2026 Crypto Boom: Crypto Index Funds Become the New Investor Favorite

Next year, it is anticipated that funds that follow a basket of cryptocurrencies will become increasingly popular. Investment head Matt Hougan of Bitwise claims that investors are looking for easier access to a wider variety of digital assets. He claimed that while the cryptocurrency market as a whole is expected to expand, it is impossible to forecast which coins will be successful. So, even though it’s not for everyone, holding a market-tracking fund can be a wonderful place to start.

Crypto index funds are going to be a big deal in 2026. The market is getting more complex and the use cases are multiplying.

Hougan

Bitcoin’s 60% Market Share Limits Growth of Multi-Crypto ETFs

Bitwise and other exchange-traded funds track numerous cryptocurrencies. These funds are modeled after the S&P 500, which tracks the top 500 US companies listed on the stock exchanges. Multiple multi-crypto ETFs launched in the US earlier this year. In proportion to token market capitalization, these funds hold cryptocurrencies. However, these products have witnessed minor inflows. CoinGecko reports that Bitcoin controls approximately 60% of the market. Hougan stated he cannot predict which chain will triumph despite his crypto expertise and network. He said he cannot foresee the outcome either.

At this stage of crypto’s development, I’d argue it’s unknowable. Outcomes will be shaped by regulation, execution, macro conditions, the actions of a few key individuals, luck, and a hundred other variables. Forecasting all of that correctly would require supernatural foresight.

Hougan

Hougan: Tokenization to Transform Finance Within Years

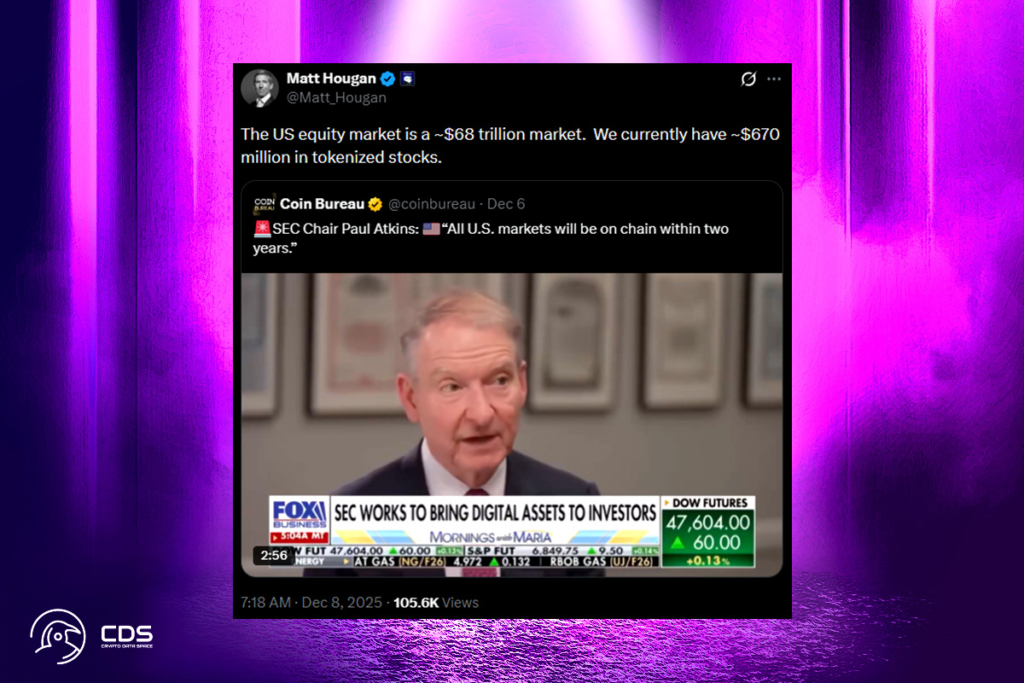

In 10 years, cryptocurrency will be far more significant than it is now, according to Hougan. Thus, the market may expand by up to 20 times. He cited SEC Chair Paul Atkins‘s statement on Wednesday that the US financial industry might use tokenization within a few years. He proposed that this change may greatly expedite industry-wide adoption.

Stablecoins will matter more. Tokenization will matter more. Bitcoin will matter more. And I think a dozen other major use cases will follow: prediction markets, decentralized finance (DeFi), privacy tech, digital identity. I don’t want to risk picking the wrong chain. Imagine correctly calling a market that goes up 100,000x — and still underperforming because you backed the wrong horse. So I use a crypto index fund as the core of my portfolio. Knowing that, however crypto evolves, I’ll own exposure to the potential winners.

Hougan

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.