Featured News Headlines

Why Solana ETFs Are Attracting Big Institutional Players

Daily inflows into Solana ETFs continue to register in the multi-million-dollar range, highlighting steady institutional interest despite recent price swings. This consistent accumulation aligns with larger institutional movements, such as Franklin Templeton’s upcoming Solana ETF launch and ongoing asset inflows by current providers.

Record Inflow Streak Highlights Investor Confidence

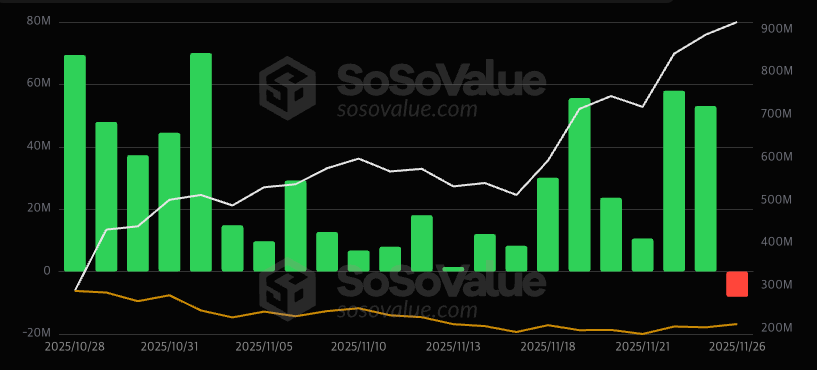

Solana ETFs, approved by the SEC in late October 2025, have maintained a strong streak of inflows. SoSoValue data reports net inflows of $53.08 million on November 25 and $57.99 million on November 24. The streak briefly paused on November 26, with an $8.10 million net outflow—the first negative reading since October 28.

Despite short-term volatility, SOL was trading around $142.93 at reporting time. Institutional investors appear undeterred, mirroring early Bitcoin ETF launches where large-scale buying continued despite market fluctuations.

The Bitwise Solana Staking ETF (BSOL) has emerged as a key vehicle for institutional exposure. According to official Bitwise reports, BSOL surpassed $500 million in assets under management within its first 18 days, holding 4.31 million SOL valued at approximately $587 million.

On-chain activity confirms these accumulation trends. Recently, Bitwise withdrew 192,865 SOL ($26.39 million) from Coinbase, transferring assets into ETF custody wallets—a clear signal of institutional accumulation.

Franklin Templeton Signals Growing Institutional Adoption

Franklin Templeton, managing $1.7 trillion in assets, has filed for a Solana spot ETF with a competitive 0.19% management fee. This announcement has strengthened market momentum, and analysts expect inflows to rise following the fund’s launch.

The participation of established asset managers validates Solana’s appeal among institutional investors. Franklin Templeton’s prior blockchain projects, including tokenized money market funds, position the firm to efficiently manage these new ETF structures.

Fee structures also suggest robust long-term interest, as crypto ETFs currently charge management fees ranging from 0.19% to 0.80%. Historical data from Bitcoin and Ethereum ETFs shows that lower fees help attract and retain institutional participants.

Market Structure and Technical Dynamics

SOL’s price action diverged from inflows in November, facing sustained downward pressure even as institutions continued to accumulate. Analysts interpret this as a potential re-accumulation phase.

Derivative markets add complexity to the picture. Open interest fluctuated throughout the month, with spikes reflecting increased speculative activity. Falling prices combined with changing open interest may indicate aggressive short positions followed by periods of covering and realignment.

A notable gap remains between ETF inflows and their impact on the spot market. ETF providers often acquire assets through over-the-counter transactions, which introduces a lag before these purchases influence visible exchange prices.

Institutional Engagement Across Crypto

The broader cryptocurrency market now has a total capitalization of $3.22 trillion, with daily trading volumes reaching $154.75 billion in late November. CME-regulated crypto products have also set new records, underscoring growing institutional participation in both spot ETFs and derivatives.

Sustaining this inflow trend will depend on multiple factors, including regulatory developments, Solana network performance, competitive blockchain offerings, and macroeconomic conditions. However, analysts caution that recent events, such as the Upbit Solana hack, could dampen short-term sentiment and inject renewed volatility into SOL markets.

Comments are closed.