Featured News Headlines

ETH Whale Awakens After 10 Years, Chooses Staking Over Selling

An early Ethereum whale has resurfaced after a decade of complete silence — but instead of cashing out, the long-term holder has staked their entire ETH portfolio, signaling renewed confidence in the network’s long-term prospects.

Whale Stakes $120 Million in ETH After Waking Up

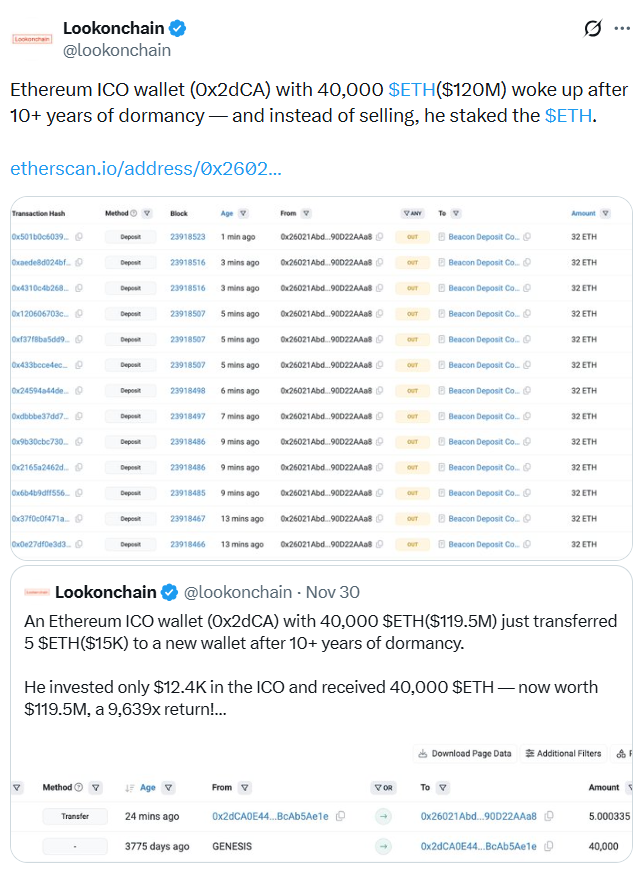

According to blockchain analytics platform Lookonchain, the wallet in question holds 40,000 ETH, purchased for roughly $12,000 during Ethereum’s genesis launch in July 2015. Today, the stash is valued at approximately $120 million.

Rather than sending the funds to a crypto exchange — a move often interpreted as preparation to sell — the whale instead deployed 100% of their holdings into staking. This suggests the wallet owner is choosing to reinforce their commitment to Ethereum rather than exit the market.

The move comes amid widespread discussion about large ETH holders reshuffling their portfolios. Over the past month, analysts have speculated that selling pressure from whales may be contributing to short-term price swings.

Other Early Ether Holders Take Different Paths

Not all Ethereum OGs are making the same decision.

One early wallet that accumulated 254,908 ETH during the ICO began selling on Nov. 26, starting with a 20,000 ETH transaction and gradually offloading more. By Saturday, the wallet’s remaining balance had dropped to about $9.3 million worth of ETH.

Meanwhile, another longtime holder who gathered 154,076 ETH beginning in 2017 moved 18,000 ETH to Bitstamp. This wallet had previously sold 87,824 ETH at an average price of $1,694.

In a separate case, a major Ethereum ICO wallet that reactivated in September after eight years also chose to stake a portion of its holdings. The owner, who originally acquired 1 million ETH during genesis, recently transferred 150,000 ETH to a new staking wallet.

Top Ethereum Addresses Continue Accumulating

Despite mixed behavior among long-term holders, the largest ETH addresses continue to increase their share of the supply. Blockchain analytics firm Glassnode reports that the top 1% of addresses now control 97.6% of ETH, up from 96.1% one year ago.

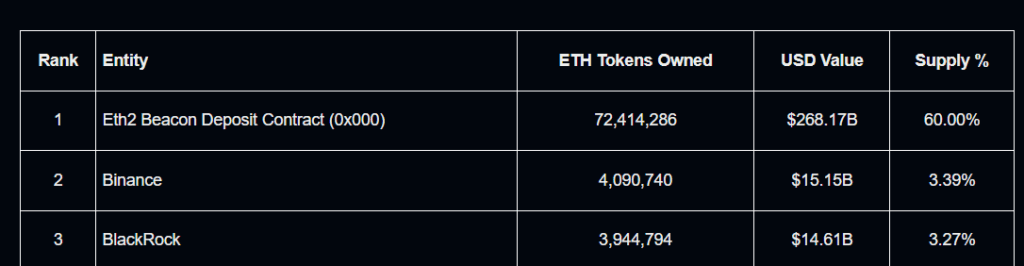

The Eth2 Beacon Deposit Contract remains the single largest holder with 72.4 million ETH — worth about $203 billion — representing roughly 60% of Ethereum’s total supply, according to intelligence platform Arkham.

Crypto exchange Binance ranks second with 4 million ETH, while BlackRock holds the third-largest amount at 3.9 million ETH.

Comments are closed.