Featured News Headlines

Bitcoin Leads Major Liquidations Across Crypto

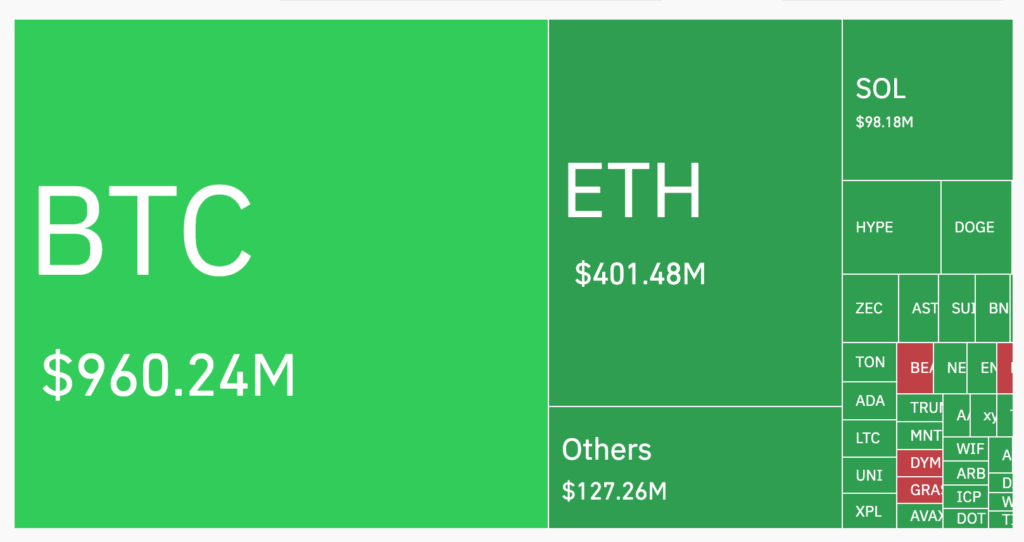

The cryptocurrency market faced another major liquidation event, with Bitcoin (BTC) leading the losses. Data from Coinglass shows that 391,164 traders were liquidated in the past 24 hours, amounting to $1.91 billion in total liquidations.

Bitcoin Bears the Brunt

Long positions dominated the sell-off, with $1.78 billion liquidated, while shorts only accounted for $129.3 million. The largest single liquidation occurred on Hyperliquid, a decentralized perpetuals exchange, where a BTC-USD position worth $36.78 million was closed.

Bitcoin led the market, with $929 million of its $960 million total from long positions. Ethereum (ETH) followed with $403.15 million in liquidations, primarily from leveraged longs.

Whale Accounts Hit Hard

On-chain data highlights the impact on high-profile traders. PeckShieldAlert reported that several major ETH whales were liquidated after ETH fell below $2,900, with individual losses ranging from $2.9 million to $6.52 million.

Lookonchain noted that Machi, a prominent trader, saw his account shrink to just $15,538, with total losses exceeding $20 million. Another notable figure, the “Anti-CZ Whale,” experienced a significant drop in profits.

“He was once a legend with nearly $100 million in profit — now his profits have dropped to $30.4 million,” Lookonchain stated.

Market-Wide Impact

The liquidation wave coincided with a 6% drop in total crypto market capitalization, now standing at $2.9 trillion. According to the Kobeissi Letter, the market has lost $1.3 trillion since early October.

“This is one of the fastest moving crypto bear markets ever,” the report added.

The letter described the market as a “mechanical bear market”, triggered by heavy leverage and cascading liquidations. As leveraged traders are forced to sell while prices fall, a feedback loop intensifies downward pressure.

“Throughout the course of this 45-day bear market, crypto has seen little to no bearish fundamental developments. The market is efficient. It will iron itself out,” the Kobeissi Letter explained.

Technical Pressure and Future Considerations

The recent sell-off illustrates how leverage can amplify price movements in volatile markets. Large liquidations in BTC and ETH show the fragility of heavily leveraged positions. While the market reacts quickly to liquidations, some analysts suggest the efficiency of crypto markets may eventually stabilize prices once the cascade subsides.

Comments are closed.