Featured News Headlines

Hyperliquid Enters On-Chain Credit Markets with New Borrow and Lending Feature

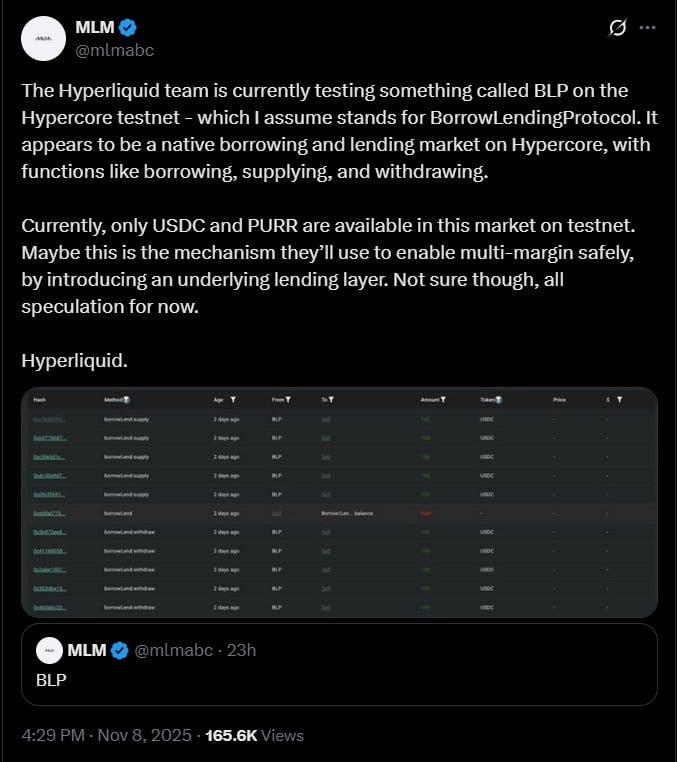

Hyperliquid, one of the fastest-growing decentralized exchanges, is expanding beyond perpetual trading with a new BorrowLendingProtocol (BLP) currently being tested on its Hypercore testnet. This move signals the platform’s first step into native on-chain credit markets — a development that could transform it into a full-stack DeFi ecosystem.

A Native Lending Layer in the Works

Early testnet data shows that the BLP module allows users to borrow, supply, and withdraw assets directly on-chain, with USDC and PURR currently available in testing. While still in its early phase, the framework suggests Hyperliquid’s goal to integrate shared lending pools, rather than relying on isolated balances for margin.

If fully implemented, this lending layer could allow traders to access on-chain credit, positioning Hyperliquid as more than just a perpetual DEX — evolving it toward a complete on-chain financial stack.

Dominating the DEX Market

Hyperliquid continues to outpace competitors, posting over $303 billion in trading volume in October alone, surpassing Lighter (LIGHTER) with $272 billion and Aster (ASTER) with $260 billion. Its open interest also hit $7.2 billion, topping all perpetual DEXs combined. This dominance underscores both deep liquidity and strong trader confidence, key factors that could help Hyperliquid lead the next phase of DeFi innovation.

HYPE Token Faces a Cooldown

After an impressive October rally, HYPE, Hyperliquid’s native token, has entered a consolidation phase. It trades around $40, struggling to break resistance as RSI hovers near 46 and MACD slips into negative territory — signaling short-term weakness. Analysts note that unless new buying pressure emerges soon, HYPE could continue consolidating before attempting another upward move.

As Hyperliquid tests its new on-chain lending protocol, the project’s next steps could redefine what a fully integrated DeFi ecosystem looks like — blending trading, borrowing, and liquidity into one seamless, decentralized platform.

Comments are closed.