HYPE Token Unlock Analysis: Is a Price Correction Coming?

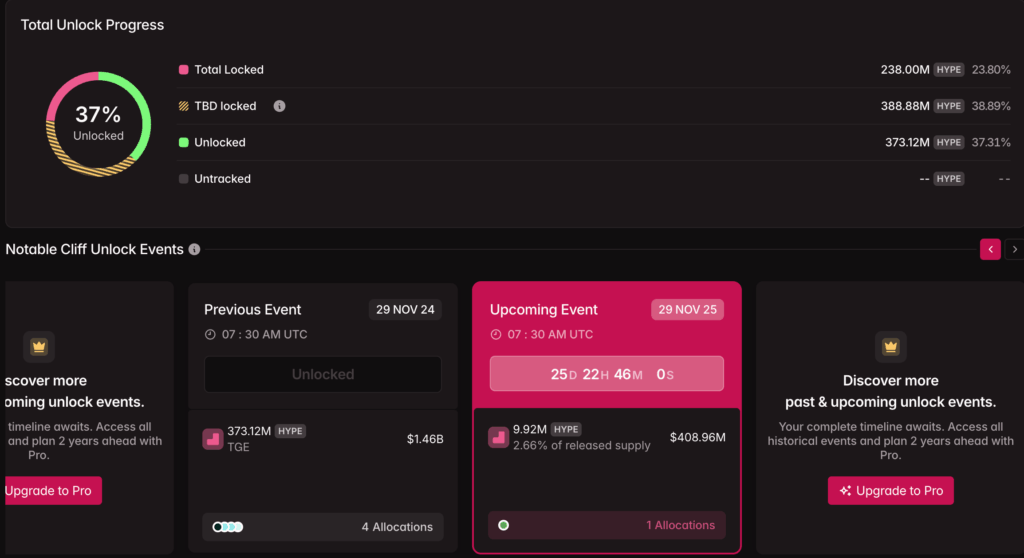

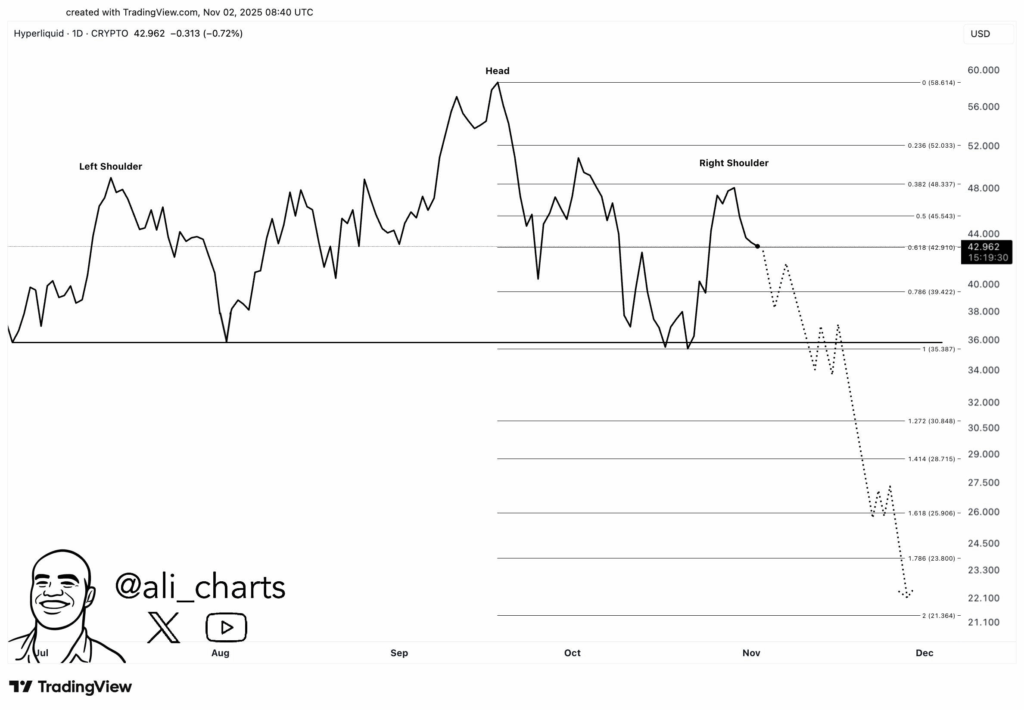

In November, millions of Hyperliquid (HYPE) tokens are set to be unlocked, accounting for roughly 2.66% of the circulating supply. Historically, large token releases create temporary sell pressure and dilution risks, as investors may offload part of their holdings. From a technical perspective, several analysts point to a possible head-and-shoulders pattern forming on HYPE’s daily chart—an indicator that could signal a short-term pullback toward $20 if confirmed.

