Second-Largest Bitcoin ETF Inflow as BTC Reaches New Peaks

As Bitcoin reached a new high on Monday, U.S.-based spot Bitcoin ETFs had their second-largest day of inflows ever. On that day, a total of $1.18 billion was invested in eleven U.S.-domiciled Bitcoin spot ETFs. Since November 7, 2024, when ETFs saw an inflow of $1.37 billion after Donald Trump won the U.S. presidential election, this was the second-highest.

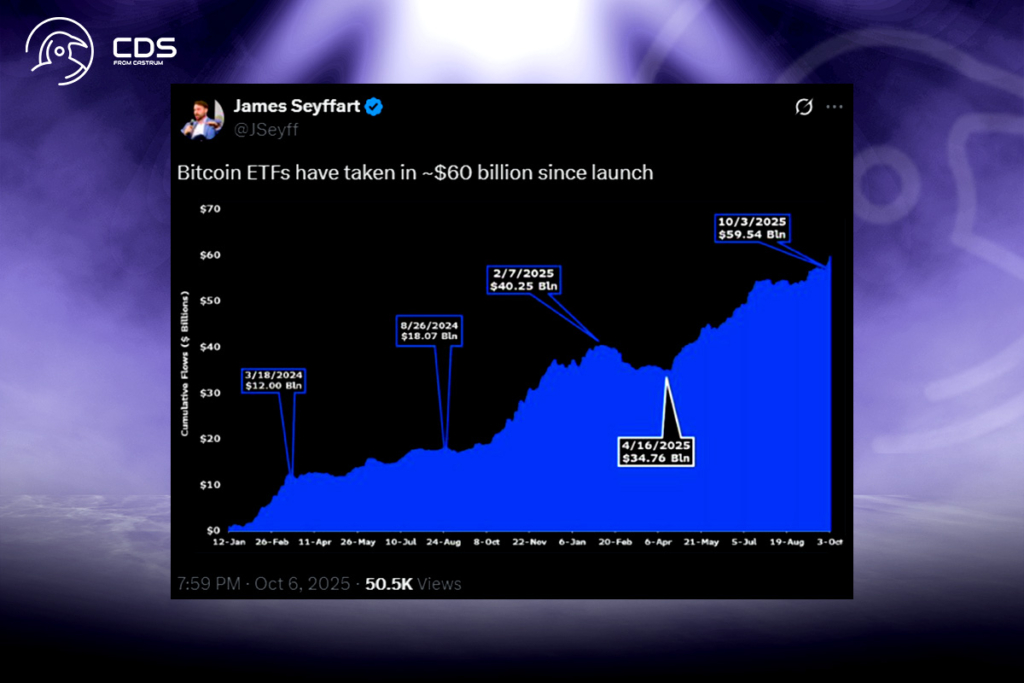

James Seyffart, an ETF analyst at Bloomberg, stated on X on Monday that Bitcoin ETFs have made almost $60 billion in total since their inception. With regular investors supposedly still staying out of the market, the enormous demand for Bitcoin ETPs highlights the institutional investors’ substantial influence in the current bull market.

Bitcoin ETF Inflows Hit Multi-Month High as BTC Reaches New Peaks

A staggering $967 million was invested in the BlackRock iShares Bitcoin Trust (IBIT) on Monday, accounting for the majority of the inflows. Since early October, the ETF has received inflows totaling $2.6 billion. An inflow of $112 million was recorded by the Fidelity Wise Origin Bitcoin Fund (FBTC), $60 million by the Bitwise Bitcoin ETF (BITB), and $30 million by the Grayscale Bitcoin Mini Trust (BTC). Franklin’s funds, Invesco, and WisdomTree all saw slight inflows.

Massive ETF Inflows Highlight Institutional Confidence in Bitcoin’s Upswing

On Tuesday, Nova Dius President Nate Geraci said that the BlackRock Bitcoin ETF is almost at $100 billion in assets under management. IBIT has 783,767 BTC and an AUM of about $98.5 billion in cash and Bitcoin, according to the official website. IBIT is on track to reach that milestone in less than 450 days, compared to more than 2,000 days for the Vanguard S&P 500 ETF, the largest ETF in the world, according to Geraci. He stated that out of the 4,500 trading ETFs, just 18 had an AUM of more than $100 billion.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.