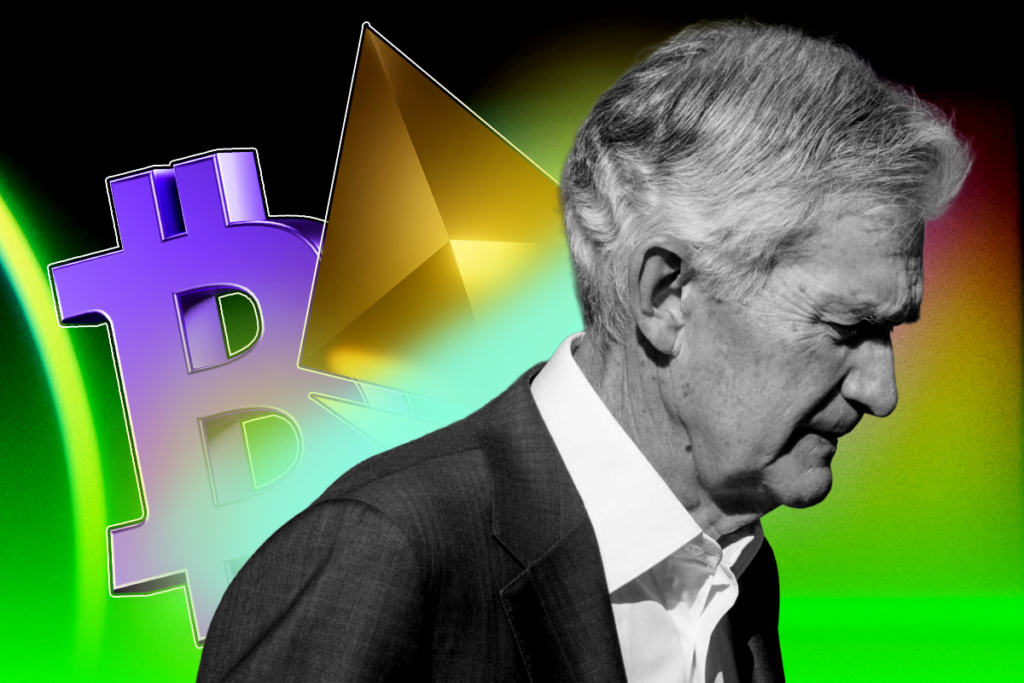

Powell Ignites Bitcoin and Ethereum: Fed Hints at Rate Cuts

After Federal Reserve Chairman Jerome Powell did not rule out a rate cut at Jackson Hole, Wyoming, on Friday, the price of Bitcoin and other cryptocurrencies increased. According to CoinGecko, within 15 minutes of Powell’s speech beginning, Ethereum rose to $4,600 from $4,300, an over 7% increase, and Bitcoin soared to $114,700 from $112,000, a nearly 2.5% gain. Over the past week, both cryptocurrencies have continued to decline by 2.9% and 1.4%, respectively.

Federal Reserve May Adjust Policy in September, Powell Suggests

Powell remained adamant that the central bank is more vulnerable to inflation than the labor sector. However, he said that if the central bank’s dual mandate of full employment and stable prices clashes, it is ready to change its course. Powell noted that the central bank is not on a predetermined path, but that the baseline outlook and the changing risk balance can call for a change in the policy stance. This suggested that at its September meeting, the central bank may cut interest rates. Powell cautioned, however, that economic data had not yet fully reflected inflation brought on by Trump’s tariffs, and that this situation may last for months.

It will continue to take more time for tariff increases to work their way through supply chains and distribution networks. Come what may, we will not allow a one-time increase in the price level to become an ongoing inflation problem.

Powell

Bitwise Strategist: Powell Likely to Focus on Tariffs and Sticky Inflation

According to analysts, earlier this week, Bitcoin and other cryptocurrencies were declining in anticipation of Powell’s eighth and last address as Fed head in Jackson Hole. They warned that cautiously hawkish comments could let investors down, as markets were poised for softening in September. Juan Leon, Senior Investment Strategist at Bitwise, stated on Thursday that he anticipated Powell would concentrate on trade concerns and sticky inflation. Additionally, he projected that Powell would refrain from making any prior commitments to a rate cut in September, which might result in a stronger tone of pressure on riskier assets.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.