Sacks Fires Back at NYT: He Described the Times Report as “Nothing Burger”

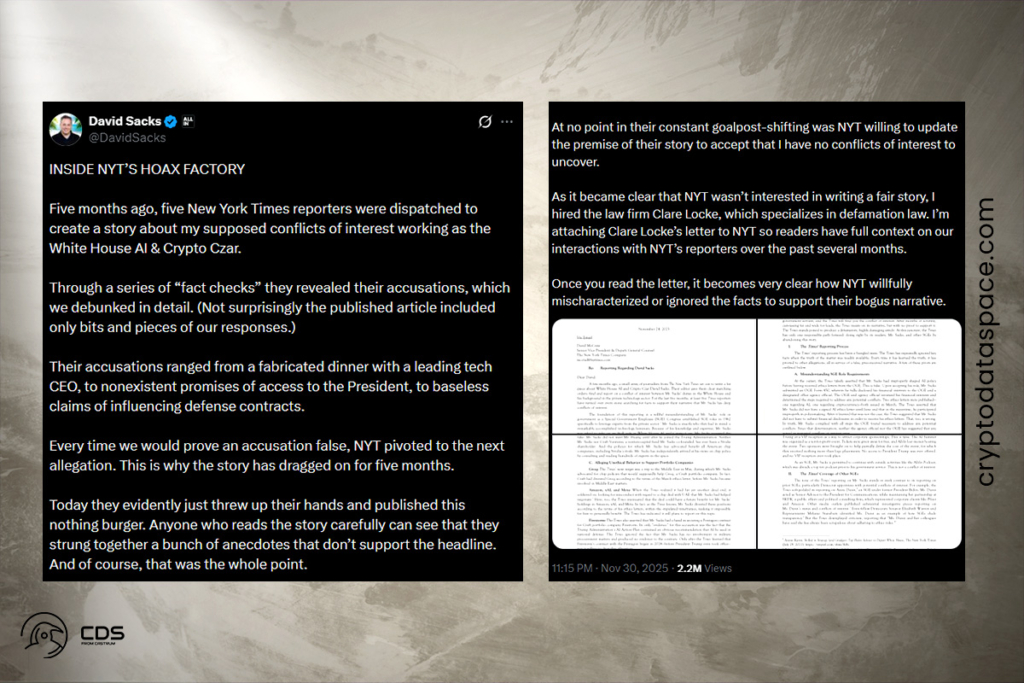

David Sacks, the White House’s AI and cryptocurrency czar, has retaliated against a New York Times story. According to the story, his position as a government adviser might help his personal and close associates’ investments. In a post on X, Sacks claimed to have thoroughly refuted the Times’ reporting during the previous five months. The story exposing his purported conflicts of interest was nonetheless published by the outlet on Sunday.

Today they evidently just threw up their hands and published this nothing burger. Anyone who reads the story carefully can see that they strung together a bunch of anecdotes that don’t support the headline.

Sacks

NYT Highlights Potential Conflicts in Sacks’ Craft Ventures Portfolio

Sacks is a partner and founding member of Craft Ventures, a venture capital firm. In the past, his position at the White House as a special government official garnered notice. Sacks and Craft liquidated more than $200 million worth of cryptocurrency and stocks associated with it before becoming the crypto czar. Sacks owned at least $85 million of this. He did, however, keep his interest in several illiquid investments, including private equity in businesses that dealt with digital assets. In May, Democratic Senator Elizabeth Warren claimed that Sacks had invested money in the cryptocurrency sector. She contended that he might be able to profit from crypto policy decisions he influences in the White House due to his investments.

According to The Times, Sacks had 708 technology investments after reviewing his financial statement. 20 of these investments involve cryptocurrencies, and 449 involve artificial intelligence. The site claims that all of these ventures might profit from the laws that Sacks openly backs. The outlet cited Craft Ventures’ investment in BitGo, a cryptocurrency infrastructure business, as one instance of a possible conflict in Sacks’ position. In September, BitGo submitted an application to go public. Craft owns 7.8% of the business, according to regulatory filings.

The Times reported that Sacks was a strong supporter of the GENIUS Act, which was passed into law earlier this year and regulates stablecoins. This would increase the coins’ use and adoption by institutions, according to many cryptocurrency observers. The Times also mentioned Sacks and Craft’s connections to AI-related businesses. The value of these businesses has increased dramatically as a result of Wall Street and the White House placing bets on the technology’s potential.

Sacks Blasts NYT Over Alleged Misrepresentation

Sacks included a letter from his Clare Locke lawyers to The Times in his X post, accusing the publication of trying to produce an attack article. Additionally, the letter asserted that the reporters had explicit instructions to identify conflicts of interest. Sacks went on to say that it was evident how the NYT deliberately misrepresented or disregarded the facts in order to bolster their false narrative. Jessica Hoffman, Sacks’s spokesperson, informed the Times that Sacks abides by the regulations that apply to private government workers. Sacks is also required to divest his assets in some companies but not in others, according to the Office of Government Ethics.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.