Market observers have also noticed signs of controlled selling activity. One trader commented that recent price action shows “some TWAP out, slow efficient selling,” suggesting that large holders may be offloading strategically. The trader added, “Not sure what’s going on but going to just wait for more clarity.”

At the same time, some traders view the volatility as a potential opportunity. According to Route2FI, “HYPE closing a 1-minute candle around $40 in November could turn into a temporary yield farm.” This remark highlights speculative short-term strategies, though such approaches carry high risk and are generally best left to experienced market participants.

Strong On-Chain Fundamentals

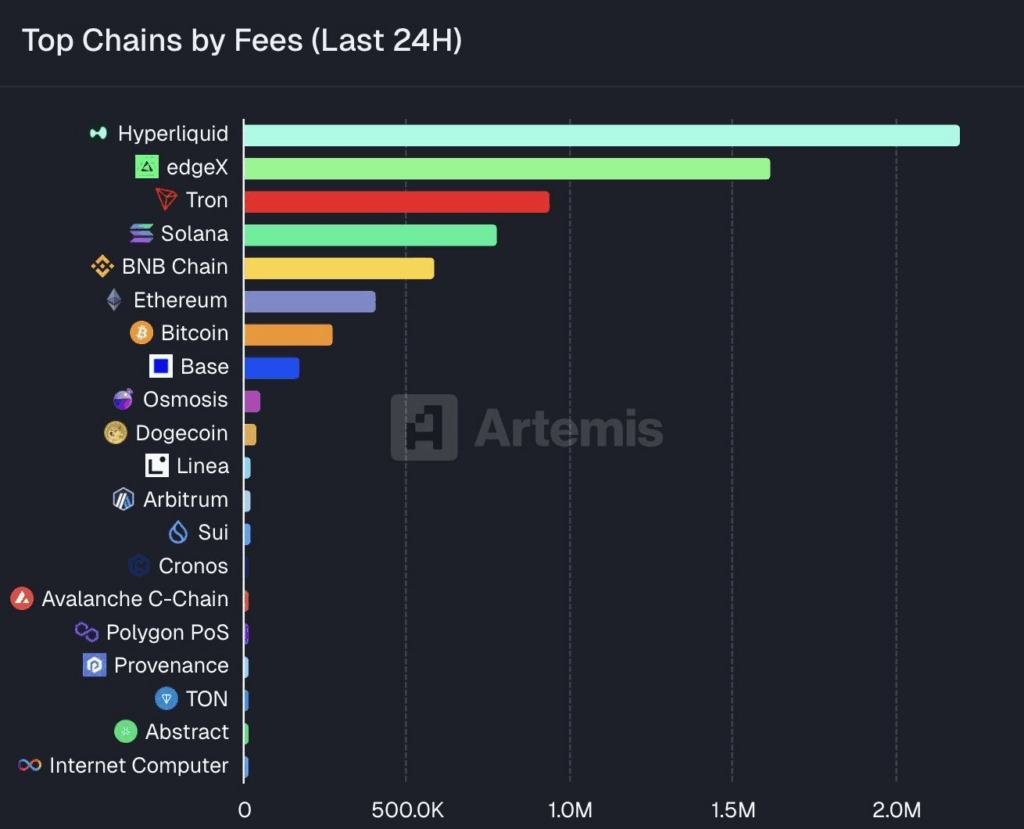

Despite short-term concerns, Hyperliquid continues to demonstrate exceptional on-chain revenue performance. Data from Artemis revealed that in the past 24 hours alone, the project generated over $2.2 million in trading fees, surpassing every other blockchain. Earlier reports also indicated that Hyperliquid captured nearly 33% of total blockchain revenue, positioning it as one of the most profitable decentralized exchanges in DeFi.

If the project allocates part of its fee income toward buybacks, burns, or liquidity initiatives, it could help offset selling pressure from the upcoming unlock. In the long run, HYPE’s true strength will depend on how effectively the team transforms these revenues into tangible value for holders. The November unlock, therefore, is less a threat and more a key test of Hyperliquid’s sustainable profitability within the evolving DeFi landscape.

Comments are closed.