Featured News Headlines

MicroStrategy Faces $8.8B Passive Exit Under MSCI Proposal

MSCI has launched a consultation on new criteria that would remove companies whose digital asset holdings exceed 50% of total assets from its indexes. This potential rule change could trigger up to $8.8 billion in passive fund outflows for Strategy Inc. (formerly MicroStrategy) and threatens Michael Saylor’s long-running Bitcoin accumulation strategy.

Index Removal Threatens Core Strategy

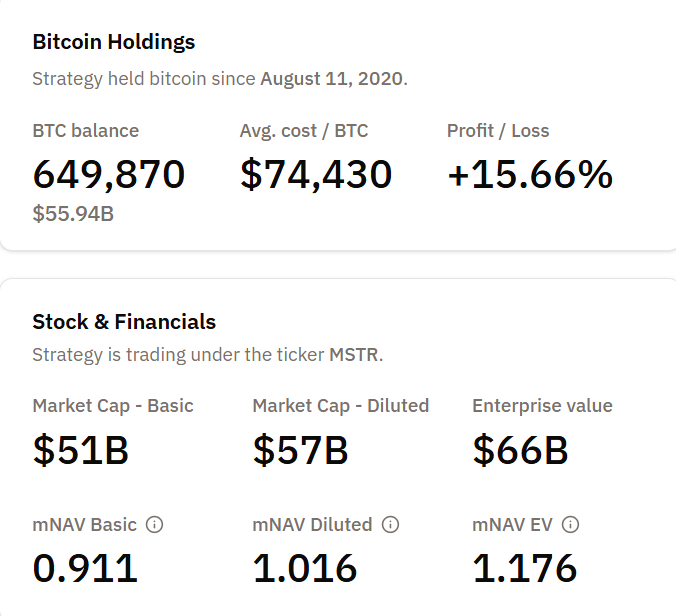

Strategy Inc. currently holds 649,870 Bitcoin, with an average purchase price of $74,430. This break-even level aligns with the company’s average cost basis, and with Bitcoin trading under pressure, the profit margin is extremely slim. The company’s market capitalization stands at $51 billion based on basic share count, $57 billion fully diluted, and $66 billion in enterprise value.

In September 2025, MSCI began a formal consultation on how to classify Digital Asset Treasury (DAT) companies. According to the consultation documents, the proposed rule would exclude companies whose digital assets represent 50% or more of total assets and whose core business revolves around them.

Some MSCI clients argue that these companies function more like investment funds than operational businesses suitable for equity indexes. According to JPMorgan, exclusion by MSCI alone could cause $2.8 billion in passive fund selling. If other index providers adopt similar rules, total outflows could reach $8.8 billion.

Valuation Premium Collapses as Bitcoin Falls

The timing makes the situation more severe. Strategy’s stock has fallen 60% from its recent highs, erasing the valuation premium that funded its capital-raise-and-buy strategy. Its market Net Asset Value ratio (mNAV) is now approaching parity with underlying Bitcoin holdings, signaling declining investor confidence in Saylor’s “sell stock, buy Bitcoin, repeat” model.

This premium is critical because it underpins Strategy’s entire financial engine. The company funds Bitcoin purchases through equity offerings and convertible debt issuance, relying on the stock consistently trading above the value of its Bitcoin holdings. Without that premium, the model weakens significantly.

Meanwhile, financing costs have risen. Earlier in 2025, Strategy issued new convertible notes under less favorable terms. With Bitcoin underperforming, profitability pressures are building. As of mid-November, Strategy’s Bitcoin holdings show a 15.81% gain, but if BTC drops closer to the $74,430 break-even point, margins compress rapidly.

Market Divided Over Index Classification

Not all market participants support the proposed exclusion. Matthew Sigel, Head of Digital Asset Research at VanEck, wrote on X that JPMorgan’s report reflects client feedback rather than an explicit call for exclusion. This highlights that the debate is as much about process as it is about the underlying fundamentals.

The consultation underscores widespread uncertainty in how the financial industry should classify Bitcoin treasury companies. MSCI’s rules typically distinguish operational firms from investment vehicles. Although Strategy continues to run its analytics software business, its massive Bitcoin holdings dominate its identity, creating a hybrid profile that complicates classification.

Decision Date Approaches

The January 15, 2026 decision date is critical. Until then, Strategy must manage its Bitcoin exposure, financing obligations, and shareholder expectations. The outcome will determine whether Bitcoin treasury companies retain access to passive capital—or face reclassification and exclusion from major indexes.

The stakes are high for Saylor’s model. Other firms like MARA Holdings, Metaplanet Inc., and Bitcoin Standard Treasury Company are also under scrutiny, but Strategy’s scale makes it the primary test case. If excluded, the ruling could set a precedent for how index providers treat publicly traded companies that use Bitcoin as a primary reserve asset.

Comments are closed.