PayPal Crypto Revolution Begins: Here’s What Merchants Need to Know

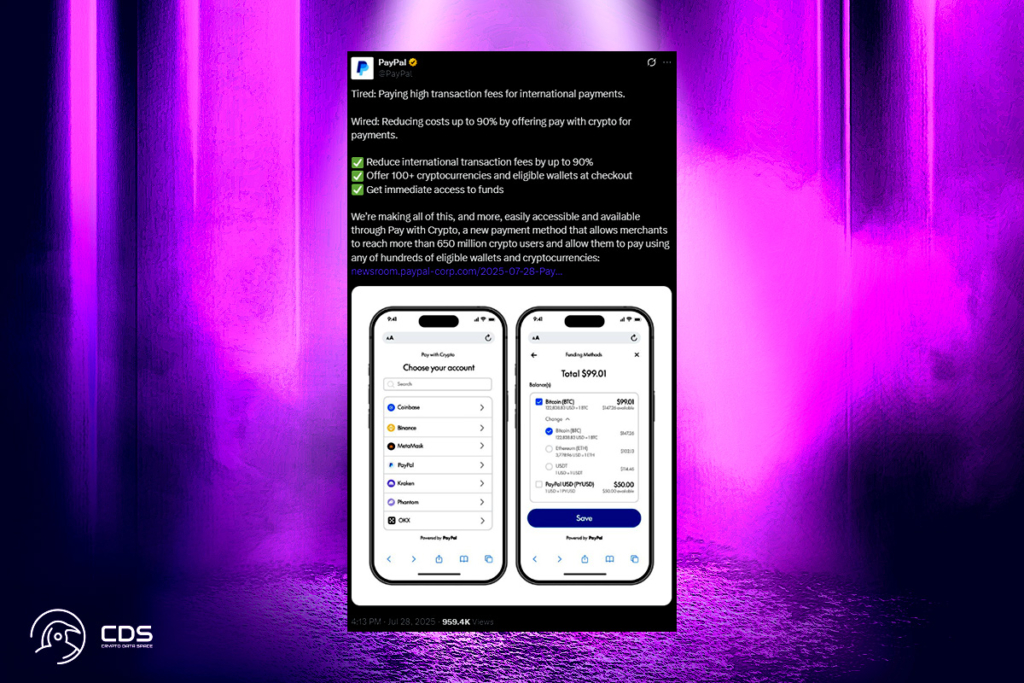

Targeting international transactions and increasing the usefulness of its own stablecoin, payments provider PayPal is about to introduce a new tool that will allow US merchants to accept payments using more than 100 cryptocurrencies. Businesses will be able to accept a variety of payment methods, including Bitcoin, Ether, Solana, USDt, USD Coin, and XRP, according to a Monday announcement. Coinbase Wallet, MetaMask, OKX, Kraken, Binance, Phantom, and Exodus are among the cryptocurrency wallets that the tool interfaces with.

At checkout, cryptocurrency payments will be immediately converted to either fiat money or PayPal‘s stablecoin, PYUSD. As a result, businesses may accept cryptocurrency payments without worrying about price fluctuations. Moreover, PayPal states that the 0.99% transaction fee it charges businesses for cryptocurrency payments is 90% less than the standard credit card processing fees. According to PayPal, cross-border transactions can be costly and difficult for small and medium-sized enterprises. This function attempts to make them easier.

Stablecoin Wars: PYUSD Surges While Stripe Expands USDC Access in 70 Countries

CoinGecko statistics show that the market value of the PYUSD has increased by about 80% since January 1st, from $497 million to $894 million. As rivals like Stripe are introducing new functionality for international cryptocurrency payments, it is also arriving.

Users in 70 countries adopted Stripe‘s stablecoin payment option for USD Coin on its first day of availability in October 2024. The fintech business joined forces with Coinbase in June to incorporate fiat-to-crypto services on both platforms. Stripe integrated its fiat on-ramp into Coinbase Wallet, while Stripe expanded support for Coinbase’s Base network.

PayPal Expands Crypto Services After GENIUS Act Approval

The new functionality from PayPal comes after the GENIUS Act was recently passed. The law offers businesses like PayPal a controlled opportunity to increase the range of services they offer and include stablecoins in their payment systems. Globally, small businesses are also becoming more receptive to cryptocurrency payments. Because of its speed and reduced costs, industries such as food and beverage, retail, travel, e-commerce, and even real estate have resorted to accepting cryptocurrency payments.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.