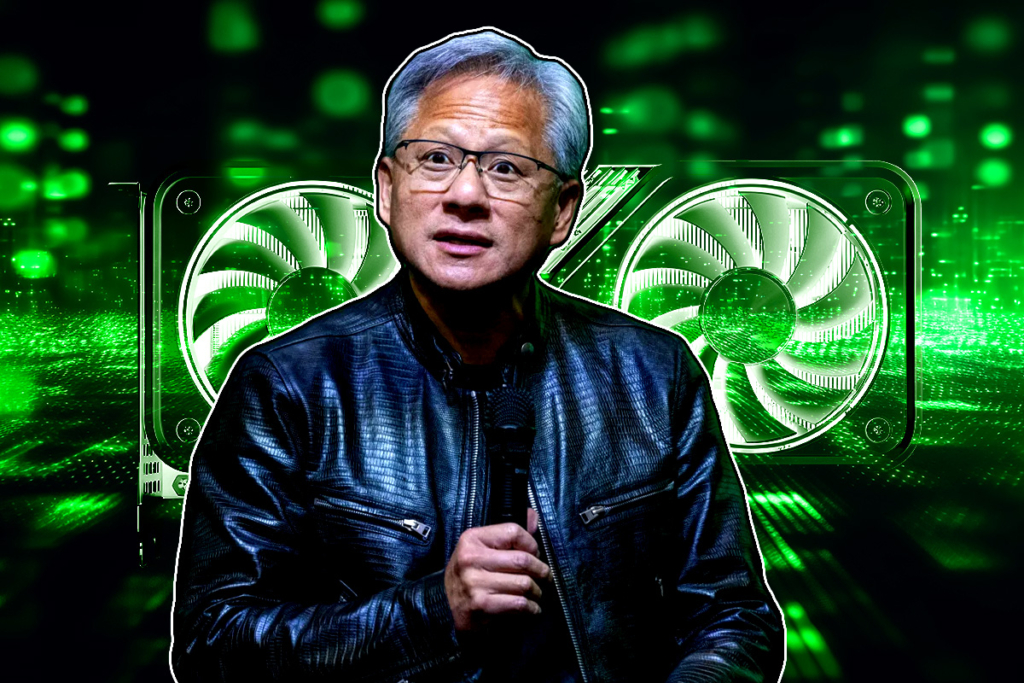

Nvidia CEO Quietly Dumps Nvidia Shares: Is This a Warning Sign?

Jensen Huang, the CEO of Nvidia, made around $152 million by cashing in over a million shares at peak prices, and he still has more than five million shares to sell. Huang’s Rule 10b5-1 plan has been quietly dumping shares at about $161.91 a share since mid-June. On the other hand, Nvidia recently reached another new high at $165.69.

Profit-Taking or Panic? The Truth Behind Nvidia’s Insider Selling

It’s hardly panic selling, though. The diversification and tax planning are normal. Through year-end, he has set a restriction on total sales at six million shares, ensuring consistent, predictable selling rather than a sudden market surge.

Insider selling always causes a stir, but Nvidia‘s AI and GPU momentum is the main news. It’s not worth reading too much into these anticipated sales as long as the outcomes remain positive. This appears to be harmless profit-taking for the time being.

Nvidia’s AI Dominance Remains Unshaken Despite CEO’s Share Sales

Nvidia’s key business principles are still strong and unaffected by the media attention surrounding Huang’s share sales. With record-breaking demand driving both revenue and innovation, the business maintains its dominance in the AI and GPU markets. The insider deals are unlikely to shake investor trust as long as Nvidia keeps up its rapid expansion and produces outstanding financial outcomes. Instead of short-term insider movements, long-term shareholders should continue to focus on Nvidia’s leadership in the AI revolution.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.