Featured News Headlines

Pantera Capital Bets Big: $300M Investment Strategy Focuses on Digital Asset Treasury Companies

Pantera Capital has made waves in the digital asset space by deploying over $300 million into crypto treasury companies, signaling a major shift in institutional investment strategies. The firm believes these specialized companies will outperform traditional crypto ETFs through innovative yield-generation mechanisms.

Strategic Advantage Over Traditional Holdings

According to Cosmo Jiang, Pantera’s general partner, and content head Erik Lowe, digital asset treasuries (DATs) offer superior returns compared to simply holding cryptocurrencies directly. These companies can “generate yield to grow net asset value per share,” resulting in increased token ownership over time.

The investment strategy targets companies across the United States, United Kingdom, and Israel that maintain substantial holdings in major cryptocurrencies including Bitcoin ($119,451), Ethereum ($4,628), Solana ($196.02), and various altcoins.

BitMine Emerges as Star Example

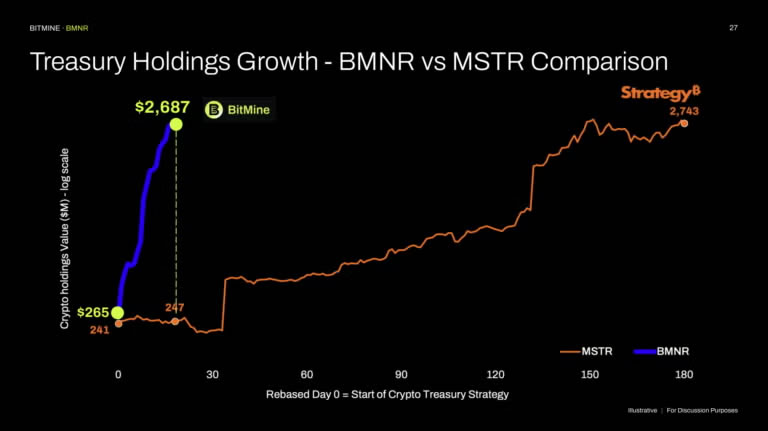

BitMine Immersion Technologies, led by Tom Lee, has become Pantera’s flagship investment from their DAT Fund. In just two and a half months, BitMine transformed into the largest Ethereum treasury company globally and ranks third among all public companies for crypto holdings.

The company currently holds nearly 1.2 million ETH, valued at approximately $5.3 billion, with ambitious plans to acquire 5% of Ethereum’s total supply. BitMine’s stock has skyrocketed over 1,300% since launching its ETH acquisition strategy in late June, dramatically outpacing Ethereum’s 90% gain during the same period.

Market Risks and Warnings

Despite the impressive performance, industry experts remain cautious. Ethereum co-founder Vitalik Buterin has warned about potential overleveraging risks, while Standard Chartered analysts previously flagged concerns about treasury companies facing difficulties during sharp price declines.

The crypto treasury trend has attracted backing from traditional finance heavyweights including Stan Druckenmiller, Bill Miller, and ARK Invest, suggesting growing institutional confidence in this emerging investment model.

Comments are closed.