Featured News Headlines

Reliance Industries Posts Record Q1 Profit of ₹26,994 Crore – What This Means for Investors

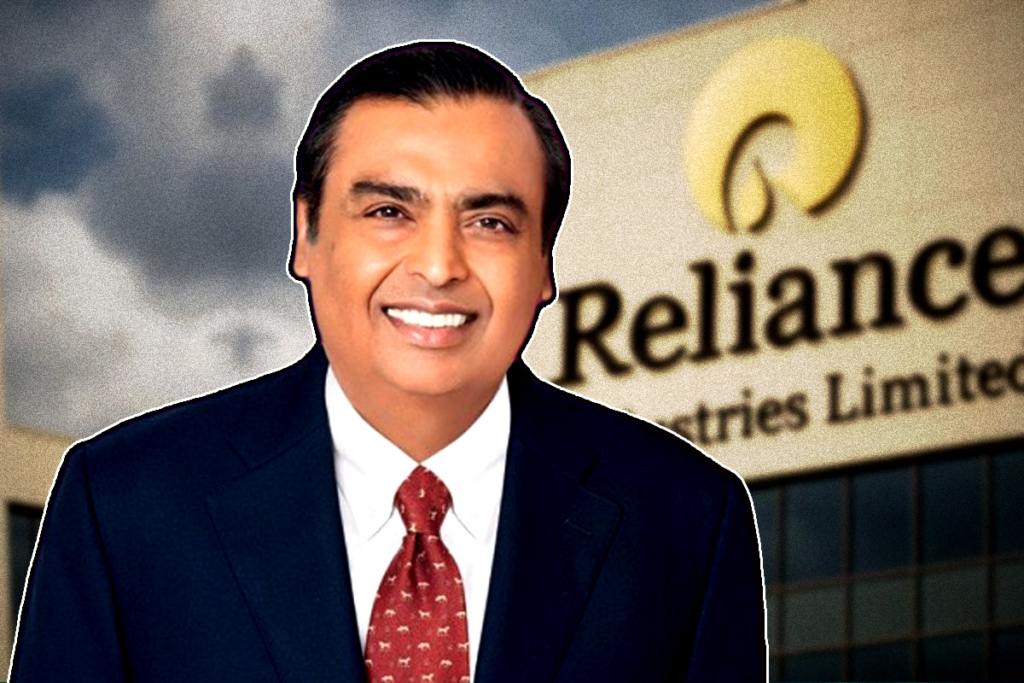

Shares of Reliance Industries (RIL) slipped up to 2.39% to ₹1,440.60 on the NSE on Monday, July 21, despite the company reporting a blockbuster first-quarter performance for FY26. The Mukesh Ambani-led conglomerate, India’s most valuable company, posted a net profit of ₹26,994 crore, marking a staggering 78% jump compared to ₹15,138 crore in the same period last year.

The surge in profits was primarily fueled by a remarkable rise in other income, which soared 280% to ₹15,119 crore, largely thanks to gains from strategic stake sales, including multiple tranches of Asian Paints shares.

Stellar Revenue Growth and Operational Performance

Reliance Industries’ total revenue from operations grew 5% year-on-year to ₹2,48,660 crore. Operationally, the company also saw robust improvements, with EBITDA rising nearly 11% to ₹42,905 crore, while the operating profit margin expanded to 17.25% from 16.41% last year.

The company’s telecom arm, Jio Platforms, reported a net profit of ₹7,110 crore, up 25% YoY, while revenue climbed 19% to ₹41,054 crore. Jio’s EBITDA jumped 24% to ₹18,135 crore, with ARPU increasing 15% to ₹208.8 per user per month, signaling continued strength in the telecom business.

Reliance Retail: Steady Growth Amid Expansion

Reliance Retail Ventures, the company’s retail arm, delivered steady growth in Q1. Net profit rose 28% to ₹3,271 crore, revenue advanced 11% to ₹84,171 crore, and EBITDA climbed 13% to ₹6,381 crore, with margins expanding slightly to 8.7%.

During the quarter, Reliance Retail aggressively expanded its footprint, opening 388 new stores, bringing the total store count to 19,592 with an operational area of 77.6 million square feet. The registered customer base now stands at 358 million, highlighting the scale of the retail business.

Analysts’ Take: One-Off Gains and Sector Performance

Post-Q1 results, analysts remain cautiously optimistic. Most note that the retail revenue fell short of expectations, while the profit spike was largely driven by a one-time gain from the Asian Paints stake sale.

- Macquarie Analysts highlighted Jio’s robust performance but noted retail growth lagged. They pointed out that Q1 earnings beat estimates primarily due to one-off investment gains, while the O2C segment shows gradual recovery. They cautioned that the share price could see near-term moderation.

- Morgan Stanley echoed concerns about retail revenue and fuel refining misses. However, they praised Reliance’s telecom business, new energy ventures, and balance sheet strength, while also highlighting the need to monitor the impact of new European sanctions on Russian oil.

- JP Morgan Analysts noted better telecom margins and progress in the New Energy business as key positives. They observed that retail growth decelerated to 11% YoY, while O2C EBITDA underperformed. Nevertheless, they remain bullish on RIL’s PAT growth potential in FY26/27.

European Sanctions on Russian Oil: Potential Implications

Recent EU sanctions on Russian oil could have broader market implications. The EU imposed new banking restrictions and curbs on Russian crude-derived fuels, while lowering the oil price cap to $60 per barrel. India, as the second-largest importer of Russian oil, could benefit from reduced prices, with Russian crude accounting for nearly 40% of total imports.

Notably, Rosneft owns 49.13% of Nayara Energy Ltd, which operates a 20 million-tonne refinery in Vadinar, Gujarat, and over 6,750 petrol pumps. Reports suggest early talks between Rosneft and Reliance Industries regarding the sale of this stake could further influence the market.

The Big Picture: Strategic Growth Amid Challenges

Reliance Industries’ Q1 performance reflects a well-diversified portfolio. Strong gains from telecom and new energy businesses, along with strategic stake sales, offset slower-than-expected retail growth. While near-term challenges include sanctions on Russian oil and market volatility, the company remains strategically positioned for growth.

With robust operational metrics and continued expansion across retail, telecom, and energy segments, RIL continues to be a key player in India’s corporate landscape, navigating geopolitical risks while maintaining investor confidence.

Comments are closed.