Featured News Headlines

Why Market Makers Triggered the October Crypto Crash

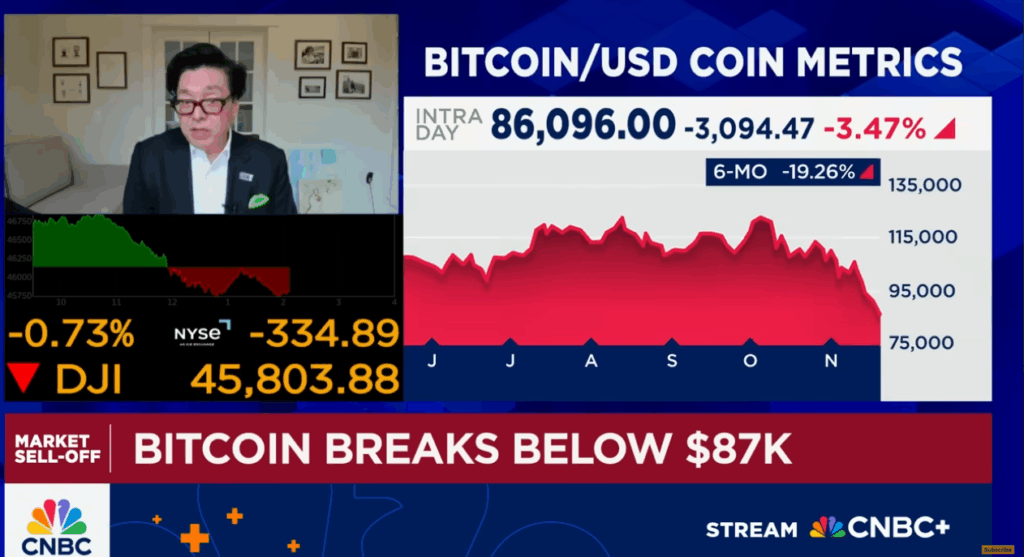

The ongoing cryptocurrency market weakness may stem from severe balance sheet damage at major market makers, according to Tom Lee, chairman of Ether treasury company BitMine. Lee told CNBC on Thursday that the October 10 market crash, which wiped out $20 billion in liquidations, created unexpected liquidity problems for these critical market participants.

October Crash Left Market Makers Scrambling

The October 10 event caught numerous market makers unprepared, forcing them into defensive positions. With reduced capital to operate and declining revenue from trader activity, these firms face mounting pressure. Lee explained that market makers are now actively shrinking their balance sheets to preserve remaining capital.

“And if they’ve got a hole in their balance sheet that they need to raise capital, they need to reflexively reduce their balance sheet, reduce trading. And if prices fall, they’ve got to then do more selling,” Lee stated during the interview.

He described the gradual market decline over recent weeks as a direct reflection of what he called “market maker crippling.” The situation creates a negative feedback loop where falling prices force additional selling to meet capital requirements.

Why Market Makers Matter More Than You Think

Lee, who co-founded research firm Fundstrat, compared crypto market makers to central banks in traditional finance. These entities provide essential liquidity that keeps markets functioning smoothly. When their operations become impaired, the entire ecosystem suffers from reduced trading efficiency and increased volatility.

“Market makers are critical in crypto because they provide liquidity. I mean, they act almost as the central bank in crypto,” he emphasized.

Bitcoin traded above $121,000 before the October 10 crash. The asset has since declined to $86,900, with the broader market following similar trajectories. Lee noted that current market conditions echo the initial crash, suggesting the unwinding process continues.

Recovery Timeline Could Take Weeks

Drawing parallels to 2022, Lee provided a timeline for potential market stabilization. He referenced a similar market maker crisis that year, which required eight weeks to fully resolve. The current situation has only progressed through six weeks, indicating potential continued weakness ahead.

“In 2022, it took eight weeks for that to really get flushed out. We’re only six weeks into it,” Lee observed.

He suggested that Bitcoin and Ethereum may serve as leading indicators for broader equity markets due to the ongoing market maker unwinding. The combination of this forced deleveraging and weakened liquidity creates challenging conditions across asset classes.

Market makers typically profit from bid-ask spreads and trading volume. When both decrease simultaneously, as seen in recent weeks, these firms face compressed margins. The need to reduce risk exposure while maintaining operations creates a difficult balancing act.

Lee’s analysis points to systemic issues rather than isolated incidents. The health of market makers directly influences price stability and trading conditions. Until these firms repair their balance sheets and restore normal operations, the market may continue experiencing subdued performance and heightened sensitivity to selling pressure.

Comments are closed.