Leaked Fundstrat Report: Bitcoin, Ethereum, Solana Face Deep Pullback

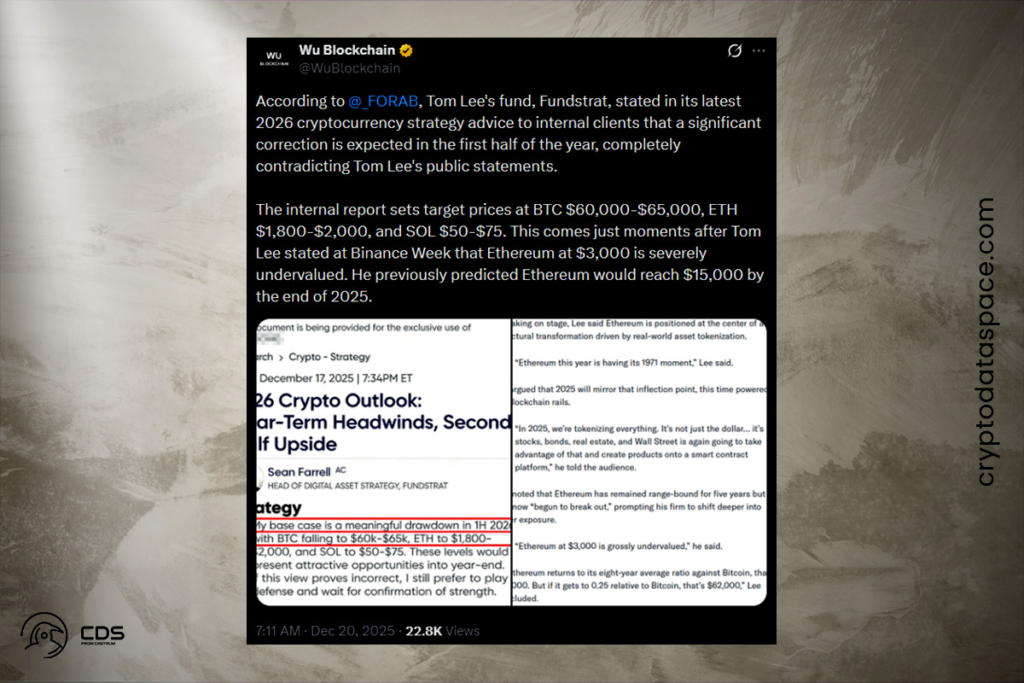

According to circulating research credited to Fundstrat Global Advisors, cryptocurrencies have a negative outlook. However, Tom Lee’s recent public remarks seem to be at odds with this viewpoint. Screenshots posted on X suggest that the document is Fundstrat’s internal guidelines for its 2026 crypto strategy. It forewarns of a significant decline in the first half of 2026. According to the research, Bitcoin will drop to between $60,000 and $65,000, Ether to between $1,800 and $2,000, and Solana to between $50 and $75. It also mentions that later in the year, purchasing chances can present themselves.

Fundstrat’s Leaked 2026 Crypto Outlook Conflicts With Lee’s Bullish Call

Fundstrat has not made the information available to the public. Wu Blockchain and other cryptocurrency-focused accounts, however, assert that the document was sent to internal clients. Sean Farrell, the firm’s head of digital asset strategy, is credited with writing the circulating 2026 crypto blueprint. This widespread perspective contradicts remarks Lee made earlier this month on stage at Binance Blockchain Week in Dubai. In a public statement, Lee claimed that Bitcoin could reach $250,000 within a matter of months and that Ether, currently trading at around $3,000, is significantly underperforming.

Lee Says Ether Is Entering a Bitcoin-Like Supercycle

Ether’s price might get close to $12,000, according to Lee, if it were to revert to its eight-year average ratio against Bitcoin. If 2021 relative levels were revisited, prices would likely be close to $22,000. According to Lee’s presentation, an ETH/BTC ratio of 0.25 would imply prices higher than $60,000. Additionally, Lee asserted in November that Ether is beginning on the same trajectory as Bitcoin, whose price has increased by more than 100 times since 2017.

We believe ETH is embarking on that same Supercycle,

Lee

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.