Negative ETF Flows Suggest Market Momentum Is Fading

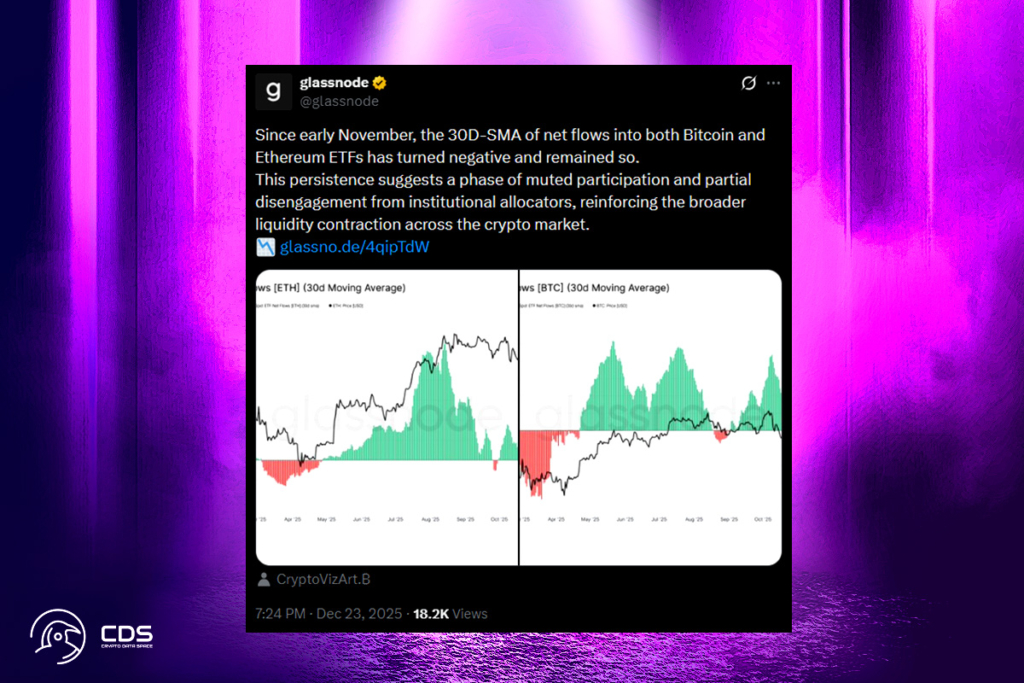

Bitcoin and Ether exchange-traded funds have exhibited a persistent outflow pattern, according to analytics platform Glassnode. This suggests institutional investors are pulling out of the cryptocurrency sector, it said. The 30-day simple moving average of net flows into US spot Bitcoin and Ether ETFs has been negative since early November.

This persistence suggests a phase of muted participation and partial disengagement from institutional allocators, reinforcing the broader liquidity contraction across the crypto market,

Glassnode

The spot markets for the tokens, which have been declining since mid-October, typically outpace flows into cryptocurrency ETFs. Additionally, ETFs are considered a good indicator of institutional sentiment. For the majority of this year, the market has been driven by this sentiment. But now that the market as a whole has shrunk, it seems to have turned negative.

Crypto ETF Outflows Accelerate as Selling Pressure Returns

The Kobeissi Letter stated on Tuesday that the push to sell cryptocurrency ETFs has returned. According to the research, crypto funds saw withdrawals of $952 million last week. Now, in six of the past ten weeks, investors have taken money out. According to Coinglass, during the last four trading days, total Bitcoin ETF flows have been negative. Nonetheless, during the previous week, there were slight inflows into BlackRock’s iShares Bitcoin Trust (IBIT). The industry-leading BlackRock fund has received $62.5 billion in inflows since its launch, surpassing all other spot Bitcoin ETFs, notwithstanding the recent withdrawals.

IBIT Ranks High on Bloomberg’s 2025 Flow List Despite Losses

IBIT is the only ETF on Bloomberg’s “2025 Flow Leaderboard” that has a negative year-over-year return, according to Bloomberg ETF analyst Eric Balchunas on Saturday. According to him, BlackRock’s flagship Bitcoin fund even outperformed the 64%-up SPDR Gold Shares fund (GLD).

The real takeaway is that it was sixth place despite the negative return. That’s a really good sign long term IMO. If you can do $25 billion in a bad year, imagine the flow potential in a good year.

Balchunas

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.