Bitcoin Supply Pressure Grows as ETFs Expand Access

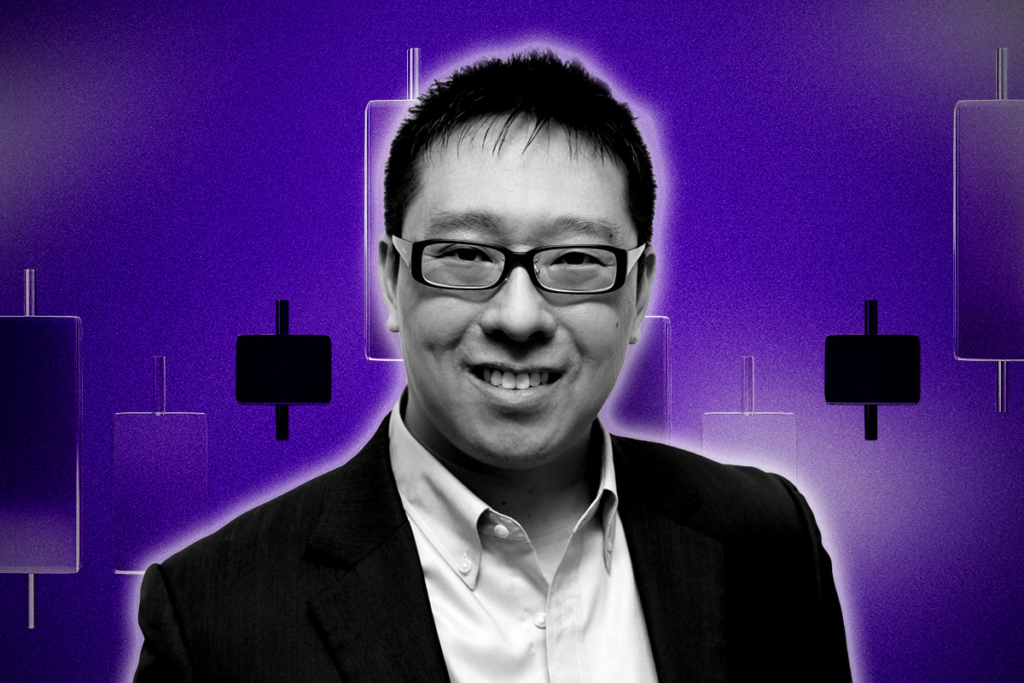

As Bitcoin trades below recent highs, one of its most vocal long-term supporters argues that the current wave of pessimism is less about fear and more about strategy. Samson Mow, widely known for promoting a long-term, high-value thesis for Bitcoin, says the market narrative has shifted into a coordinated effort to shake loose supply from weaker holders.

According to Mow, the growing number of bearish headlines is not organic. Instead, he believes the pressure is emerging at a sensitive moment in Bitcoin’s adoption curve, when access is expanding but available supply remains limited.

“Everyone wants your Bitcoin right now,” Mow has said, arguing that fear-driven commentary is intensifying precisely because Bitcoin is becoming harder to ignore in mainstream finance.

A Narrowing Price Range Draws Attention

Bitcoin recently hovered around $89,800, after failing to reclaim the $95,000 level. Since peaking above $125,000 in October, daily price action has formed a series of lower highs, compressing BTC into a tighter range between $85,000 and $93,000.

While such consolidation phases are not unusual for Bitcoin, Mow points to timing as the crucial difference. Spot Bitcoin ETFs are increasingly common in traditional portfolios, and discussions around reserve diversification are moving from theory to practice.

This creates what Mow describes as a contradiction: broader access to Bitcoin is increasing, yet market sentiment appears more anxious.

“The fear is rising just as Bitcoin’s role in the financial system becomes harder to reverse,” he noted.

Ownership, Not Price, Takes Center Stage

From a structural perspective, market observers note that a daily close above $93,700 could reopen the path toward the psychologically significant $100,000 level, while weakness below $87,400 may shift attention toward earlier congestion zones near $82,000.

However, Mow’s core argument goes beyond charts or short-term moves. As Bitcoin becomes embedded within regulated balance sheets, he argues that the critical question is not price, but availability.

“There is very little Bitcoin left outside these systems,” Mow emphasized.

In his view, that scarcity — rather than volatility — explains why demand for existing supply has become so intense.

Comments are closed.