AERO Price Soars Before Crashing Back: Is the Rally Already Over?

In the past day, Aerodrome Finance (AERO) has increased by 8.5% as liquidity inflows have reached a significant peak. Together, spot investors, derivatives, and smart money invested more than $16 million in the asset. Even while it could be excellent news, AMBCrypto’s analysis suggests that there might be a significant obstacle in the way. So much so that AERO fell as quickly as it rose, dropping 8.77% to $1.31 at the time of writing

AERO Records Explosive Growth Across Spot and Derivatives

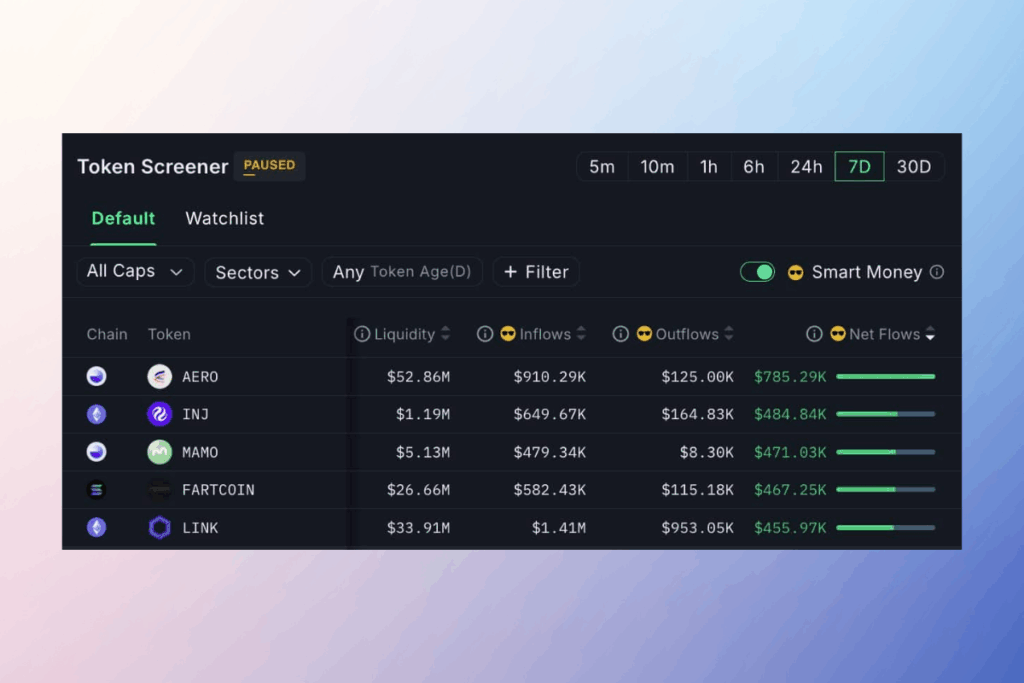

In actuality, AERO was the most bought token for the previous seven days, according to Nansen. Together, they purchased $785,000 worth of AERO, and at the time of reporting, the market’s greatest amount of accessible liquidity was $52 million.

The biggest inflows into AERO have also occurred in the derivatives market. Derivative investors contributed more than $16 million in the past day alone. As a result, open interest increased by 16% to just over $100 million. The OI-weighted funding rate increased to 0.0184% at the same time as this spike.

Strong activity was also evident in the spot market. Investors prefer private wallets for long-term holding, with netflows on spot exchanges over the last 48 hours hovering just over $1 million, according to Coinglass.

Fibonacci Retracement Signals Key Barrier for AERO

However, AERO still faces a significant resistance level in the future despite optimistic inflows. The Fibonacci retracement line indicates this obstacle. Analysis also showed that even if AERO breaks through its $1.47 press time ceiling, there are still other resistance levels around. In the end, market momentum will determine AERO’s next course of action. A possible breakthrough rally would be confirmed by a spike in volume.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.