Sanofi Q2 Disappoints, But 2025 Outlook Just Got Brighter!

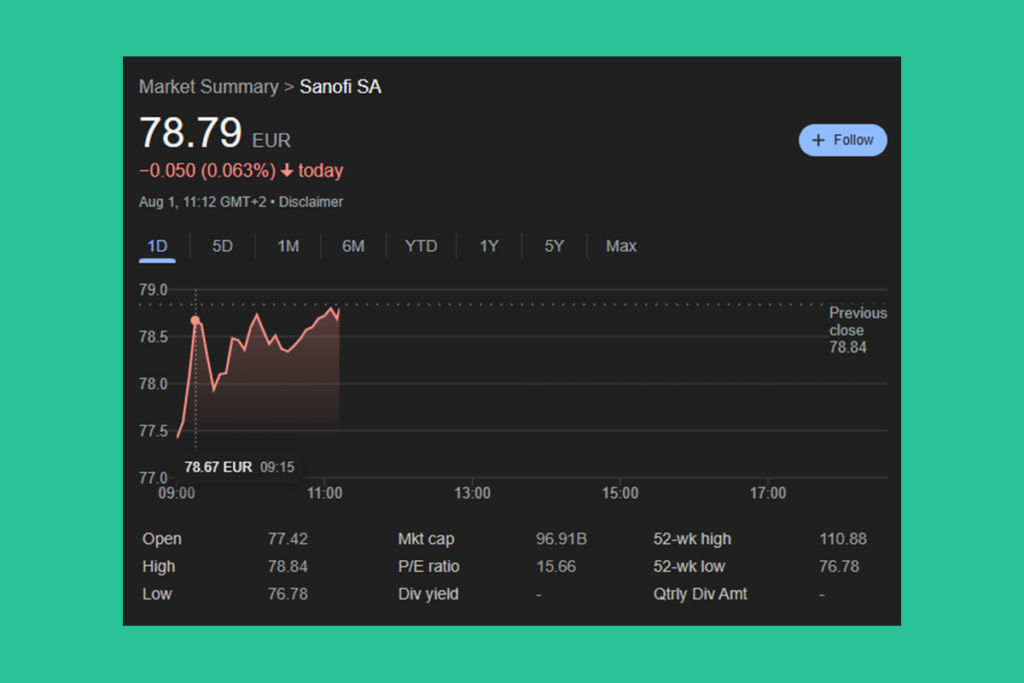

Sanofi posted mixed Q2 2025 results, exceeding its full-year 2025 top-line revenue goal while missing estimates on both profitability and sales. The stock fell in early trade as a result of investors’ negative reaction, despite the pharmaceutical giant’s continued optimism about its future trajectory. Lower-than-expected vaccine revenues and higher operating costs were the main causes of the lower-than-expected profitability. This shortcoming was somewhat mitigated, though, by the high demand for specialist care and therapies for rare diseases.

Sanofi Falls Short on Q2 Earnings & Revenue Amid Weak Vaccine Demand

Sanofi missed analyst projections of $1.32 with Q2 earnings per share (EPS) of $1.25. Revenue was €9.89 billion, which was less than the €10.05 billion that was anticipated. Seasonal variations in influenza demand and heightened competition in pediatric vaccinations caused vaccine sales to underperform.

The specialty care markets continued to increase by double digits, especially in Dupixent and rare disease treatments. However, as Sanofi continued to invest in late-stage pipeline products, R&D and marketing costs increased significantly, placing pressure on profitability.

Sanofi Lifts 2025 Revenue Growth Target Despite Q2 Setback

Sanofi increased its full-year 2025 revenue growth target to a mid-single-digit percentage despite the quarterly setback, pointing to robust progress in oncology and specialized care. The company anticipates that future growth will be driven by pipeline milestones in rare illnesses and immunology.

Analysts warn, nevertheless, that margin constraints, European pricing issues, and heightened competition may soon restrict upside. Future Phase 3 trial results and prospective regulatory clearances will be major triggers that institutional investors will be closely monitoring.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.