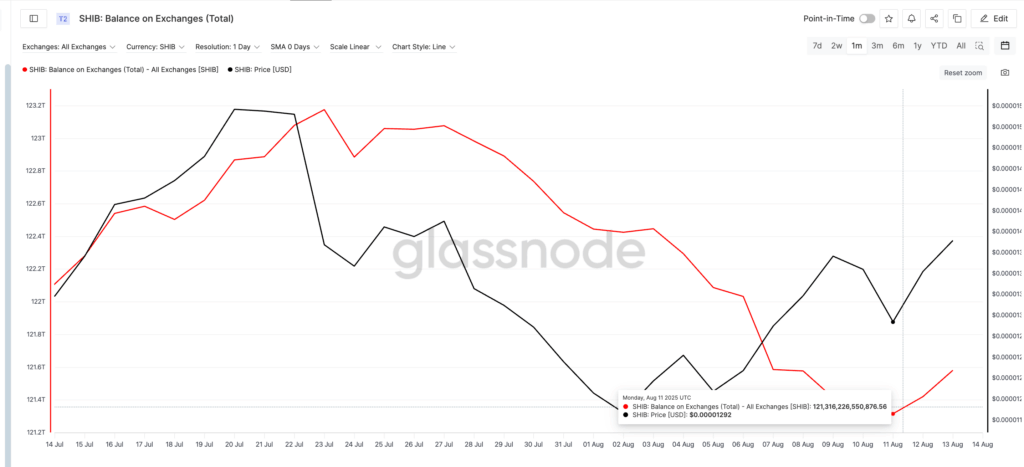

Exchange Supply Decline Signals Bullish Sentiment

One encouraging metric for bulls is the drop in SHIB’s exchange supply. Between July 31 and August 11, exchange balances fell from 122.54 trillion to 121.31 trillion tokens — a nearly 1% drop. This reduction in available supply typically lowers selling pressure and often supports continued price growth.

Notably, the price began rising shortly after the August 11 supply dip — mirroring similar moves seen on July 24 and August 6. These patterns indicate that reduced exchange balances can act as a short-term catalyst for price action.

However, since the recent price increase, exchange balances have started to rise again. Traders should watch this closely, as an uptick in available tokens could reverse the current trend.

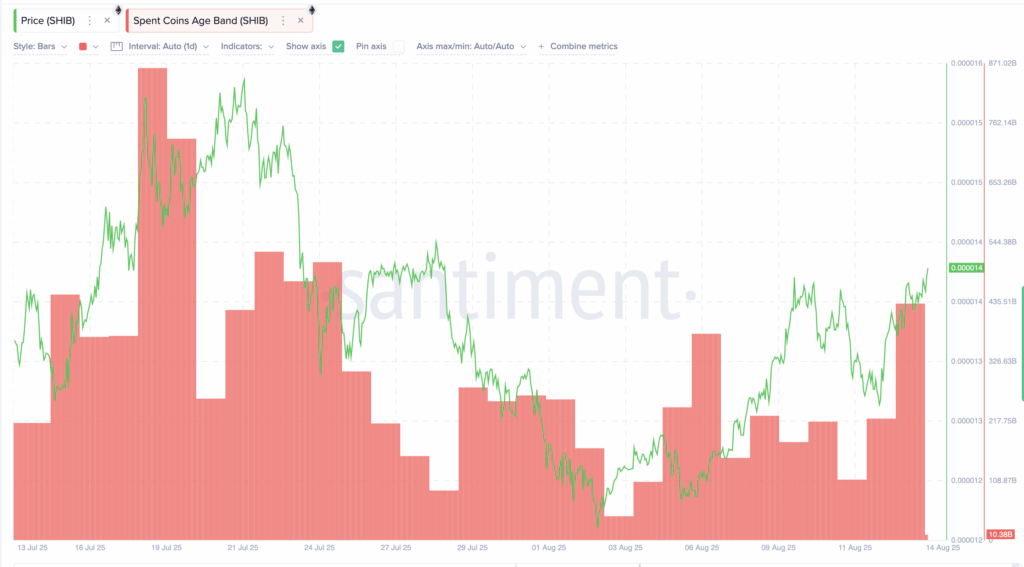

Spent Coin Age Bands Suggest Potential Profit-Taking

While lower exchange supply is bullish, the rise in the Spent Coin Age Bands metric introduces caution. This indicator tracks when older, dormant coins are moved — often signaling profit-taking by long-term holders.

After hitting multi-week lows in early August, the metric has now returned to levels last seen on July 24 — right before a SHIB correction. Historically, local highs in this metric have preceded price pullbacks.

Comments are closed.