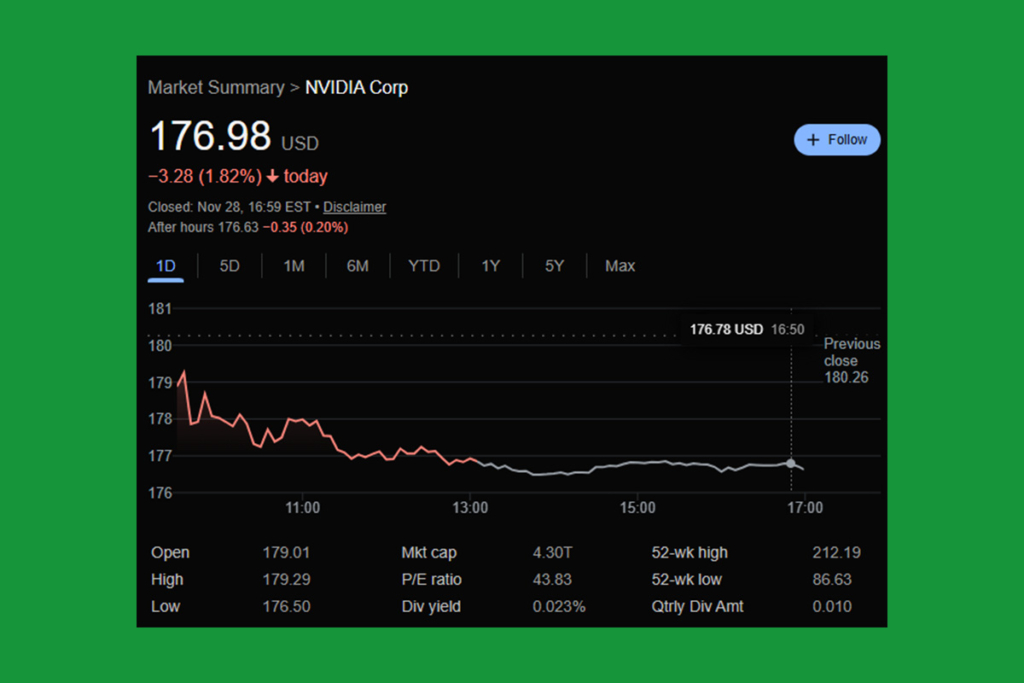

Nvidia Dips in November: Is This a Buying Opportunity for AI Investors?

After months of sharp increases, Nvidia’s stock dropped considerably in November. Profits were locked in by investors, and the whole tech market stalled. However, analysts argue that this decline is only transitory. Wall Street anticipates that Nvidia will pick up steam as new cycles of demand for AI emerge. The company’s product pipeline continues to be among the strongest in the industry, and it continues to dominate the GPU market.

Nvidia GPUs Still in High Demand Despite Short-Term Stock Drop

Weakening fundamentals were not the source of Nvidia’s November decline. AI accelerators are still hard to come by. GPU purchases are still rising from major cloud providers. Workloads are being moved to AI-native platforms by businesses. Performance benchmarks are anticipated to be reset by the company’s 2025 H200 and Blackwell architecture releases. These new processors might drive the next big wave of data center upgrades, according to analysts. This puts Nvidia in a position to protect its market share despite increased competition.

High Demand and Premium Pricing Keep Nvidia Margins Strong

The majority of analysts are still optimistic despite the pullback. Nvidia‘s price goals are still trending upward. Long-term contracts for AI infrastructure have resulted in exceptionally high revenue visibility for 2025 and 2026. Additionally, investors anticipate excellent margins. Strong demand for networking hardware, growing software revenue, and premium pricing all help Nvidia. Even if macroeconomic conditions tighten, these variables could prolong earnings growth. Wall Street thinks there might be a chance to purchase after the November decline. Before increasing their exposure, many funds are waiting for stability.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.