Revolution in Finance: Binance’s White-Label Solution for Stock Exchanges

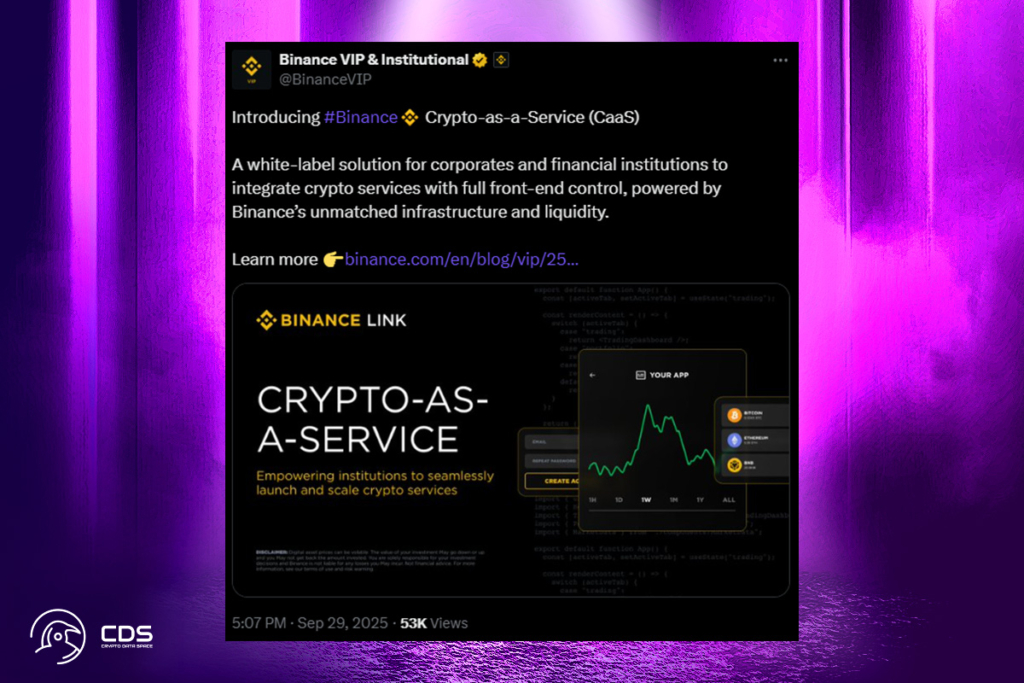

For licensed banks, brokerages, and stock exchanges wishing to provide crypto services to their customers, Binance is introducing its own crypto-as-a-service option. These TradFi institutions will be able to access Binance’s spot and futures markets, liquidity pools, custody solutions, and compliance tools through the white-label solution. This will enable them to do so without having to start from scratch with their own infrastructure, Binance said on Monday.

Institutions retain full control of the front end — their brand, client relationships, and user experience — while Binance powers the back end: supporting trading, liquidity, custody, compliance, and settlement.

Binance

Binance Targets TradFi With New Service Rollout

Binance stated that there has never been a greater demand from clients for digital assets. Offering crypto access is now required for TradFi institutions, according to the exchange. A crypto-as-a-service solution was also introduced by Coinbase, one of Binance’s main rivals, in June. With a broader deployment scheduled for the fourth quarter, a limited number of institutions will have access to Binance’s new service starting on Tuesday.

Major TradFi firms and publicly traded companies are rapidly investing in cryptocurrencies, especially in the US. This is because Wall Street now feels confident enough to invest in this asset class as a result of the Trump administration’s crypto-friendly regulatory initiatives. Clients already have access to cryptocurrency exposure through equities in crypto treasury firms and spot crypto exchange-traded funds offered by numerous banks and stock exchanges. Nonetheless, Binance’s crypto-as-a-service might enable them to provide their customers with a more straightforward method of purchasing and disposing of cryptocurrency.

Cut Costs, Reduce Risks: Binance’s Crypto Infrastructure Pitch to TradFi Giants

According to Binance, instead of developing their own infrastructure, TradFi institutions are increasingly using crypto-native systems. They seek to lessen operational risks, streamline processes, and cut expenses. According to Binance, the crypto-as-a-service option offers a quicker route to market without the burden of developing everything internally.

Building the technology, compliance framework, and liquidity pipelines in-house can be expensive, time-consuming, and potentially high-risk.

Binance

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.