Hyperliquid Trading Volume- HYPE Eyes All-Time High as Futures Traders Boost Positions

Hyperliquid Trading Volume– Over the past 24 hours, Hyperliquid (HYPE) has extended its upward momentum, climbing 6.58% and reclaiming the $40 price level following a brief pullback. This recovery has drawn attention as broader market liquidity inflows could potentially push HYPE toward its previous all-time high.

Whale Activity Sparks Renewed Optimism

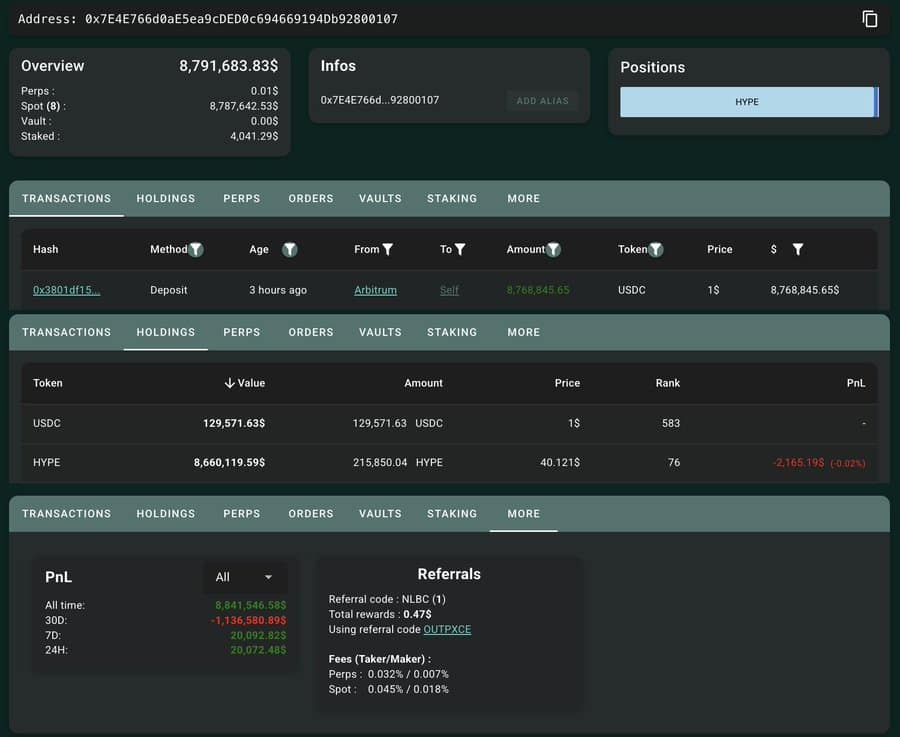

A significant factor behind the recent strength appears to be the return of a prominent Hyperliquid (HYPE) whale. This investor, previously known for securing $8.44 million in profits on Hyperliquid, has re-entered the market by acquiring approximately 215,850 HYPE tokens valued at $8.66 million.

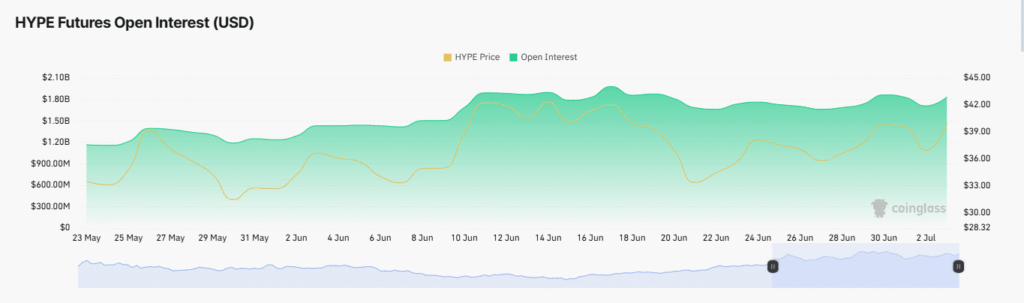

According to AMBCrypto, this large-scale buying has influenced market sentiment, with futures traders showing increased interest. The article notes that “interest among futures investors has increased as positions on the asset rise,” signaling growing confidence in HYPE.

Futures Traders Increase Long Positions

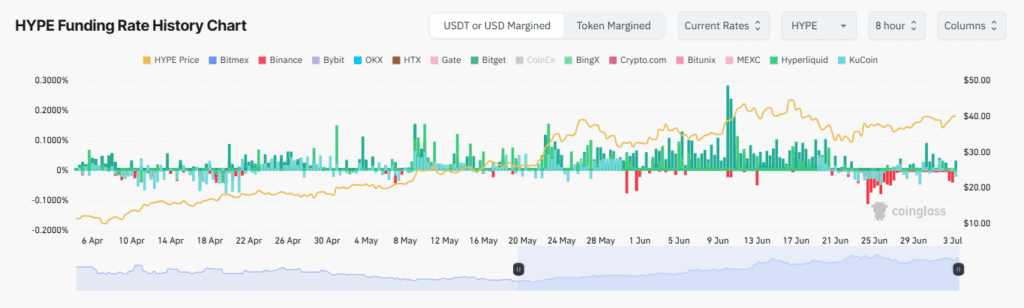

Retail futures traders have also joined the rally, increasing their long positions. CoinGlass data shows HYPE’s Funding Rate rose to 0.0084% over the last day, reflecting heightened trading activity and positive market sentiment.

Supporting this trend, trading volume surged to $1.56 billion—the highest since June 26—indicating intensified market participation and derivative trader profits.

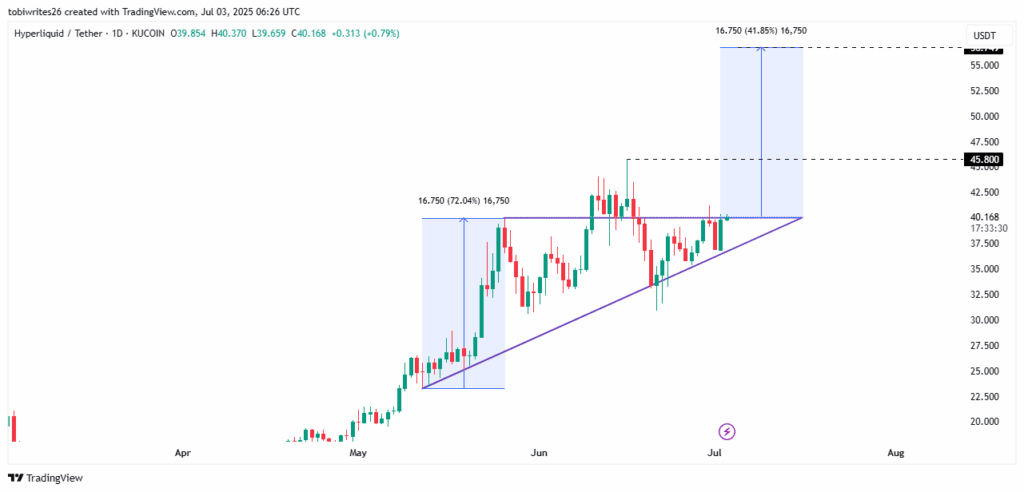

HYPE’s daily chart reveals the asset is currently trading within an ascending triangle, a bullish pattern marked by rising support and flat resistance. The price is approaching the critical resistance near its all-time high of $45.80.

If buying pressure overcomes sellers at this level, Hyperliquid (HYPE) could revisit this peak and potentially advance further, with a 41% upside to around $56 possible. Conversely, a weakening sentiment might keep the price confined within the triangle for longer.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.